KUALA LUMPUR: TMK Chemical Bhd is doubling down on its core business with strategic acquisition plans and the construction of a new plant to meet growing market demand.

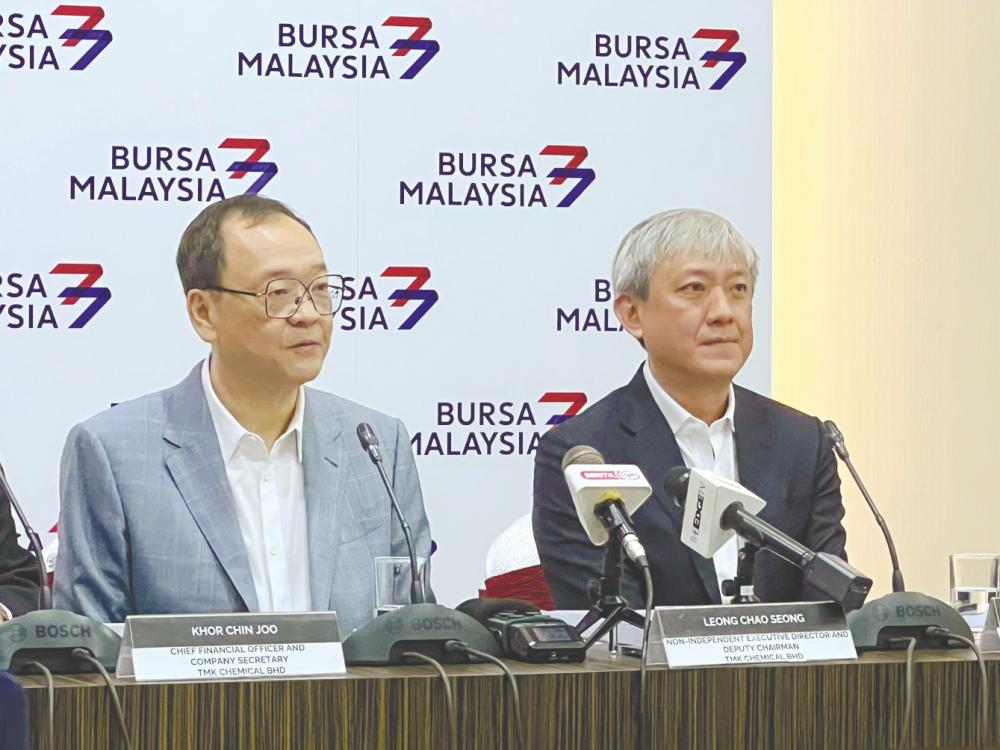

Non-independent executive director and deputy chairman Leong Chao Seong revealed that the company is in the early stages of evaluating acquisition targets closely aligned with its existing operations.

“We are not looking to diversify but rather to integrate further within our industry,” he said at a press conference following TMK’s listing on Bursa Malaysia’s Main Market today.

While specifics of the acquisition targets remain under wraps, it has been confirmed that the company’s focus is on bolstering its existing strengths rather than entering new markets.

In addition to the potential acquisition, Leong said, the company is progressing with the construction of a plant slated for completion by 2026.

“Once operational, the new plant will double the current production capacity to 352,254 tonnes of chlor-alkali derivatives, which has already reached the rate disclosed in the prospectus. The plant expansion reflects our commitment to meeting growing market demand and maintaining our competitive edge.”

Leong said the company remains bullish on its growth prospects, citing Malaysia’s robust economic recovery and increased foreign direct investment (FDI) as key drivers. “We see a strong manufacturing rebound over the next two years, supported by new factory developments and industrial activity,” he added.

While remaining optimistic, Leong said, the company acknowledges challenges, particularly in scaling operations beyond its existing markets in Malaysia, Singapore and Vietnam. “Expansion into Indonesia is on the radar, though it will proceed cautiously.”

Leong highlighted Malaysia’s strategic advantage amid global shifts such as the China-Plus-One strategy, noting strong demand for industrial land. “We are seeing real demand with industrial land prices climbing significantly. This reflects investor confidence in Malaysia as a manufacturing hub,” he said.

TMK Chemical shares made a commendable debut on Bursa Malaysia, opening at RM1.97, a 12.6% premium over the initial public offering (IPO) price of RM1.75. The opening price valued the chemical trading and storage company at RM2 billion. The shares closed at RM1.92 on volume of 47.49 million units.

The IPO attracted significant interest, with the public portion oversubscribed by over 14 times. Institutional investors also fully subscribed to the offering, underscoring confidence in the company’s growth potential. The IPO raised RM385 million in fresh capital.