PUCHONG: Enterprise IT services provider, TechStore Bhd, delivered a revenue of RM53.6 million for the nine months (9M) ended September 30, 2025 (FY25), in which the maintenance and support services segment contributed 69.5% of the total revenue.

It was primarily derived from the supply of hardware and software, the provision of

professional services and preventive maintenance for the Intelligence Supervisory Control and Data Acquisition (SCADA) system, as well as the supply of Internet of Things (IoT) modules, expander modules, cameras, and network video recorders.

There are no comparative figures for the preceding corresponding quarter and year-to-date results, as this is the fourth interim financial report being announced in compliance with the ACE Market Listing Requirements of Bursa Malaysia.

Meanwhile, the design and implementation services segment accounted for the

remaining 30.5% of turnover.

9M FY25 profit after tax (PAT) came in at RM6.8 million, which included a one-off listing expense of RM0.9 million.

Excluding this non-recurring expense, TechStore would have recorded a PAT of RM7.7 million for the cumulative financial period.

On quarterly performance, TechStore’s Q3 FY25 revenue stood at RM18.8 million

compared to RM20.8 million in Q2 FY25.

This was primarily due to the progressive completion of the Light Rail Transit 3 (LRT3) automatic fare collection (AFC) project and ongoing billing for professional services and preventive maintenance related to the Intelligence SCADA system.

Despite the lower revenue in Q3 FY25 compared to Q2 FY25, the group recorded a

9.9% increase in PAT to RM3.0 million from RM2.7 million.

The improvement was mainly driven by the maintenance and support services segment, which contributed to a higher gross profit margin during the quarter.

Correspondingly, the group’s gross profit margin improved to 36.6% for the quarter from 23.9% in Q2 FY25.

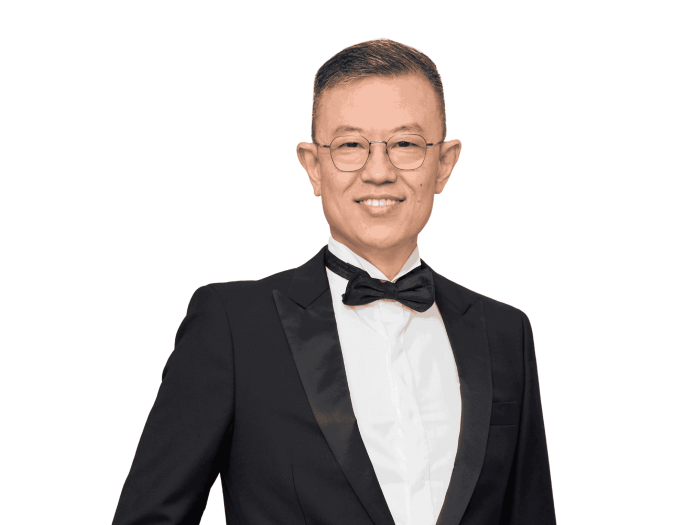

Managing director Tan Hock Lim said the company is pleased to deliver positive progress since listing, with its reported nine-month performance already surpassing its FY24 full-year results.

“TechStore’s project pipeline remained healthy, supported by an order book of RM106.6 million as at September 30, 2025, providing earnings visibility for the group,” he said.

TechStore’s outlook remains promising, driven by national development priorities

under Budget 2026, which allocates more than RM12 billion to modernise the national transport system in line with the 13th Malaysia Plan (2026 to 2030).

These initiatives emphasise a safer, more efficient mobility network through major rail projects, including MRT3, the Klang Valley Double Track Phase 2, and the Penang LRT Mutiara Line.

The Ministry of Transport is also implementing platform screen doors across LRT stations to enhance passenger safety.

Beyond transportation, the Budget 2026 also accelerates the government technology (GovTech) transformation to strengthen public services and national digital infrastructure.

“These developments bode well for TechStore, underpinned by our proven expertise in both brownfield and greenfield projects, and our active role in Malaysia’s transport digitalisation landscape through major railway projects such as LRT3 and the RTS Link.

“Moving forward, we are pursuing larger and more complex opportunities, including transportation projects in Johor and Penang, as well as initiatives within the

public sector.

“As of September 30, 2025, our tender book has expanded to RM1.9 billion, underscoring strong traction in both railway and public sector enterprise IT

opportunities,” Tan said.

TechStore remained in a healthy financial position, supported by a net cash position

and net assets per share of RM0.14 as at September 30, 2025.

The group also generated a positive net operating cash flow of RM22.7 million in 9M FY25.

To recap, TechStore raised RM25.0 million in fresh funds from its listing on the ACE

Market of Bursa Malaysia on February 18, 2025.