Asian stocks rose as softer US inflation data lifted rate cut hopes and Micron’s strong earnings eased tech sector fears, while the BoJ hiked rates

HONG KONG: Asian markets advanced on Friday as softer-than-expected US inflation data bolstered hopes for future interest rate cuts.

The positive sentiment was further supported by blockbuster earnings from chipmaker Micron Technology, which helped calm fears of a tech sector bubble.

The yen fluctuated after the Bank of Japan raised its borrowing costs to a three-decade high, a move that followed data showing persistent inflation above its target.

Wall Street’s three main indexes rose after data showed US inflation slowed in November to its lowest level since July.

The reading provided some hope for future rate cuts, though traders had recently pared bets on a fourth successive reduction in January.

Markets now see a 20% chance of a cut next month, but anticipate two by the end of 2026, according to Bloomberg News.

Analysts cautioned that the longest-ever US government shutdown, which ended in mid-November, likely distorted the inflation figures.

Economists at Bank of America warned to take the report “with a large grain of salt”, citing “shutdown-related distortions”.

Concerns about a potential tech bubble were tempered after Micron Technology’s quarterly profits nearly tripled to USD 5.2 billion.

The chip firm also provided an upbeat outlook for the current quarter, benefiting from the artificial intelligence boom.

Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei, Mumbai, Bangkok and Wellington all traded higher.

Tokyo’s market gained more than 1% after the BoJ lifted borrowing costs to their highest level since 1995.

The rate hike came hours after data showed Japanese inflation held steady at 3% in November, above its 2% target.

The yen retreated to 156.16 per dollar before recovering to around 155.90.

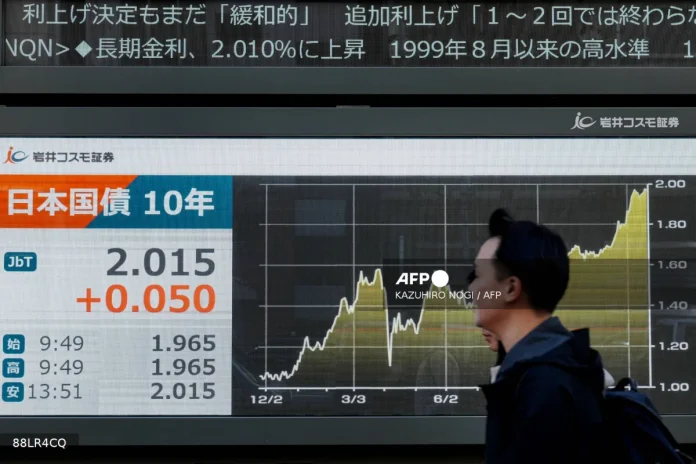

Yields on 10-year Japanese government bonds hit a 26-year high.

Bond yields have risen recently on worries about Prime Minister Sanae Takaichi’s budget discipline, while the yen has weakened.

Observers expect the yen to strengthen as the Federal Reserve cuts rates while the BoJ lifts them.

“As the BoJ proceeds with measured rate increases while Fed implements one to two cuts, the yield gap… will continue tightening,” wrote IG market analyst Fabien Yip.

“This convergence should exert sustained downward pressure on (the dollar against the yen) throughout the year.” – AFP