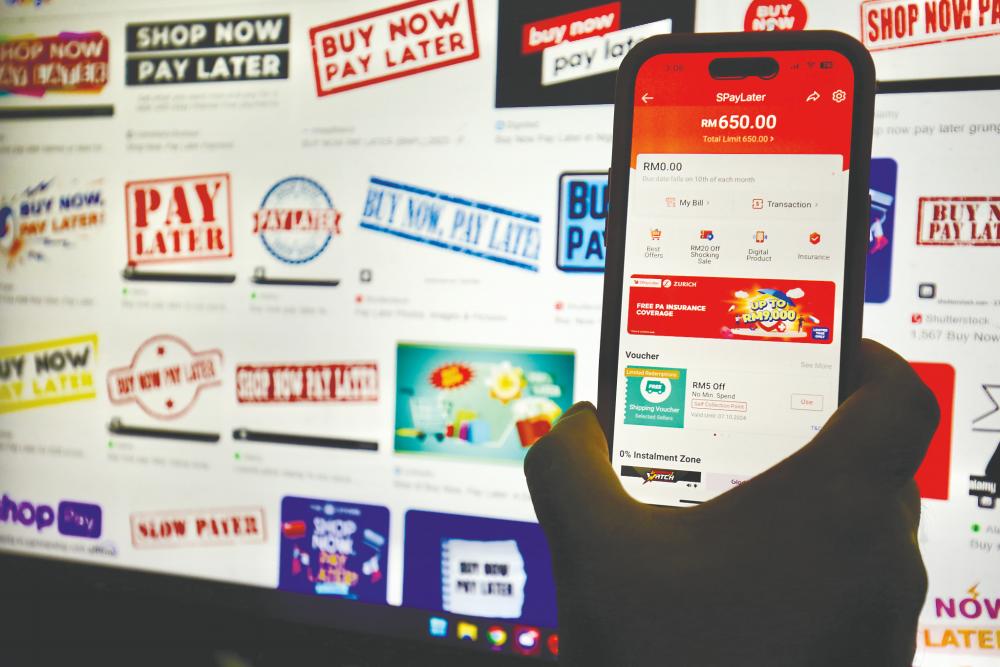

PETALING JAYA: Young consumers signing up for “buy now pay later” (BNPL) schemes face the risk of increasing debt as the ease of access and lack of upfront costs make such schemes appealing, said UiTM Academy of SME and Entrepreneurship Development coordinator Dr Mohamad Idham Md Razak.

He was commenting on a Tuesday report in which the Credit Counselling and Debt Management Agency said 53,000 individuals under the age of 30 are burdened by nearly RM1.9 billion in debt.

The report quoted Finance Minister II Datuk Seri Amir Hamzah Azizan as saying 28% of working adults borrow money for essential goods and the growing use of personal loans, credit cards and BNPL schemes among them is concerning.

Mohamad Idham said young adults seem to be making impulsive purchases without understanding the long-term financial consequences.

“Signing up for BNPL services en masse could spur long-term behavioural changes that encourage reckless spending and normalise the population’s debt load. This would lead to financial vulnerability.”

He said BNPL schemes distort financial responsibility by creating the appearance of affordability and encouraging consumers to seek instant gratification at the expense of sound financial planning.

“This would drop savings rates, cause credit defaults, negatively affect consumer credit ratings and constrain future borrowings. The risks are made worse as most BNPL schemes do not require rigorous credit checks, especially for younger people.”

He said financial ignorance is a major driver of debt mismanagement and impairs one’s ability to decide on borrowing and spending as individuals might underestimate the true cost of their debt, leading them to borrow more than they can manage, overspend and accumulate high-interest charges.

“It is undeniable that financial ignorance correlates quite strongly with the popularity of BNPL schemes and other forms of credit as it makes costly items seem affordable since one pays in smaller instalments.

“However, signing up for such credit would lead to overspending. While it could be a useful tool, BNPL schemes should be used carefully with responsible budgeting.”

Mohamad Idham said the rising debt burden of those aged 30 and below could be countered with a strategy that integrates financial education, oversight and tailored support, and includes financial literacy programmes in school curriculum as early as possible.

“This should include money management skills that educate children on the effects of debt and ways to avoid it. When young shoppers feel comfortable using BNPL schemes, they should take more time before signing up and show more discipline.

“Budgeting and deciding to save for future expenses or saving ahead of time would help keep one out of the debt trap.”

Muslim Consumer Association president Datuk Nadzim Johan said many people seek the pleasure of having money despite their unstable finances.

“Even if the credit card limit is low, it could be quickly depleted due to a lack of financial knowledge while its poor dissemination leaves individuals with inadequate guidance,” he said, adding that people often look to the government for solutions to their financial issues but the ultimate responsibility rests with the individual.

He said the government faces various challenges in managing the financial issues of citizens, including the need to balance regulations to protect consumers while encouraging economic growth.

“It is essential for individuals to be proactive, take control of their financial decisions and avoid over-reliance on credit to fund lifestyle choices. BNPL schemes may seem harmless at first but they will cause long-term harm to those who cannot pay on time.”