KUALA LUMPUR: Hong Leong Bank Bhd’s (HLBank) net profit for the first quarter ended Sept 30, 2019 (Q1 20) fell 2.6% to RM688.58 million from RM706.92 million a year ago mainly, due to lower net income and lower share of profit from associated companies.

Excluding a one-off gain from divestment of joint venture of RM72 million recorded in the corresponding quarter last year, net profit for Q1 20 would have expanded 8.5%.

Its revenue also dropped 2.7% to RM1.22 billion RM1.25 billion.

Net interest income improved 3.4% to RM882 million, benefiting from loan book growth and lower cost of funding due to repricing of high cost fixed deposits post-OPR cut. Consequently, net interest margin rose five basis points to 2.03%.

Non-interest income came in at RM334 million, supported by improvement in fee income but offset by lower forex gain and absence of one-off gain from divestment of joint venture in the corresponding quarter last year, giving rise to non-interest income ratio of 27.4%.

Operating expenses contracted 0.6% to RM522 million. Accordingly, cost-to-income ratio stood at 43.0%.

Gross loans and financing grew 6.8% to RM138.7 billion with gross impaired loan ratio at 0.81%.

HLBank said its capital position remained robust with common equity tier 1, tier 1 and total capital ratios at 12.8%, 13.4% and 15.7% respectively.

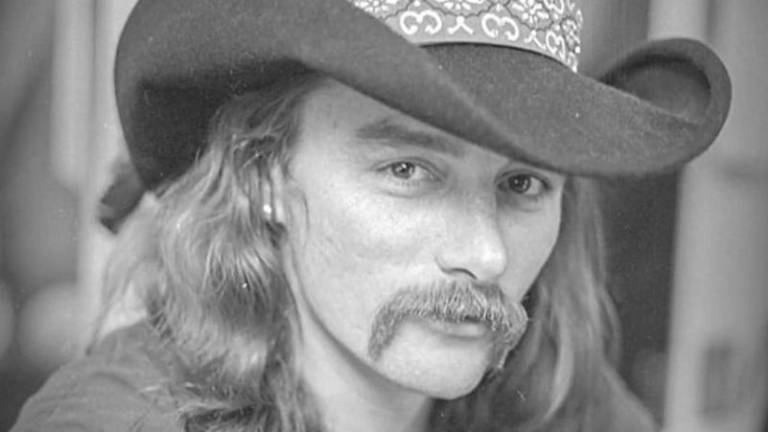

HLBank group managing director and CEO Domenic Fuda (pix) said the banking sector remains challenging, amidst ongoing external headwinds and soft consumer sentiment.

“We remain confident that with our strategic priorities in place, we should continue to see further operational improvements and business growth going forward.”

HLBank said it remains focused on its goal to be a highly digital and innovative Asean financial services institution.

“We continue to explore new growth opportunities while revamping our cost structure through the digital transformation journey, enabling us to achieve sustainable growth and returns for our stakeholders.”

Meanwhile, HLBank’s parent Hong Leong Financial Group Bhd (HLFG) saw its net profit for the first quarter ended Sept 30, 2019 (Q120) fall 3.1% to RM490.2 million from RM505.7 million mainly due to lower non-interest income.

Excluding one-off gains from an equity divestment of RM72.2 million recorded in the corresponding quarter last year, the group’s normalised net profit would have expanded 7.0%.

Its revenue was lower by 4.1% to RM1.33 billion compared with RM1.38 billion in the previous year same quarter.

HLFG declared a first interim dividend of 13 sen per share.