KYM hopes to turn around in FY16

KUALA LUMPUR: KYM Holdings Bhd aims to return to the black for the financial year ending Jan 31, 2016 (FY16) driven by an improved corrugated carton business that has been facing stiff competition.

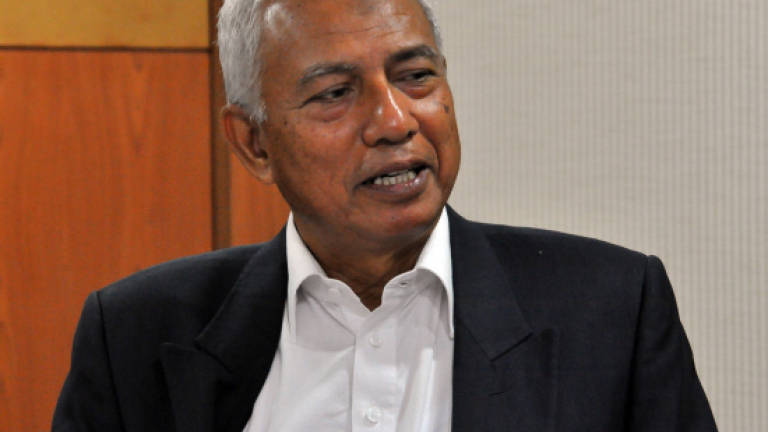

At a press conference after the company's AGM here yesterday, chairman Datuk Seri Isahak Yeop Mohamad Shar (pix) said he expects the corrugated carton segment to slowly recover in coming months, helped by the restructuring plans that have been put in place. These include streamlining business operations, replacing machinery as well as disposing of non-core assets.

Proceeds from the planned divestments will be channelled back to its core business of the manufacturing of corrugated cartons and industrial bags.

"We just want to concentrate on the manufacturing business, we still find our strength here…We've been constantly talking to agents and interested parties (to divest the land), but we still have not concluded any deals," Isahak said.

For the moment, KYM is planning to sell two parcels of residential land measuring 70 acres and 43 acres in Manjung and Ipoh, Perak, which carry a net book value of RM14.82 million and RM12 million each, according to its latest annual report.

Last November, it sold two pieces of industrial land in Johor for RM9 million, as its on-going efforts to unlock the value of its non-core assets.

KYM posted a net loss of RM2.95 million in FY15, compared with a net profit of RM4.3 million in FY14, due to losses incurred in the corrugated carton division, higher manufacturing costs arising from a weaker ringgit, rising labour costs and margin compression.

In FY15, the company only exported 20% of its industrial bags to overseas, mainly due to the political uncertainty in Thailand. He, however, is hoping its overseas contribution will return back to the 30% level seen in recent years.

Besides Thailand, KYM's exporting markets also include Indonesia and Singapore. Going forward, the company is eyeing to tap into other Asean countries such as the Philippines and Vietnam.

"Even Indonesia market, if there is opportunity to increase our sales, definitely we'll also look at the existing markets," Isahak noted.

With the facilities expansion exercise, he said the company is looking at higher utilisation rate of 70% by year-end from the current 60%.

"We've installed our facilities since early last year, now we've excess capacity, we're ready for bigger orders from clients," he added.

KYM has a monthly capacity of producing 15 million industrial bags at its three manufacturing plants in Perak.

The company expects to maintain 10% revenue growth for FY16. At present, the industrial bags division makes up 60% of its total revenue, while the remainder 40% is from the corrugated carton business.

Asked of currency impact on the business, Isahak explained that while the company has to incur higher costs to import the raw materials, the foreign exchange gain from the export activities has somewhat cushion the impact of the weakening ringgit.