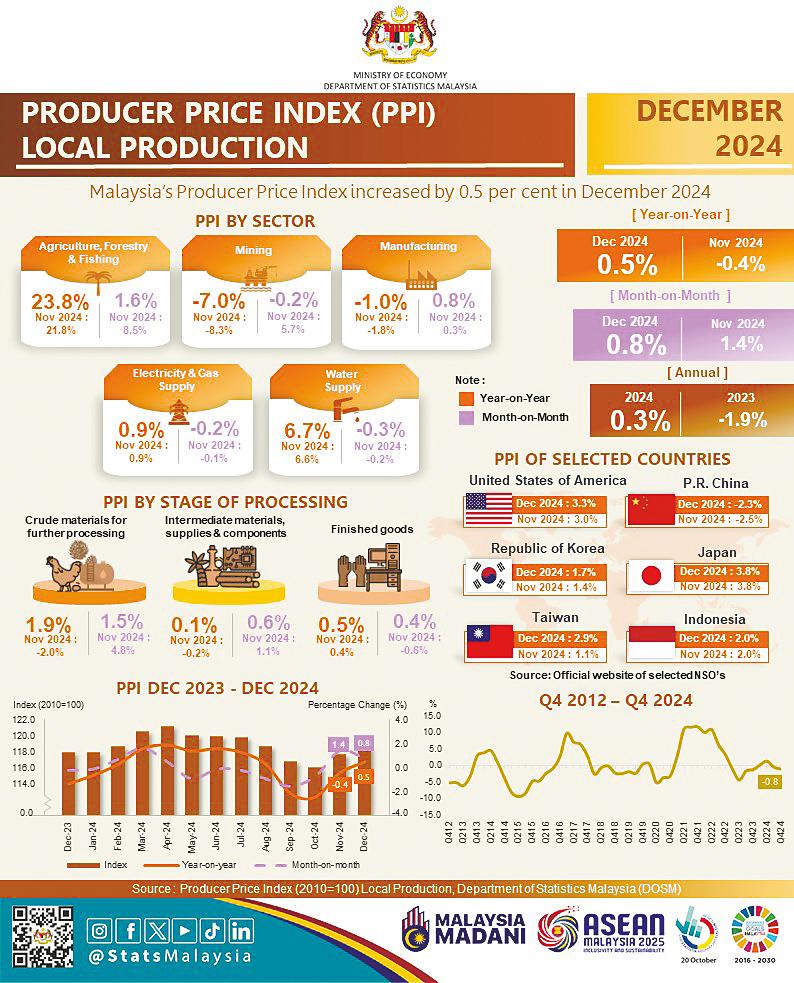

PUTRAJAYA: Malaysia’s Producer Price Index (PPI), which measures price changes at the producer level, increased marginally by 0.5% year-on-year in December 2024, from a 0.4% decline in the previous month.

The decrease was driven by mixed performance across key sectors, with notable increases in the Agriculture, forestry and fishing.

The Chief Statistician Malaysia, Datuk Sri Dr Mohd Uzir Mahidin said: “The agriculture, forestry & fishing sector recorded a significant increase of 23.8% in December 2024, reflecting strong momentum compared to 21.8% in November 2024 due to the growing of perennial crops (41.9%).”

Meanwhile, he added the mining sector contracted by 7.0%, a smaller decline than the previous month of negative 8.3%. The decline was primarily due to the extraction of crude petroleum index, which fell by 9.7%.

The manufacturing sector saw a slight decline of 1.0% (November 2024: -1.8%), with key subsectors of manufacture of coke & refined petroleum products dropping sharply by 15.5% and manufacture of computer, electronic & optical products decreased by 1.5%.

On the other hand, the electricity & gas supply sector recorded a 0.9% increase, while the water supply sector continuing its upward trend by 6.7%.

On a month-on-month basis, Mohd Uzir said the PPI local production continued to increase by 0.8% in December 2024 as compared to 1.4% in November 2024. The agriculture, forestry & fishing sector rose by 1.6% (November 2024: 8.5%), supported by growing of perennial crops index (2.1%).

The manufacturing sector performed positively, increasing by 0.8% (November 2024: 0.3%), led by manufacture of food products (3.2%) and manufacture of computer, electronic & optical products (0.7%).

Conversely, the mining sector recorded a marginal decline of 0.2% (November 2024: 5.7%), dragged down by a 2.4% decrease in the extraction of natural gas index. In the utilities sector, the electricity & gas supply sector declined slightly by 0.2%, while the water supply sector decreased marginally by 0.3 per cent.

“The crude materials for further processing index recorded a year-on-year increase of 1.9% (November 2024: -2.0%), supported by a 2.4% rise in the non-food materials index. The finished goods index rose by 0.5% (November 2024: 0.4%), with capital equipment index increasing by 1.2%,” said Mohd Uzir.

Meanwhile, he added the intermediate materials, supplies & components index edged up slightly by 0.1% (November 2024: -0.2%), driven by materials & components for manufacturing index (3.3%).

On a monthly basis, the crude materials for further processing index increased by 1.5% in December 2024. The intermediate materials, supplies & components index rose by 0.6%, while the finished goods index recorded a rise of 0.4%.

“The PPI local production continued to decline by 0.8% in the fourth quarter of 2024, as compared to 0.2% decline in the third quarter of 2024. The decline was due to mining (-11.0%) and manufacturing (-1.8%) sectors. Conversely, the agriculture, forestry & fishing sector recorded a significant increase of 19.8%, while water supply and electricity & gas supply increased by 6.7% and 0.9%, respectively.

Meanwhile, quarter-on-quarter basis, the PPI showed a 0.8% decline, as compared to a 1.6% decrease in the third quarter of 2024, said Mohd Uzir.

In 2024, he added the the PPI local production increased by 0.3% after posted a negative 1.9% in 2023. The incline was particularly supported by a positive index of agriculture, forestry and fishing of 7.9%, as compared to double-digit negative 13.8% in the previous year.

Likewise, Water supply and electricity & gas supply sectors increased by 6.5% and 0.6%, respectively.

However, both mining and manufacturing indices declined by 2.0% and 0.3%, respectively.

In December 2024, global crude oil prices continued to fluctuate due to factors such as OPEC+ production cuts, geopolitical tensions and shifting demand dynamics.

According to Reuters, China’s crude oil imports fell influenced by the increasing adoption of New Energy Vehicles (NEVs) and crude prices.

These factors contributed to a drop in global oil prices from US$ 78 per barrel in December 2023 to US$ 74 per barrel in December 2024.

Meanwhile, Malaysia’s average crude palm oil price (CPO) for December 2024 reached RM 5,119.50 per tonne, up from RM 5,011.50 per tonne the previous month.

According to the Malaysian Palm Oil Board (MPOB), the lowest output since March 2024 impacted the Malaysia’s CPO market dynamics.

A comparison among selected countries showed that the United States Producer Price Index (PPI) increased by 3.3% this month, up from 3.0% in November 2024.

The rise was primarily due to the final demand goods, particularly in the energy index.

Japan’s PPI rose by 3.8%, maintaining the same pace as in the previous month. It was the highest since June 2023, as costs continued to rise for transport equipment and beverage & foods.

Factory gate prices for goods produced by United Kingdom rose marginally by 0.1% in December 2024 (November 2024: -0.5%), driven by higher costs for food products and softened decline in the Coke and refined petroleum products.

China’s producer prices continued to decline by 2.3% in December 2024, lower than a 2.5% decline in the previous month.

This was the 27th consecutive month of producer deflation, the lowest decline since August 2024, as Beijing continued its efforts to stimulate demand towards the end of the year.

Regarding Malaysia’s current selected commodity prices, Mohd Uzir explained that “according to Commodity Market Outlook by the World Bank, the overall commodity outlook for 2025 indicates a downward trend, with an anticipated 5% decline in prices, followed by a 2.0% decrease in 2026”.

“The downturn is attributed to factors such as oversupply in energy markets, overcapacity in metals and stabilise agricultural prices. The U.S. Energy Information Administration (EIA) forecasts that global oil production growth will surpass demand, leading to an oversupplied market.

“Consequently, Brent crude prices are expected to average US$ 74 per barrel in 2025, an 8.0% decrease from 2024, and decline further to US$ 66 per barrel in 2026.”