PETALING JAYA: Malaysia may lose market share to Indonesia in the short term after a call by India’s top vegetable oil trade body to boycott Malaysian palm oil.

This, in turn, may see a rise in local palm oil inventories, which will be a negative for the Malaysian palm oil industry.

“Assuming that India’s demand falls by 50% per month, this would increase Malaysia’s palm inventories by about 200,000 tonnes. Based on an inventory of 2.45 million tonnes as at end-September 2019, this means that palm stockpiles in Malaysia would rise to 2.65 million tonnes,” said AmInvestment Bank Research (AmResearch).

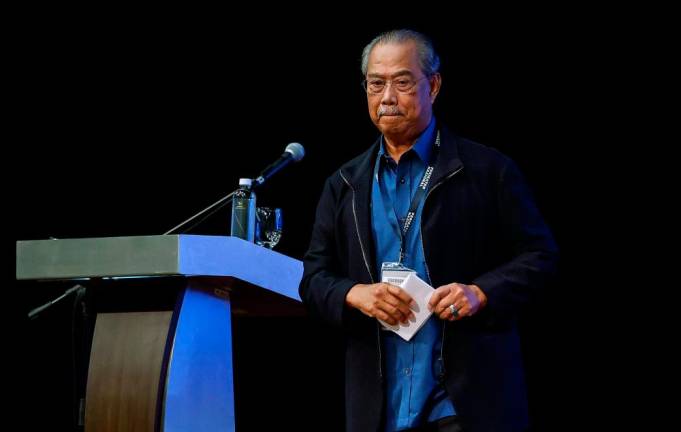

India’s Solvent Extractors Association (SEA) members have been asked to refrain from importing palm oil from Malaysia following Prime Minister Tun Mahathir Mohamad’s remarks on Kashmir in his speech at the United Nations General Assembly.

Industry players in India have said that the processing industry can switch to palm oil from Indonesia, sunflower oil from Ukraine and soybean oil from Argentina.

It was reported that some Indian buyers had already shifted to Indonesia’s palm products for deliveries in November, December and first-quarter 2020.

India imported about 6.7 million tonnes of palm and kernel products from Indonesia in 2018 compared with 2.5 million tonnes of crude and processed palm products from Malaysia.

India accounted for 14.2% of Indonesia’s palm and kernel exports in the first seven months of 2019 (7M19).

In the first nine months (9M19) of the year, India imported 3.9 million tonnes of processed and crude palm oil from Malaysia, or about 434,246 tonnes per month, accounting for 27.9% of Malaysia palm export for the period.

However, India raised the import tariff on Malaysia’s refined palm products by 5 percentage points in September this year, which eliminated any trade advantage with Indonesia. The import tariff on Malaysia and Indonesia’s refined palm products is now the same at 50%.

AmResearch believes that the price discrepancy between Malaysia and Indonesia may narrow going forward.

“Crude palm oil (CPO) price in Malaysia may fall while CPO price in Indonesia may increase due to the switch in demand from India.”

Currently, the research house believes that the price difference between CPO in Malaysia and Indonesia is RM200 to RM300 a tonne.

November palm oil futures prices gained RM21 to close at RM2,236 yesterday.

Plantation companies with significant exposure to Indonesia are Kuala Lumpur Kepong, Sime Darby Plantation, Genting Plantations, IJM Plantations and TSH Resources. Plantation companies with palm refineries in Indonesia include KLK and Sime Darby Plantation.

For the sector, AmResearch retained its neutral stance as it does not know how long the trade spat between the two countries will last.