Manulife warns of overvaluation risk for Malaysian stocks

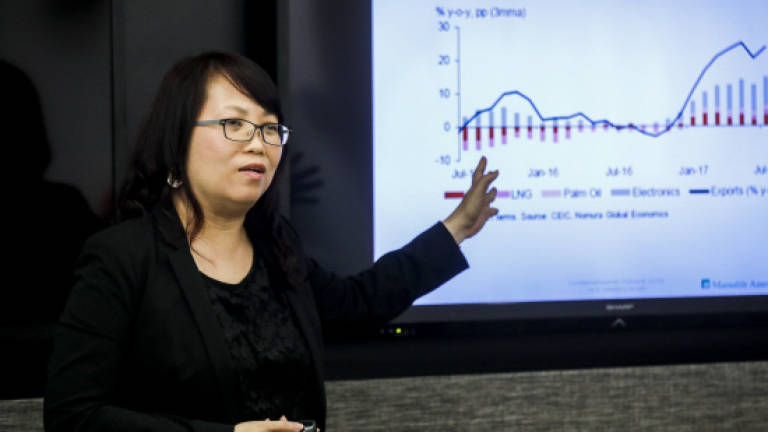

KUALA LUMPUR: A key risk to the Malaysian equity market is overvaluation that can cause volatility, even though the market is not in such a situation now, said Manulife Asset Management head of total solutions & equity investments, Malaysia, Tock Chin Hui.

“You have capacity expansion (by Malaysian corporates over the past two years) so 2018 will see earnings growth. But if valuation goes up above what’s expected, that’s a major risk,” she told a media briefing on the 2018 market outlook here today.

“The equity market is not just affected by economics, it's also affected by the perception of valuation,” added Tock.

On the global equity market selldown affecting the local bourse, Tock opined that the local equity market takes cue from the rest of the world markets, hence it is sentiment-driven.

The FBM KLCI rebounded 24.23 points or 1.34% to 1,836.68 points today after the heavy sell-off two days ago. Market breadth was positive, with gainers outpacing losers by 625 to 460.

The total market capitalisation returned to above the RM1.9 trillion level to RM1.916 trillion after RM43 billion was wiped off on Tuesday.

The ringgit, meanwhile, strengthened 0.2% to 3.9065 against US dollar as at 5pm today.

“If you focus on buying fundamentals and the reasons why you want to invest in the equity market (because global growth is synchronised, coupled with corporate earnings growth and buying into Malaysian companies that are niche in the global supply chain), then you won’t (go wrong) and a sell down like that will give opportunity from a valuation angle,” Tock said.

Malaysian corporate earnings growth momentum is expected to pick up this year as several corporates have undergone capacity expansion and are now well positioned to benefit from the anticipated demand recovery amid synchronised global growth.

Tock said part of its strategy is to focus on Malaysian companies that will benefit from cyclical opportunities such as robust economic backdrop, against which corporate earnings are set to catch up with economic growth and strong commodity prices.

“Longer term, we look to invest in innovative companies that owned niches in the global supply chains as well as those that focus on serving the needs of millennials and the ageing population.”

She said Malaysia will also stand to benefit from capital flows into Asia, as the country’s strong exports and benign inflation provide a conducive environment for investment.

Meanwhile, it expects the Malaysian corporate bonds sector to perform well this year, driven by stable economic growth, corporate bond yields being less vulnerable to external shock and market volatility as well as demand for corporate bonds to continue to hold up, supported by ample liquidity in the local market and local investors demand for yield pick-up.