KUALA LUMPUR: SME Bank will continue to strengthen its policies, procedures, systems and infrastructure to optimise its service delivery and customer experience in 2023 while it remains committed to providing support and going the extra mile to assist micro, small and medium enterprises (MSME) in addressing challenges and seizing opportunities.

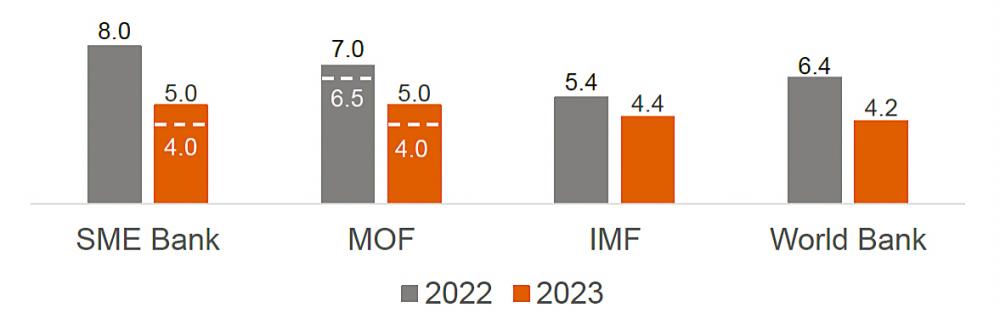

SME Bank group president/CEO Datuk Wira Aria Putera Ismail in a statement said, “SME Bank foresees that the economy will continue growing in 2023 albeit at a moderating pace of 4-5%, down from the 8% growth forecast for 2022 as headwinds become more evident.

“Growth momentum is supported by still-resilient domestic demand, tight labour market and the prospect of China’s economic relaxation. The forecast is in line with the government’s projection and international bodies such as International Monetary Fund and World Bank.”

The global slowdown in demand, alongside persistent inflationary pressures, aggressive tightening of monetary conditions, strong US dollar, and climate change risks, poses significant challenges to emerging markets including Malaysia.

Domestically, there are some considerable uncertainties as well. Impending subsidy rationalisation, broad-based upward price pressures and monetary policy tightening will likely dampen consumer spending.

SME Bank’s chief economist, Lynette Lee, commented, “While the boost from pent-up demand and full economic reopening diminishes, our economic growth forecast of 4-5% this year is still respectable.

“Malaysia’s resilient domestic demand, excess individual savings, alongside a diversified economy, should cushion against spillover from the external sector. The ongoing recovery in tourism and education related sectors amid spare capacity, investment growth momentum backed by robust approved foreign direct investments and infrastructure projects will continue to lend support to economic growth.”

MSME are unlikely to escape the ripple effects of the moderation in gross domestic product growth as they account for 97.4% of overall establishments in Malaysia, she said.

“SME Bank forecasts two rate hikes of 25bps each in first-half 2023, bringing the Overnight Policy Rate to 3.25% in 2023 as monetary policy normalisation is needed to buffer against any uncertain economic shocks in the future. Nonetheless, the postponement of the RM1,500 minimum wage implementation for micro-enterprises to July 1, 2023 and no electricity hike for households, MSME as well as agriculture industries will allow MSME some cash flows flexibility to sustain in 2023.”

Aria Putera said: “Despite the cautious business environment, MSMEs have indicated through the SME Bank’s 2022 SME Sentiment Index that they are optimistic, resilient and ready to adapt to the current economic challenges.”

In 2023, SME Bank will continue to be an effective agent of change by advocating and promoting environ-mental, social and governance (ESG) adoption among MSME through more sustainability-linked offerings with competitive rates such as High Tech and Green Facility , Low Carbon Transition Facility, Young Entre-preneur Fund 2.0 and IBS Promotion Fund 2.0.

Through SME Bank Future Modality, SME Bank will focus on four pillars – to be a centre of excellence for entrepreneur development through its training arm, Centre for Entrepreneur Development and Research Sdn Bhd, advocating ESG adoption among MSME, strengthening digital ecosystem and offering niche products and services.