AMPANG: As global uncertainties renew interest in safe-haven assets, more Malaysians are turning to gold – not just as ornamental pieces, but as a trusted form of savings and investment.

Homegrown jeweller Habib Jewels has seen a steady rise in demand over the past five years, driven by strong cultural ties, surging gold prices and shifting consumer preferences post Covid-19.

Group executive chairman Datuk Seri Meer Habib told theSun that gold remains deeply embedded in the purchasing habits of Malaysians, whether for milestone events, financial security or asset diversification.

“The motivation is deeply rooted in culture across all major ethnic groups in Malaysia. Long before formal banking systems were established, gold served as a trusted store of value.

“Families would buy gold to be sold later when funds were needed for the haj pilgrimage, children’s education or property purchases. To this day, gold remains a symbol of security and trust for many Malaysians,” he said.

He added that gold-buying behaviour changed significantly during the Covid-19 pandemic in 2020.

The resulting global economic disruptions and rising national debts prompted many to turn to gold as a hedge against inflation.

“Since January 2020, gold prices have surged by approximately 126%. In 2023 alone, prices increased by about 28%, and this year has seen even more dramatic growth, with a 31% rise recorded in just the first few months.

“Overall, prices have climbed about 44% since early 2024, making gold one of the most stable and high-performing assets in today’s financial climate.”

He noted that while younger Malaysians were once more inclined towards cryptocurrencies such as Bitcoin, there is now a growing shift in preference towards gold.

“This is quite a rare scenario where you’re able to purchase something, enjoy wearing it and later sell it for a profit. That’s the unique advantage of gold jewellery.”

During the pandemic, many Malaysians withdrew their EPF savings, but those who chose to invest in gold have since seen significant returns.

“Even with gold prices at record highs, public confidence remains strong. Despite my own caution that prices may have risen too fast, Malaysians continue to invest. Their confidence has even surpassed my expectations.”

While digital gold investments are gaining traction, Meer said many Malaysians still prefer physical gold due to the sense of security and tangibility it offers.

He attributed this preference to Malaysia’s mature gold ecosystem, where gold remains highly liquid and can be easily sold at jewellery stores or even abroad.

“Habib’s own gold bars, certified by the London Bullion Market Association, are internationally recognised and can be traded worldwide.”

He described the current surge in gold prices as unusual, driven by global factors such as inflation, pandemic-related debt and ongoing geopolitical tensions.

“China and Russia are buying more gold as confidence in the US dollar drops,

especially after sanctions during the Russia-Ukraine war.

“Recent US trade policies and political uncertainties have further accelerated this trend. In times of uncertainty, gold remains a reliable safe haven.”

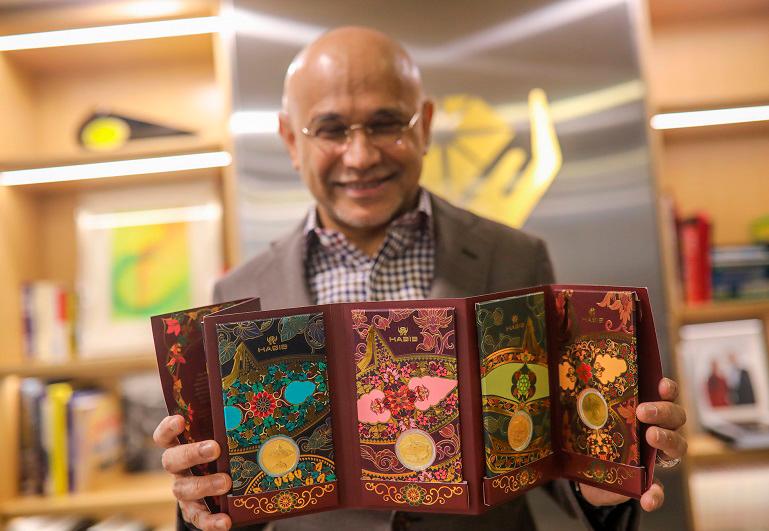

Habib Jewels also introduced collectible gold wafers – an innovation now widely adopted across the industry.

He emphasised the brand’s commitment to craftsmanship and its annual focus on promoting traditional Malaysian arts through limited edition 0.2-gram gold pieces.

This year, the focus is on the wau (traditional kite), with Habib creating designs inspired by the cultural symbol.

“It’s not just about the gold value, but also the collectability and uniqueness that people find appealing.

“Habib is a proud Malaysian identity. We’re as good as, if not better than, international brands. It’s time Malaysians recognise the value in local craftsmanship, and Habib is committed to putting Malaysia on the map with our world-class jewellery designs.”