Goh Ban Huat's oil & gas venture falls through

KUALA LUMPUR: Ceramic products and bathroom accessories maker Goh Ban Huat Bhd (GBH) has not given up on securing a new asset after its plan to venture into the oil and gas industry via a reverse takeover (RTO) was surprisingly aborted.

The proposed venture into the oil and gas sector was put on hold after GBH and the vendors mutually cancelled the company's proposed acquisition of Globalmariner Offshore Services Sdn Bhd for RM38 million.

GBH said its unit Ekspresi Tepat Sdn Bhd and the vendors mutually agreed to terminate the memorandum of agreement (MOA) to buy Globalmariner from Dynac Sdn Bhd, Zahar Mohd Hashim Zainuddin, Shafinaz Shaukat and Datuk Dr Freezailah Che Yeom.

GBH said it received a letter on Monday from the vendors on their intention to end the proposed RTO. The vendors gave no reason for the termination.

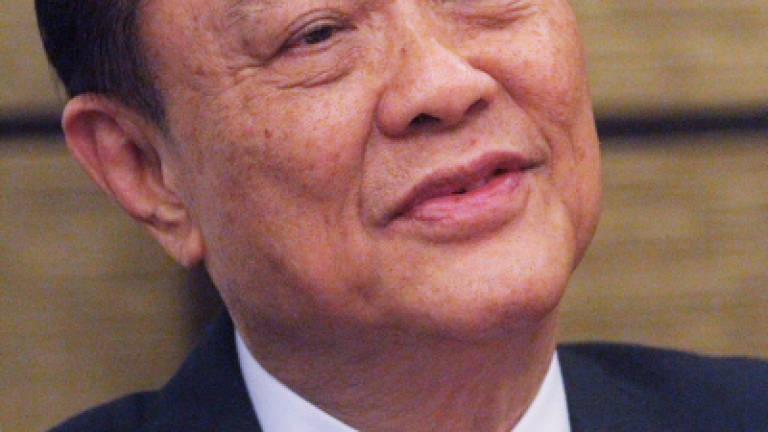

Speaking at a press conference here yesterday, GBH chairman Tan Sri Tan Hua Choon said the company is not disappointed by the termination of the RTO, and is instead looking forward to a better deal.

"We have to seek a new asset to be injected, we'll evaluate other options to prevent (GBH) becoming a cash company," he said.

Tan stressed that GBH's new business is not only confined to the oil and gas sector, but declined to elaborate.

"We'll not limit our scope, as in the past, we never limit ourselves to just oil and gas (business), we'll consider any new business considered viable and good for the company's prospects," he said.

Ekspresi Tepat signed the MOA on July 2 for the proposed purchase of Globalmariner for RM38 million that was to have provided an immediate avenue for Ekspresi Tepat to venture into the oil and gas industry, specialising in floating production storage and offloading facilities, or FPSOs.

Globalmariner holds a licence from Petroliam Nasional Bhd (Petronas), which can give it a competitive advantage when it comes to bidding for FPSO contracts.

Following the termination of the deal, Ekspresi Tepat intends to exercise its put option right under the terms of share sale agreement dated July 2, 2014. The agreement involved a proposed RTO of GBH following its acquisition of shares in Dynac from the vendors for a purchase consideration of RM632 million.

"Such a put option is exercisable by Ekspresi Tepat at any time within a period of 60 days if the definitive agreement has not been executed by the parties in accordance with the terms of the MOA and within the period for execution prescribed in the MOA," it said.

Under the terms of the deal, the purchase consideration would be satisfied via a combination of cash and the issuance of new GBH shares at an issue price of RM2 per GBH share.

At the EGM yesterday, GBH received shareholders' approval for the proposed disposal of 13.93 acres of land that currently houses it ceramic ware manufacturing operation to another Tan-linked company, Keladi Maju Bhd, for RM192.37 million.

The RM71.2 million net gain arising from the land sale was supposed to mainly fund the RTO exercise.

Following the land diposal, GBH will fall into the PN16 cash-company status, whereby it has to submit a regularisation plan to the regulator within 12 months.

Tan revealed that some shareholders were requesting for a capital repayment upon completion of the land sale, but he stressed that the company will only do so if it couldn't identify any new asset.

Filings with Bursa Malaysia show that Tan controls 64.13% and 8.64% of GBH and Keladi Maju respectively.

Other companies in which Tan has equity interest include FCW Holdings Bhd, Jasa Kita Bhd, Marco Holdings Bhd and GPA Holdings Bhd.

Trading in GBH shares was suspended in the morning session yesterday. The counter closed 40 sen or 17.78% lower to RM1.85 on some 1.06 million shares done.

For the six-month period ended June 30, GBH's net profit dropped 44.66% to RM1.37 million from RM2.45 million in the previous corresponding period, due to the increase in natural gas prices.