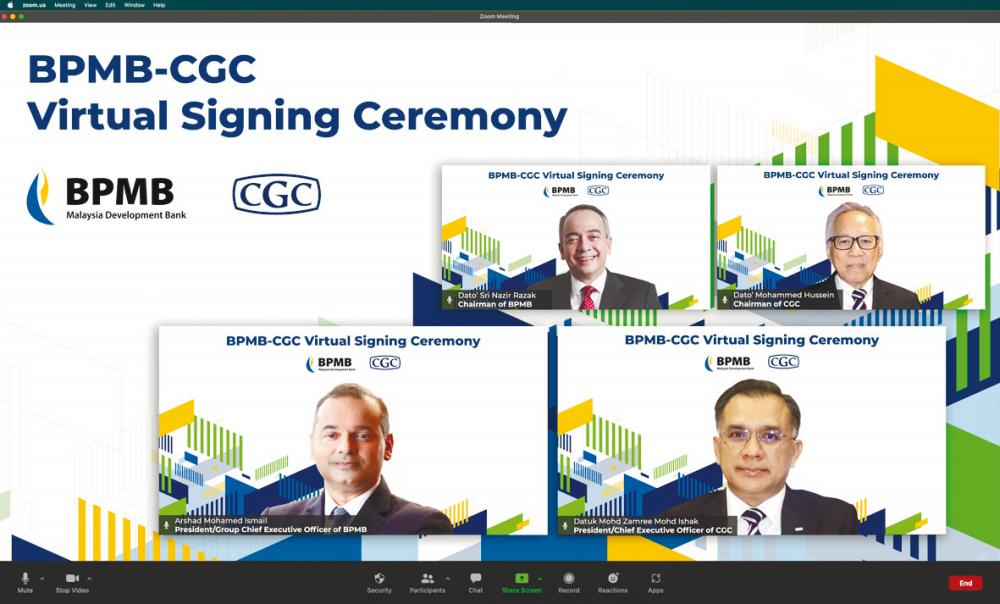

PETALING JAYA: Bank Pembangunan Malaysia Bhd (BPMB) today entered into an agreement with Credit Guarantee Corp Malaysia Bhd (CGC) and Minister of Finance (Incorporated) for the 100% acquisition of Danajamin Nasional Bhd.

The acquisition is in line with the government’s medium-term plan to streamline the mandates of development financial institutions (DFIs) to improve the national development finance ecosystem.

Following BPMB’s acquisition of shares from MOF Inc and CGC, Danajamin will be a wholly owned subsidiary of the bank.

“The strengthening of our DFIs will enhance their ability to support national economic development by availing capital to borrowers neglected by private banks, providing subsidised capital for priority sectors and crowding-in private capital to key segments of the economy,” said BPMB chairman Datuk Seri Nazir Razak in a statement.

On the merger of BPMB and Danajamin, he said the bank will work together with all stakeholders to ensure the DFI ecosystem is supportive of the needs of the nation.

“The economic crisis caused by the pandemic is a strong reminder for us all of the importance of DFIs as countercyclical lenders for the economy.”

Meanwhile, CGC chairman Datuk Mohammed Hussein said he is confident the merger will result in synergistic value which will create greater scale and take on wider mandates with greater development impact under the enlarged umbrella of BPMB.

The addition of Malaysia’s first financial guarantee insurance provider, Danajamin, will complement the bank’s existing offerings as it is expected to enhance Malaysian businesses’ access to capital markets and capital in general, he added.

Under the deal, the purchase consideration for Danajamin will be its audited net asset value as at June 30, 2021. It is expected to be concluded immediately after the completion of an interim audit, estimated to be in November 2021.