KUALA LUMPUR: Malaysian consumers are emerging as confident and frequent participants in cross-border e-commerce activity, according to a recent study by Airwallex.

Its Malaysia manager Aren Yip advised merchants to prioritise seamless and secure checkout experiences to meet rising expectations.

Yip said both Malaysian and global consumers are increasingly confident shopping internationally, particularly from well-known brands.

“The key takeaway is that shoppers are comfortable buying from international merchants. But there are three top-of-mind concerns: payment security, stability of payment methods and transparent pricing, especially in local currencies without hidden fees.”

The study showed that 94% of Malaysian shoppers are confident buying internationally, with 72% doing so at least once a month, compared with 56% globally.

“Marketplaces such as Shopee, Lazada and Taobao remain the preferred platforms

in Malaysia, while social commerce is also gaining traction.”

Yip added that influencers matter more in Malaysia, with 76% of Malaysian shoppers saying influencer recommendations impact their purchasing decisions, higher than the global average of 53%.

He also said consumers dislike encountering obstacles during payment, particularly when they are redirected to unfamiliar platforms or faced with unclear fees and exchange rates, which often leads to cart abandonment.

On the question of how Malaysian Small and Medium Enterprises (SMEs) could

scale globally, Yip said online shopping platforms such as Shopee remain an important sales channel.

“I recommend that SMEs invest in their own branded e-commerce websites. When you have your own store, you own the customer experience. It allows you to build brand loyalty, attract repeat customers and create a long-term relationship with your buyers.”

He also said 93% of Malaysian shoppers plan their purchases around occasions

such as double digit Sales, Hari Raya and the Lunar New Year.

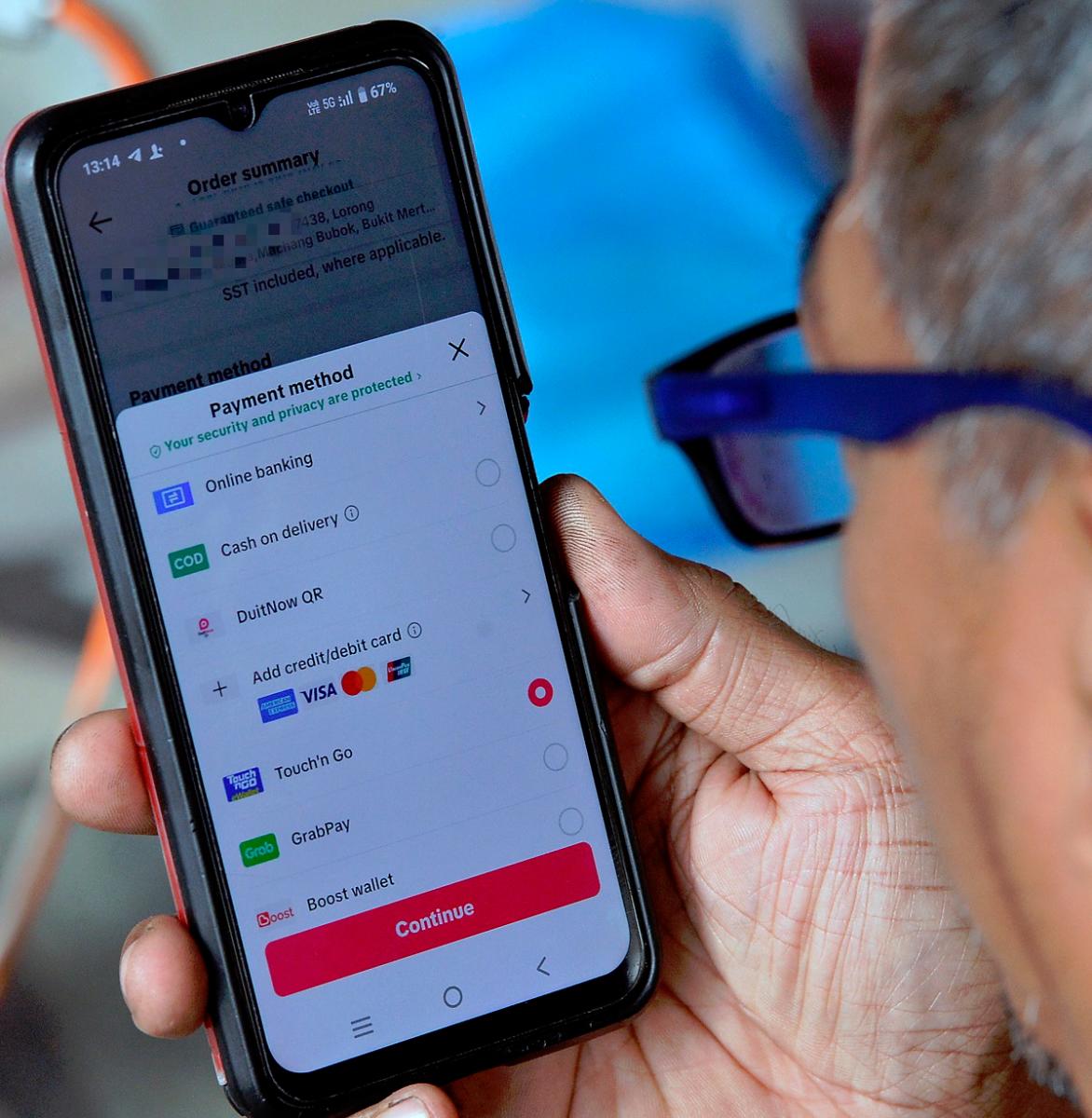

On the local digital payment landscape, Yip said while physical cards remain the top payment method in many markets, Malaysian consumers favour digital wallets and local bank transfer systems such as FPX and DuitNow.

“This is a consumer trend that sets Malaysia apart. For businesses operating here, offering a broad range of local payment options is essential to drive conversions.”

Yip said payment diversity becomes more critical when Malaysian businesses look to expand across the regional Asean markets.

“You cannot just rely on card payments when selling in countries such as Indonesia or Thailand. You need to support local methods, such as PromptPay in Thailand, which is their version of DuitNow, if you want to succeed regionally.”

The growing demand for affordability and flexibility in spending is also driving the popularity of Buy Now, Pay Later (BNPL) solutions, both in Malaysia and across Southeast Asia.

“The more payment methods a business offers, whether it’s digital wallets, BNPL or local transfer systems, the greater the likelihood of completing a sale.”