KUALA LUMPUR: Malaysia’s economy is poised to record steady growth in 2026, supported by resilient domestic demand, firm labour market conditions and a recovering tourism sector despite global tariff pressures.

Bank Negara Malaysia (BNM) governor Datuk Seri Abdul Rasheed Ghaffour said the external environment next year will remain challenging, with global growth and trade expected to “vibrate further” due to the full impact of tariff actions.

However, he noted that global policy support would help prevent a deeper slowdown.

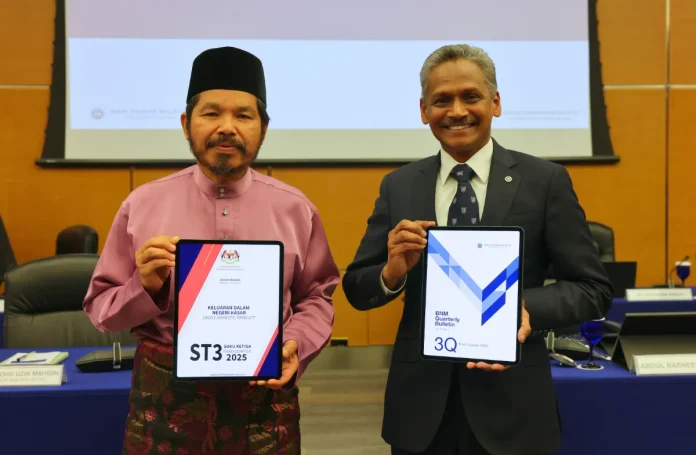

“Negative effects of tariffs and uncertainty will be partly cushioned by fiscal support and monetary policy easing, which will help sustain domestic demand,” he said during the release of Malaysia’s third-quarter gross domestic product (GDP) performance today.

The domestic economy expanded by 5.2% in the third quarter of 2025, up from 4.4% in the second quarter of 2025, driven by sustained domestic demand and higher net exports.

BNM noted that favourable labour market conditions, income-related policy measures and cash assistance programmes supported household spending.

Investment activity was underpinned by continued capital expansion by both private and public sectors.

On the external front, net exports grew faster as export growth outpaced import growth.

For the nine months, Malaysia’s economy grew by 4.7%, well within BNM’s forecast range of 4.0–4.8%.

“At this rate for this year, we may record a growth rate that is closer to the upper range of this forecast,” Abdul Rasheed said.

Turning to next year, the central bank governor reiterated the Ministry of Finance’s projection for growth of between 4% and 4.5% in 2026. He said the main support will continue to come from domestic demand.

“Household spending will be supported by continual employment and wage growth, the income-related policy measures and also the additional cash transfers by the government.”

Abdul Rasheed stressed that private consumption is expected to remain Malaysia’s key economic anchor.

“Personal spending will continue to be the backbone of Malaysia’s economic growth,” he said, adding that household resilience will be aided by healthy household balance sheets and the government’s cash assistance.

Abdul Rasheed also pointed to ongoing momentum in investment activity, noting that both private and public sector spending remained robust. “Recent trends continue to reflect strong investment growth across both structures and machinery and equipment.”

He said approvals tracked by the Malaysian Investment Development Authority (Mida) indicate solid future activity.

“Forward-looking indicators point towards steady investment momentum, underpinned by a healthy pipeline of planned investments.”

The continued implementation of multi-year public projects and high realisation of approved private investments will make the domestic investment landscape more resilient, he added.

Abdul Rasheed also commented on Malaysia’s labour market outlook, saying that continued employment and wage increases, particularly in domestic-oriented sectors, will support consumption next year. He noted that favourable labour conditions this year have already helped stabilise spending.

On the external sector, the governor said trade performance is likely to remain moderate.

“Tariff and global demand pressures will be offset by the continued demand for E&E goods, inbound tourism and recovery in the mining-related exports.”

While he acknowledged that global uncertainties will weigh on the export outlook, Abdul Rasheed maintained that Malaysia’s diversified export structure would help cushion the impact.

Tourism emerged as a key growth driver in the discussion, with the central bank governor highlighting its rising contribution.

He said Malaysia’s travel-related indicators showed clear signs of improvement and would become an essential engine of growth in 2026. “Next year, with increased travel activity, we expect tourism to become an engine of growth for us.”

Travel receipts for the first three quarters of 2025 were already equivalent to last year’s total, Abdul Rasheed noted.

“If you look at the data point, the first three quarters of this year in terms of travel receipts are the same as last year,” he said.

He added that domestic tourism is also likely to strengthen.

“There is a possibility that by next year or in 2026, we will see growth in domestic tourism,” he said, noting that rising mobility and improved travel partnerships would support this trend.

Despite global uncertainties, Abdul Rasheed maintained a cautiously optimistic outlook for Malaysia in the coming year.

He said the combination of resilient household spending, steady investment flows and recovering tourism activity would provide the country with a solid growth foundation. “We are confident that Malaysia remains well-positioned to navigate ongoing challenges while capitalising on new opportunities for sustainable growth.”