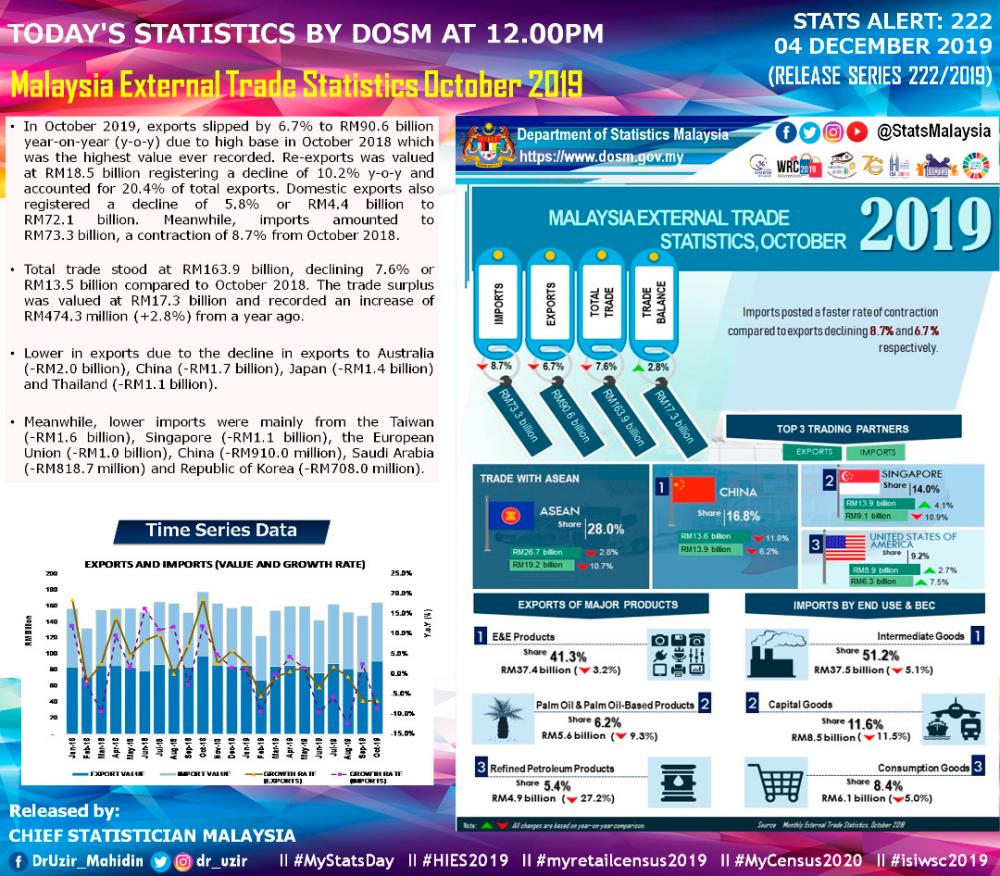

PETALING JAYA: Exports continued to lose momentum in October, declining 6.7% year-on-year (yoy) to RM90.6 billion due to a high base in October 2018, which was the highest value ever recorded, according to the Department of Statistics.

However, trade surplus came in at RM17.3 billion, an increase of RM474.3 million or 2.8% from a year ago as imports contracted 8.7% to RM73.3 billion.

Chief statistician Datuk Seri Mohd Uzir Mahidin said total trade stood at RM163.9 billion, declining 7.6% or RM13.5 billion compared to October 2018.

The main products which contributed to the decline in exports in October 2019 were crude petroleum (-50.5%); refined petroleum products (-27.2%); electrical & electronic products (-3.2%); liquefied natural gas (-17.1%); palm oil and palm oil-based products (-9.3%); timber and timber-based products (-3.9%); and natural rubber (-4.7%).

The fall in exports was also due to lower exports to Australia, China, Japan and Thailand.

“Re-exports was valued at RM18.5 billion registering a decline of 10.2% yoy and accounted for 20.4% of total exports. Domestic exports also registered a decline of 5.8% or RM4.4 billion to RM72.1 billion,” said Mohd Uzir.

On a month-on-month basis, exports expanded 16.6%.

Meanwhile, imports by end-use recorded a decrease for all main categories which are intermediate goods followed by capital goods and consumption goods.

MIDF Research expects export performance to be quite vulnerable in Q4, with the uncertainty over trade tensions.

“On the latest development of US-China trade deal, Trump hints on another year of trade tension with China, considering the idea of having a deal after the presidential election scheduled on Nov 3, 2020. This increase possibility of another round of tariffs on Chinese goods which is due on Dec 15, 2019.”

Meanwhile, UOB Research said it remains cautious on the export outlook for the remaining two months of 2019 and 2020.

“We maintain our full-year export forecast at -1% for 2019, before recovering to 2% growth in 2020. The projected recovery next year is expected to be softer relative to past cycles amid the prolonged US-China trade disputes, potential widening of trade disputes to other countries, and global tech down cycle that may drag until mid-2020.”