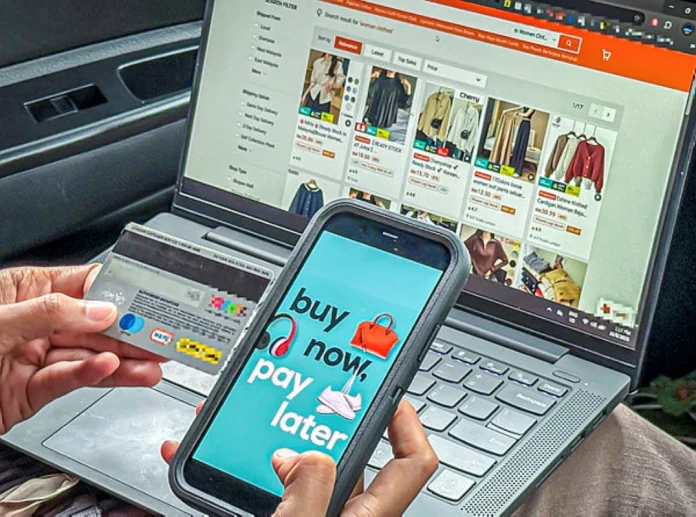

Economist says buy now, pay later services are a coping mechanism for households squeezed by stagnant wages and high living costs

PETALING JAYA: The growing use of buy now, pay later (BNPL) services in Malaysia reflects mounting economic pressures faced by households rather than irresponsible consumer behaviour, said economist Dr Idham Razak.

The finance lecturer at Universiti Teknologi Mara Malacca said the sharp increase in BNPL transactions and outstanding balances must be viewed in the context of prolonged wage stagnation alongside rising living costs, particularly for essential expenses such as food, housing and transport.

“BNPL has effectively become a short-term liquidity management tool for many consumers, especially young adults and lower-income households who are facing constrained disposable income,” Idham told theSun via WhatsApp.

Idham said BNPL allows users to smooth consumption during periods of financial stress, enabling them to meet basic needs without immediate cash outflows.

He added that this explains the strong uptake of BNPL services despite concerns surrounding household indebtedness, while pointing out that the relatively low proportion of overdue BNPL loans suggests that most users remain disciplined in their repayments.

“This indicates that BNPL is generally being used cautiously, not as a channel for excessive or impulsive consumption, but rather as a coping mechanism in a challenging economic environment,” he said.

However, he cautioned that the rapid expansion of BNPL platforms requires close regulatory scrutiny to prevent longer-term risks from emerging.

While BNPL offers temporary financial relief, sustained reliance on deferred payment schemes could obscure deeper structural issues within the economy.

“Persistent use of BNPL may mask fundamental problems such as insufficient real wage growth and limited upward income mobility, particularly among younger workers.”

Idham warned that without parallel improvements in wages, productivity and social protection mechanisms, BNPL usage could gradually entrench financial vulnerability among certain segments of the population.

“Young consumers, in particular, often have limited financial buffers to absorb economic shocks. If BNPL becomes a default financing option rather than a short-term bridge, it may expose them to higher long-term financial stress,” he said.

Idham stressed that BNPL should be viewed as a supplementary financial tool rather than a substitute for sustainable income growth or comprehensive social support.

From a policy perspective, Idham said regulators and policymakers must strike a careful balance between encouraging financial innovation and safeguarding consumer welfare.

“Responsible lending practices, clear disclosure of fees and repayment obligations and effective affordability assessments are critical to ensure BNPL does not evolve into a systemic household debt issue.”