NEW YORK: Wall Street stocks soared on Wednesday (Nov 30) after Federal Reserve (Fed) chair Jerome Powell signalled a moderation from the central bank's aggressive posture to counter inflation.

The Dow Jones Industrial Average rose 737.24 points, or 2.18%, to 34,589.77, the S&P 500 gained 122.48 points, or 3.09%, to 4,080.11 and the Nasdaq Composite added 484.22 points, or 4.41%, to 11,468.00.

All three of Wall Street’s major averages showed their second monthly advance in a row with a 5.4% gain for the S&P, compared with a 5.7% monthly gain for the Dow and the Nasdaq's 4.4% increase.

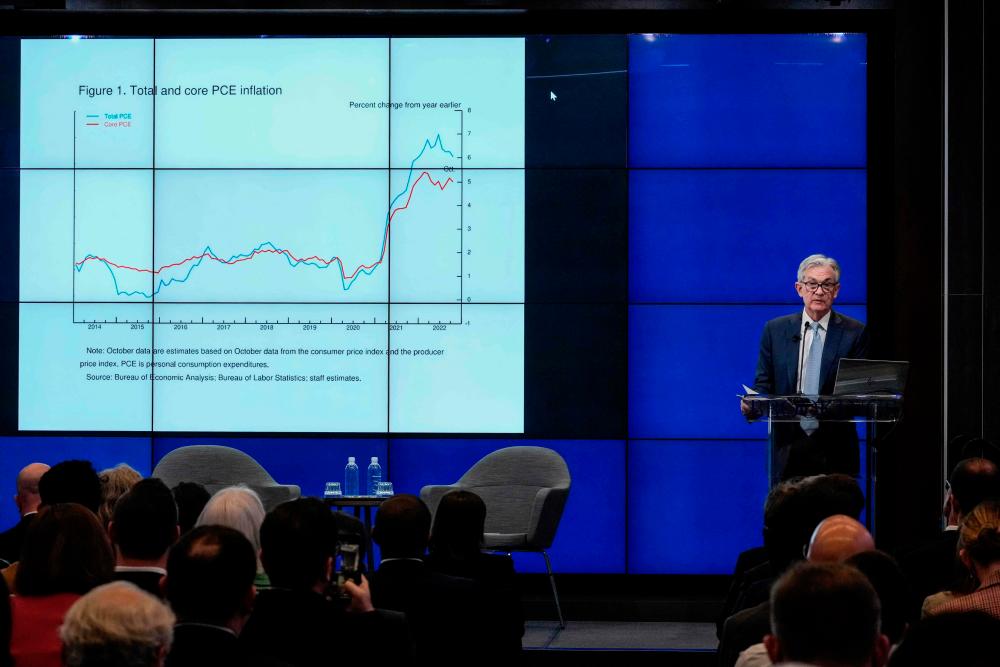

Powell, appearing at the Brookings Institution in Washington, said the Fed could ease its stance on interest rate increases “as soon as” December when policymakers are next scheduled to meet.

He added that the full effects of the bank's rapid tightening are yet to be felt.

“Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,” he said.

But Powell warned that policy will likely still have to remain tight “for some time” to restore price stability.

The Fed has raised the benchmark lending rate by 0.75 percentage points four consecutive times in recent months, out of six times this year, in an aggressive effort to rein in prices.

Powell’s latest remarks add to expectations that the Fed will undertake a smaller 0.50 percentage point increase in December.

Major indices had been near flat prior to his speech, but rallied once the remarks were reported.

Stocks have risen over the last month, in part on expectations that the Fed would soon pivot on monetary policy. Powell’s appearance was viewed as a potential risk to equities if he adopted a more hawkish tone.

“(The market) has waited with bated breath, looking for that clarification in terms of duration and extent of Fed tightening. And anything that gives hope to the idea the Fed is becoming less hawkish is viewed as a positive for stocks, at least on a short-term basis,” said Chuck Carlson, CEO at Horizon Investment Services in Hammond, Indiana.

Earlier Wednesday, government data showed the United States economy grew at 2.9% in the third quarter, annualised, better than initially estimated.

But payroll firm ADP said private employers added just 127,000 jobs in November, much less than expected and well below the level in October.

The Fed’s “beige book” of economic activity said that uncertainty and “increased pessimism” clouded the country’s outlook amid high prices and rising interest rates.

Nvidia rallied more than 8%, Microsoft jumped 6.2% and Apple climbed 4.9%.

Tesla Inc's shares surged 7.7% after China Merchants Bank International said Tesla's sales in China in November were boosted by price cuts and incentives offered on its Model 3 and Model Y. – AFP, Reuters