KUALA LUMPUR: High rise properties in established and emerging urban areas achieved favourable median rental price increase in the first half of 2022 (H1’22), with the top high-rise residential properties in Kuala Lumpur and Selangor registering the highest median rental price growth in H1’22.

According to iProperty.com.my, these properties have gained double-digit percentage growth compared to H2’21. A growing number of property seekers are shifting their focus to renting as a solution to upgrade their lifestyle and living space needs. This is due to a challenging economic climate which includes rising interest rates and a higher cost of living.

PropertyGuru Malaysia (PropertyGuru.com.my and iProperty.com.my) country manager Sheldon Fernandez said on iProperty.com.my, it has observed a 34% search increase for rental properties in H1’22. This growth in searches suggests that renting is a viable option for consumers who are looking for more freedom and flexibility as well as a financial advantage.

“The encouraging rental price growth of several top properties in the Klang Valley is also an indication that the property market has the ability to recover post-pandemic. This provides some assurance to potential buyers and upgraders who are looking to invest in a residential property. On a similar note, this situation provides an opportunity for financially-sound property investors to capitalise on the lucrative potential of rental properties,” he said in a statement today.

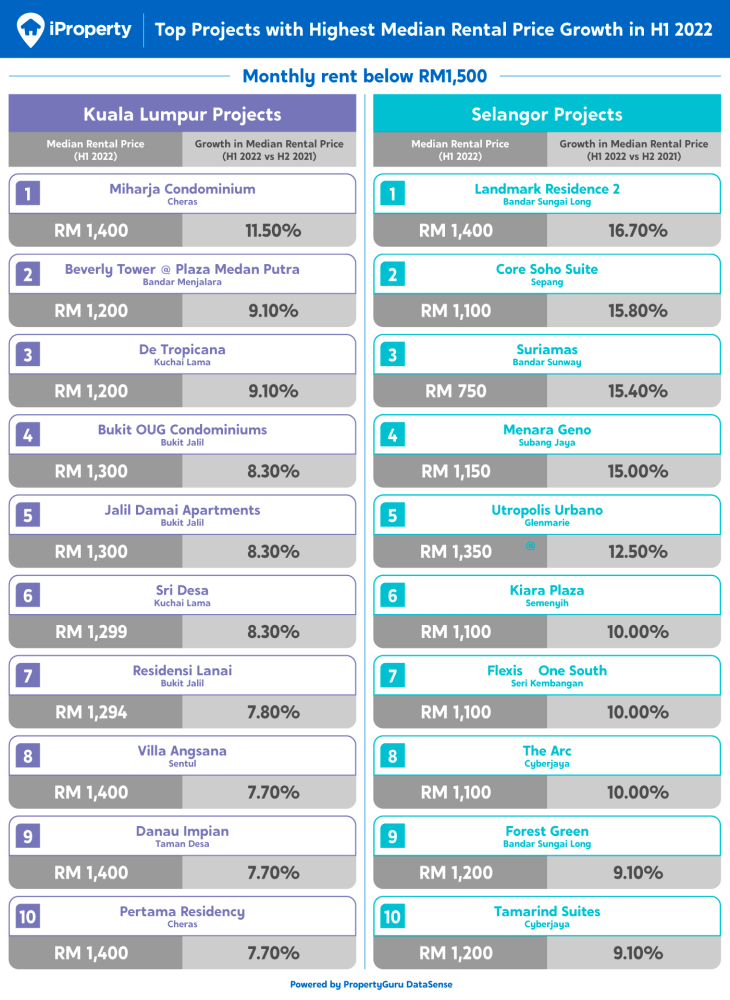

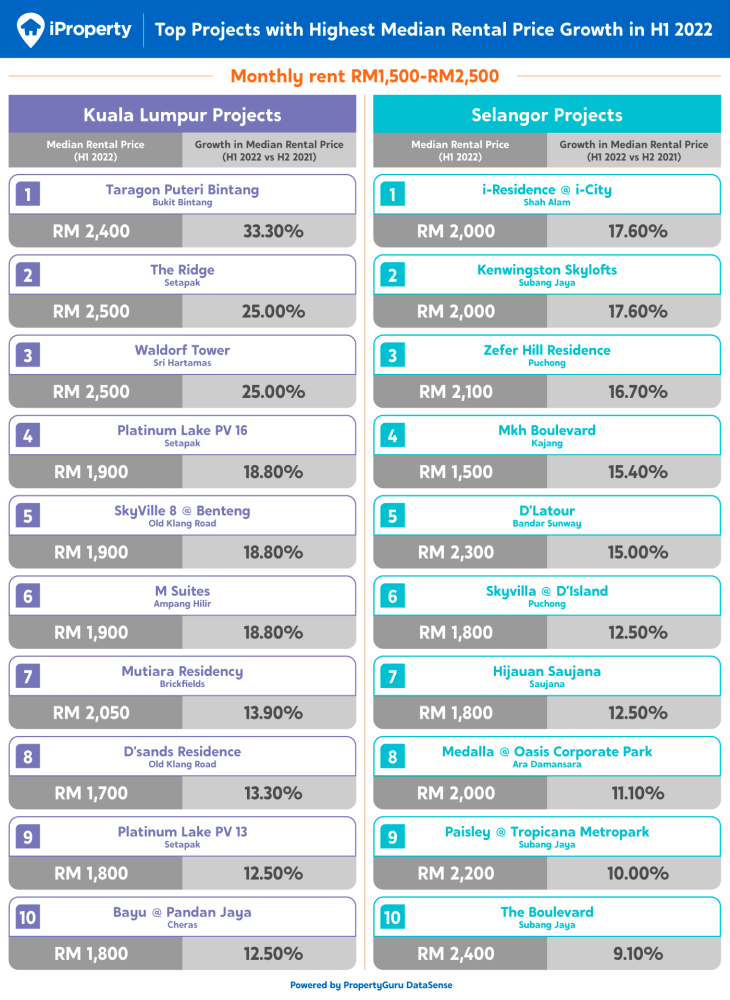

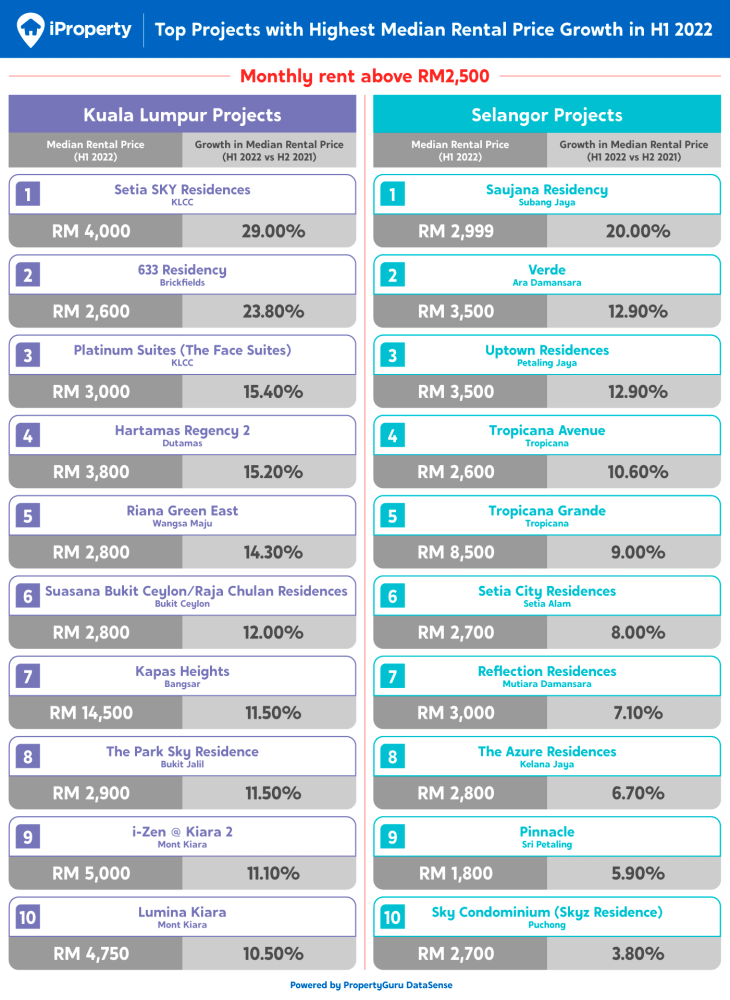

iProperty.com.my’s data offers a clearer picture of rental price movement by identifying high-rise properties within three different price tiers — below RM1,500; RM1,500 to RM2,500; and above RM2,500. This offers greater insights into various types of rental investment options that are performing well in the current climate.

Below is a rundown of the top high-rise residential properties in Kuala Lumpur and Selangor with the highest median rental growth in H1’22:

Affordability and convenience – Top properties with rental prices under RM1,500

A strategic location and economical price tags are the primary driving factors behind the median rental price growth of several high-rise properties below RM1,500 in Kuala Lumpur. Miharja Condominiums in Cheras tops the list with an 11.5% growth. The condominium is located near LRT and MRT stations and many retail experiences such as shopping malls, food courts, and restaurants. Select high-rise properties in Bukit Jalil and Kuchai Lama also emerged as winners, registering between 9.1% (De Tropicana, Kuchai Lama) and 7.8% (Residensi Lanai, Bukit Jalil) in median rental price growth. The positive movement is bolstered by the project’s convenient accessibility via several major highways.

Meanwhile, properties in Selangor’s suburbs such as Bandar Sungai Long, Cyberjaya, and Semenyih, continue to be popular among middle-income tenants. Landmark Residence 2 in Bandar Sungai Long, which recorded a median rental price growth of 16.7%, offers great value for price with its reasonable asking rent, tranquil living environment and a good road network. Similarly in Cyberjaya, The Arc and Tamarind Suites have performed well in H1 2022 with a growth of 10% and 9.1% respectively. The Arc is particularly popular among university students and foreign and local tenants who work in the locality. Meanwhile, Tamarind Suites has many of its units being rented out as short-term accommodation, banking on its attractive duplex layouts and location next to a popular neighbourhood mall.

Catering to the lifestyle demands of urbanites – Top properties with rental prices between RM1,500 to RM2,500

Properties in this price tier appeal to young urbanites as they are typically in more strategic locations and offer several lifestyle advantages. One example is Taragon Puteri Bintang in Kuala Lumpur, which saw its median rental price grow by 33.3% in H1 2022, marking a resurgence of interest in the older Jalan Pudu stretch surrounding the Bukit Bintang vicinity. The property benefits from easy access to shopping malls, entertainment outlets, LRT, and Monorail stations. For similar reasons, some properties in Setapak gained between 25% (The Ridge) and 12.5% (Platinum Lake PV 13) in median rental price growth. Setapak offers more affordable high-rise options with upgraded lifestyle facilities and convenient access to the city centre. Both bode well with modern mid-income urbanites.

As for Selangor, five rental properties in Subang Jaya and Puchong dominated the top median rental price growth list - owing to their traditional appeal as mature neighbourhoods which sustains family and community living. Being home to various eateries, family attractions and educational institutions, liveability is one of Subang Jaya’s strong points. This is reflected in the solid performance of three rental properties including Kenwingston Skylofts, which saw its median rental price increase by 17.6%.

Meanwhile, Puchong’s appeal has always been a focal point of connectivity, with numerous LRT and highway access points. As a result, the area is one of the prime movers for median rental prices in Selangor, registering between 12.5% (Zefer Hill Residence) and 16.7% (Skyvilla @ D’Island) growth in H1 2022.

Premium and exclusive – Top properties with rental prices above RM2,500

Properties in this price tier cater to wealthy tenants with a preference for luxury living. The reopening of international borders has attracted the expatriate community back to Malaysia’s property market. For example, in Kuala Lumpur City Center (KLCC), Setia SKY Residences recorded a median price rental growth of 29%. Platinum Suites (The Face Suites) gained 15.4% too due to its location within the capital city’s prime business and commercial hubs. These properties are also prominent among tourists and business travellers looking for short-term accommodations. Mont Kiara is another popular area among expatriates that saw its median rental prices rise between 11.1% (i-Zen @ Kiara 2) and 10.5% (Lumina Kiara), making it a favourite target for property investors.

For local tenants in the higher income tier, many consider an enhanced living experience with sizable spaces, conducive green surroundings and enriching lifestyle facilities as critical factors when looking for a property. A prime example is Tropicana Grande, which saw its median rental price rise by 9% - this resort-style condominium provides clubhouse facilities and fronts the Tropicana Golf & Country Resort. Verde @ Ara Damansara, with its hotel-inspired recreational facilities also made the list with a median rental price growth of 12.90%. Topping the list is Saujana Residency in Subang Jaya, with a 20% median rental price growth. Albeit older, the serviced residence offers low-density living, a dedicated private garden for its larger units, and various lifestyle facilities including an in-house convenience store and a launderette.