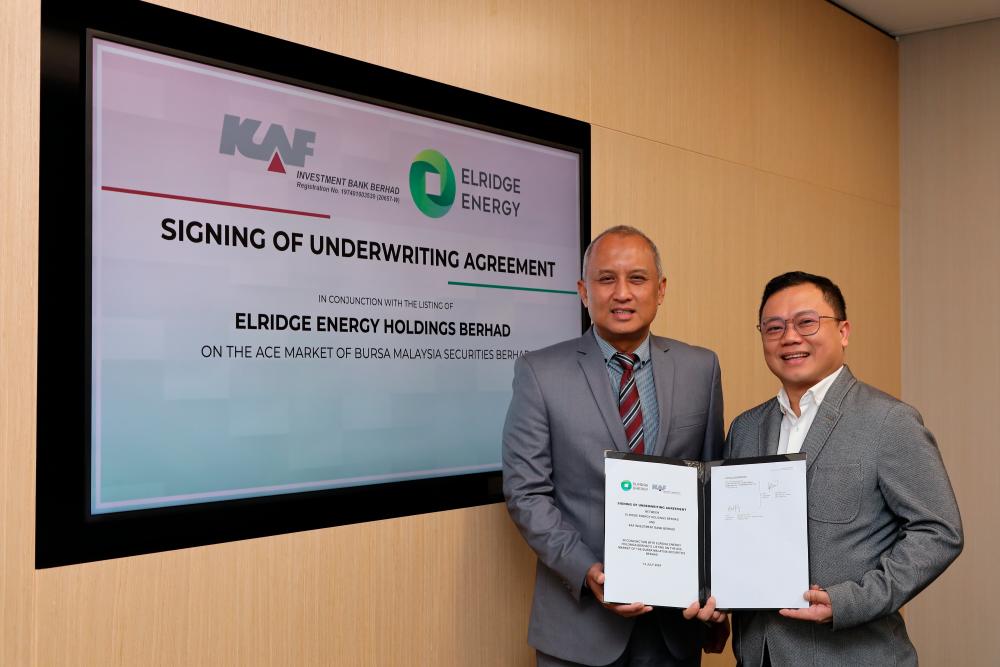

PETALING JAYA: Elridge Energy Holdings Bhd (EEH) signed an underwriting agreement with KAF Investment Bank Bhd (KIB) for the company’s initial public offering (IPO) on the ACE market of Bursa Malaysia.

EEH executive director and CEO Oliver Yeo said the underwriting agreement with KIB underscores the company’s commitment to delivering value to stakeholders.

“KIB’s extensive experience and strong track record in managing successful IPOs will be instrumental in guiding EEH through this exciting transformative phase. We have obtained the necessary approvals and are pleased with the progress concerning the listing exercise,“ he said in a statement.

The IPO entails an issuance of 350 million new ordinary shares of EEHB. This includes 80 million shares for the Malaysian public through balloting, 20 million shares for eligible directors, employees, and contributors to the group’s success.

Further, 250 million shares are allocated to Bumiputera investors, approved by the Ministry of Investment, Trade and Industry, Malaysia. In addition, an offer for sale of 350 million shares of EEH will be made available to selected investors through private placement.

EEH is an investment holding company and ,via wholly owned subsidiary Bio Eneco Sdn Bhd, specialises in manufacturing and trading biomass fuel products, focusing on palm kernel shells and wood pellets.

“The growing demand, both locally and internationally, for high quality and certified biomass fuel products as a result of the trend towards sustainable energy generation, and the urgent need for countries to address climate change, would augur well for EEH when it makes its debut on the local bourse in August of this year.

“This positive market outlook underscores the potential for biomass fuel products to contribute substantially to energy needs and environmental goals. Coupled with the current robust performance of the local indices, the timing is just right,” Yeo added.

According to Yeo, the company’s listing will enable it to leverage the growing demand and market opportunities to drive sustainable value creation for its shareholders and stakeholders.

“We intend to expand our production capacity for palm kernel shells and set up three new factories at Pasir Gudang, Kuantan, and Lahad Datu in Sabah.

“We are confident that this IPO will unlock new opportunities, allowing us to enhance our production capabilities, invest in modern technologies, and expand our market reach. By tapping into the growing market for biomass fuel products, we aim to drive long-term growth and contribute to a greener, more sustainable future,” Yeo said.

KIB co-head and director of corporate finance Ahmad Fazlee Aziz said the firm is confident that this IPO will be a key enabler for EEH to realise its strategic business objectives and fulfil its vision of becoming a prominent industry

player in the green energy space.

EEH is expected to be listed in August. KIB is the principal adviser, sponsor, underwriter and placement agent for the IPO.