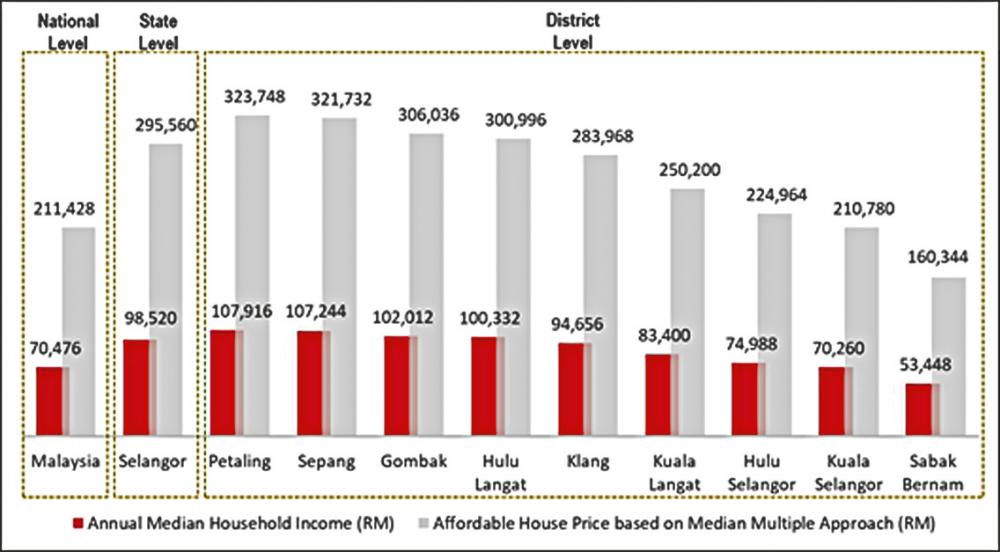

THE move to develop an Affordable Housing Price Index – as suggested by the Housing and Local Government Ministry (KPKT), so as to guide developers, prospective buyers, and local authorities to determine the appropriate price of affordable housing in locality – offers an alternative to the currently widely used national- and state-based housing affordability measures. This is because, due to the dynamic and segmented in nature of the housing market, as well as the spatial and socioeconomic characteristics of a location, different scale of measurement (national, state, district, city, or community) could produce different set of households’ housing affordability. As shown in the chart, housing affordability (calculated with Median Multiple approach) tends to increase from national to district level.

In fact, the intention of setting housing affordability threshold in an area, in order to ensure no geographical mismatch in terms of housing accessibility and affordability, has been stipulated in the National Housing Policy (DRN) (2018-2025), under the Policy Strategy 2.2: Developing localised housing affordability measures to enhance the monitoring and evaluation framework of states and local authorities. If prices of affordable housing in an area are to be reasonably set based on the median household income in that particular area, the development of a localised and more accurate housing affordability measure is necessary. Not only that it can enhance the housing supply-delivery system, but also help to alleviate the mismatch of product, location, and pricing – which has long been claimed as the culprit of overhangs.

Having said that, it is unrealistic to benchmark the prices of affordable housing on the median household income alone, without considering if these houses are even possible to be built cheap enough to make it affordable in the first place. Due to the escalating land cost and soaring building material prices, new housing construction is usually more expensive, hence, the resulting house price could become too costly for certain income groups in a particular location. As such, an effective housing affordability measure should not only be a reflection of the ability or willingness of purchasers to pay for a house, but also take into account the varying production cost of building a house in a specific location.

Most importantly, the said housing affordability measure should only be treated as a reference to help government and developers monitor the socioeconomic characteristic of locality. It should not be used as an attempt to limit housing market development or to control house prices in locality, as like the one mentioned under the Policy Action Plan 2.2.3: To require approvals for housing development to take into account the housing affordability criteria of the local area; and Policy Action Plan 2.2.4: To include the local area housing affordability threshold as an assessment criterion in the APDL application of housing developers.

This is because once the local area housing affordability threshold is set, areas that are defined as settlement of low-income groups will definitely distract any high value investment or physical development, as the likelihood of value appreciation in these areas is close to non-existent. Not to mention the process of gentrification – where a previously blighted neighbourhood becomes desirable due to wealthier people moving in, improving housing, and attracting new businesses, thereby resulting in increased property values in that particular neighbourhood – can no longer happen as the potential development value has been restricted.

One must acknowledge that the existence of a mixture of low, medium, and high-end properties in every area of the country reflects the determination of the government in alleviating, if not totally eradicating the problem of regional imbalances. Since independence, efforts have been taken to reduce the gap of income inequality through balanced town planning. As such, a deeper consideration is needed before undertaking any attempts that could contribute towards widening rich-poor disparity, and eventually pushing our society towards class discrimination.

From the microeconomics point of view, though the setting of the local area housing affordability threshold could reduce speculation in the short-term while ensuring affordable houses to stay “affordable”, it could have profound impact to the housing market demand and sentiment in the long-run. For example, a starter house priced RM300k and below is deemed sufficient for a couple that just started a family. Over the years, when the family becomes stronger in terms of financial establishment, coupled with a higher asset price through appreciation, the family is financially eligible to switch to a new house with bigger living space, higher living standard, or better quality of life. This upgrading process will definitely not be possible if the housing market is stagnant.

This article is contributed by MKH Bhd manager of product research and development Dr Foo Chee Hung.