PETALING JAYA: The recently released 2021 Property Market Report by the National Property Information Centre (Napic) shows a sign of recovery in the property sector. A total of 300,497 transactions worth RM144.87 billion are recorded, which is an increase of 1.5% in volume and 21.7% in value compared to 2020. Meanwhile, house price continues its moderate growth since 2018 despite of the market slowdown – from an average house price of RM417,974 in 2018 to RM432,111 in 2020 and further to RM434,758 in 2021 – which could probably help to restore the consumer buying sentiment.

Looking ahead, the property market will see a significant pick-up following the increase in domestic business activities as a result of the lifting of restrictions of business operating hours and the reopening of country borders on April 1.

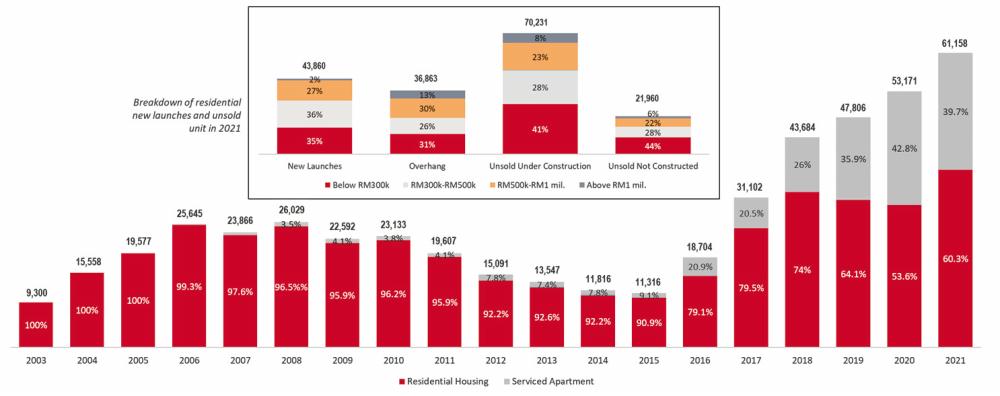

While the property market is deemed to be back on track after its subdued performance in 2020, the overall environment is still pretty much the same as the pre-crisis level, which is prevalent with “excessive supply” and “slow absorption”. This is supported by the overhang figures, where both the residential housing and service apartment have recorded a historical height – with 36,863 units and 24,295 units, respectively – amounting to 61,158 units of completed unsold, or a 15% growth from 53,171 units in 2020. If those unsold units “under construction” and “not constructed” are taken into account, a total of 203,804 unsold units is recorded, which is a 12.4% increase from 181,292 in 2020, being the highest since 2017.

The overhang may not perfectly reflect the overall market performance, but it does provide insights for property developers on how to respond to the challenges in the property sector. Rather than simply attributing overhang to the building of over-priced houses, one should realise that as high as 31% or 11,610 completed unsold residential units are contributed by products priced less than RM300,000. Another 26% or 9,461 units are priced within RM300,000- RM500,000. All these are developments initially targeted for B40 and M40 income groups. In terms of unsold units under construction and not constructed, majority of them also originated from products priced below RM300,000 – both at 41% (or 29,083 units) and 44% (or 9,641 units).

New launches in 2021 also show the similar trend. Majority (71%) of the products are aiming for B40 and M40 income groups, with 35% or 15,332 units are products priced below RM300,000, and 36% or 15,723 units priced within RM300,000-RM500,000, signifying that the supply side of the property industry is actually responding to the market demand by providing products that match the mass buyers’ affordability level.

As such, the current challenges faced by the housing industry is not merely a mismatch of the housing supply-delivery system. It is an economic issue that is deeply related to the country’s weak economic performance and the reduction in household income due to the unforeseen pandemic-induced recession. Correspondingly, measures to address housing affordability should move away from simply building more affordable houses or relaxing financing preconditions to make purchasers more viable for housing loan, but to be treated as the economic issue of the country.

This article is contributed by MKH Bhd manager of product research and development Dr Foo Chee Hung.