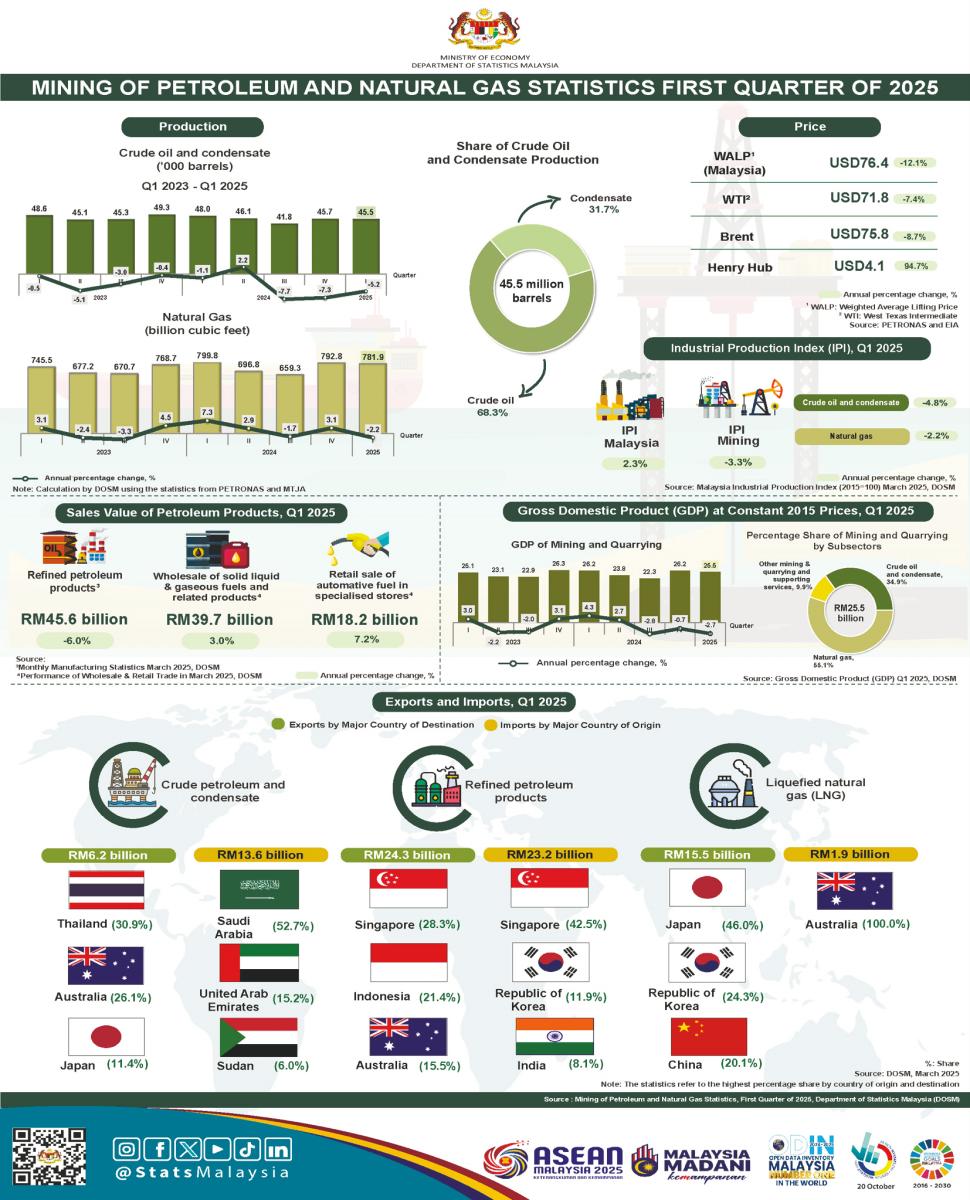

PETALING JAYA: Malaysia’s production of crude oil and condensate recorded a stable volume of 45.5 million barrels in the first quarter of 2025, reflecting the resilience of the upstream sector in navigating market uncertainties, the Department of Statistics Malaysia said in its report on the mining of petroleum and natural gas for the first three months of the year.

Chief Statistician Malaysia Datuk Seri Dr Mohd Uzir Mahidin said, “The crude oil and condensate production recorded 45.5 million barrels in the first quarter of 2025, registering a marginal negative growth of 5.2% year-on-year (Q4’24: -7.3%; 45.7 million barrels). This was supported by an improvement in production of crude oil, which showed signs of recovery with a smaller contraction of negative 6.5% compared to negative 9.3% in the previous quarter.”

Meanwhile, condensate production also recorded growth, but remained within the negative range at 2.4% compared to negative 2.5% in the previous period.

However, natural gas production shrank by 2.2% year-on-year compared to 3.1% in the previous quarter with a total production of 781.9 billion cubic feet compared to 792.8 billion cubic feet in the fourth quarter of 2024.

The Weighted Average Lifting Price for crude oil and condensate in Malaysia rose US$76.4 (RM324.7) per barrel in the first quarter of 2025, compared to US$76.3 per barrel in the previous quarter. This price increased in line with the prices of WTI and Brent, which recorded US$71.8 per barrel (Q4’24: US$70.7 per barrel) and US$75.8 per barrel (Q4’4: US$74.6 per barrel), respectively.

Elaborating the performance of external trade, Mohd Uzir said, “The export value of crude petroleum and condensate increased to RM6.2 billion compared to RM6 billion in the previous quarter. Thailand led the exports of crude petroleum and condensate with RM1.9 billion or 30.9% of total exports, followed by Australia 26.1% and Japan 11.4%.” Meanwhile, the export value of refined petroleum products declined to RM24.3 billion from RM26.5 billion in the previous quarter.

Singapore remained the main recipient of refined petroleum product exports, totaling RM6.9 billion or 28.3%, followed by Indonesia 21.4% and Australia 15.5%.

The export value of liquefied natural gas (LNG) recorded a decrease to RM15.5 billion in the first quarter of 2025 compared to RM16.7 billion in the fourth quarter of 2024, with 46% exported to the Japan, followed by South Korea 24.3% and China 20.1%.

The import value of crude petroleum and condensate declined to RM13.6 billion in the first quarter of 2025, compared to RM15.1 billion recorded in the fourth quarter of 2024. Saudi Arabia remained the dominant source country for crude petroleum and condensate imports, amounted to 52.7%, followed by the United Arab Emirates (15.2%) and Sudan (6%). The import value of refined petroleum products stood at RM23.2 billion, lower than RM25.4 billion recorded in the previous quarter, with Singapore remaining the largest contributor (42.5%), followed by South Korea (11.9%) and India (8.1%). LNG imports recorded a decline to RM1.9 billion (Q4’24: RM2.2 billion), with the entire amount imported from Australia.