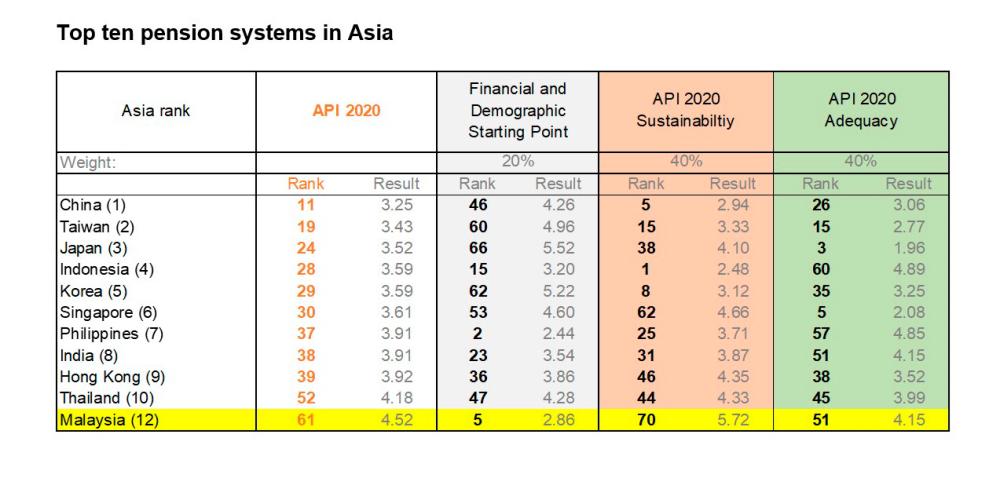

PETALING JAYA: Malaysia’s pension system ranks at 12th in Asia and 61st globally, with a lot of homework remains to be done in pension reforms, according to Allianz’s first edition of its Global Pension Report.

“When it comes to sustainability, this is mainly due to the fact that so far Malaysia has not introduced any measures that link the retirement age or the benefit ratio to the increasing life expectancy of its population. This might be owed to the circumstance that Malaysia, with its young society, is still well positioned in terms of financial leeway and demographic change – actually ranking fifth in this Allianz Pension Indicator (API) – exempting it from any immediate reform pressure. With respect to adequacy Malaysia ranks also only in the lower third,“ Allianz said in a statement today.

Despite the existence of a compulsory capital-funded saving scheme for individuals employed in the private sector, it said the Employees Provident Fund’s pension coverage is still comparatively low. Furthermore, there is still room for improvement with respect to financial accessibility and financial literacy.

“In spite of the government’s efforts to increase the awareness of the need for private old-age provision in recent years, Malaysia ranks only mid-field with respect to the level of private household’s net financial assets compared to gross domestic product. Against the background that other countries in the region like Indonesia with similar favorable demographic and financial conditions have already stepped up their reform efforts, Malaysia should reconsider its reform approach as long as there is still room to maneuver,“ said Allianz.

Sweden, Belgium, and Denmark come out as the relatively best pension systems worldwide (see table).

The API is based on three pillars of starting points (demographic change and financial leeway), sustainability and adequacy.