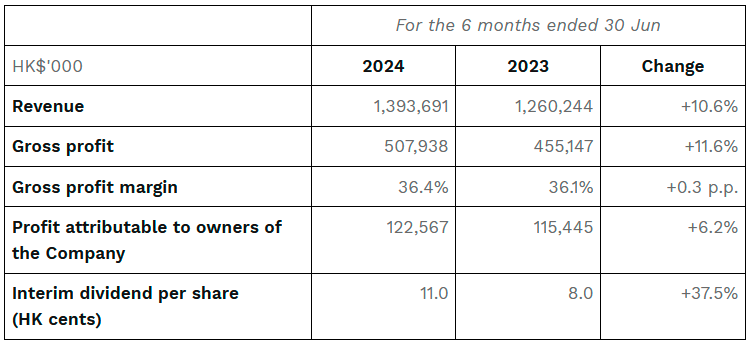

Proposed an interim dividend of HK11.0 cents per share

Highlights:

Revenue increased by approximately 10.6% to approximately HK$1,393.7 million as compared with the Corresponding Period Last Year.

Gross profit increased by approximately 11.6% to approximately HK$507.9 million as compared with the Corresponding Period Last Year, gross profit margin increased to approximately 36.4%.

Profit attributable to owners of the Company increased by approximately 6.2% to approximately HK$122.6 million as compared with the Corresponding Period Last Year.

As at 30 June 2024, the Group operated a total of 175 chain retail stores, representing a net increase of 8 stores during the Period under Review

Basic earnings per share was approximately HK12.3 cents. The Board recommended the payment of interim dividend of HK11.0 cents per share.

Financial Highlights:

HONG KONG SAR - Media OutReach Newswire - 27 August 2024 - Best Mart 360 Holdings Limited (”Best Mart 360” or the “Company”, together with its subsidiaries, the “Group”; stock code: 2360.HK), a leading leisure food retailer in Hong Kong, announced its interim results for the six months ended 30 June 2024 (”the Period under Review”). As the Company changes the financial year end date from 31 March to 31 December, the interim results of the Company covered a six-month period from 1 January 2024 to 30 June 2024 and the corresponding comparative figures covered a six-month period from 1 April 2023 to 30 September 2023. Thus, the comparative figures may not be fully comparable.

During the Period under Review, the revenue recorded by the Group amounted to approximately HK$1,393,691,000, representing an increase of approximately 10.6% as compared to approximately HK$1,260,244,000 for the six months ended 30 June 2023 (the “Corresponding Period Last Year”). Profit attributable to owners of the Company amounted to approximately HK$122,567,000 during the Period under Review (for the six-month period ended 30 June 2023: approximately HK$115,445,000), representing the period-on-period increase of approximately 6.2%.

During the Period under Review, gross profit and gross profit margin of the Group were approximately HK$507,938,000 and 36.4%, representing an increase of approximately 11.6% and 0.3 percentage points, as compared to gross profits of approximately HK$455,147,000 and gross profit margin of approximately 36.1% for the Corresponding Period Last Year, respectively. The increase in gross profit and gross profit margin for sales was mainly due to the Group’s continuous review and adjustment of sales tactics as well as product mix and cost optimization.

During the Period under Review, basic earnings per share of the Group was approximately HK12.3 cents. The Board recommended the payment of interim dividend of HK11.0 cents per share.

BUSINESS REVIEW

CHAIN RETAIL STORES

As at 30 June 2024, the Group operated a total of 175 chain retail stores, including 168 chain retail stores in Hong Kong and 7 chain retail stores in Macau, respectively. During the Period under Review, the Group follows its store optimisation strategies, which include improving the stocking arrangement, product display and shop appearance, etc., to provide a better shopping experience and enhance the brand image. The Group is persevering its search for stores in various districts to extend its retail coverage.

The Group launched a new global wine and food shop “FoodVille” in 2021, which focuses on medium-to-high-end global quality food products, including fine wines from around the world, premium chocolates, health food, frozen food, western sauces and ingredients, etc., in order to cater to the market’s pursuit of a high quality of life and broaden the Company’s customer bases. As at 30 June 2024, the Group operated 7 shops under the relevant retail brands.

For the six months ended 30 June 2024, the ratio of rental expense (on cash basis) to sales revenue of the Group’s retail stores was approximately 9.5%.

THE PRODUCTS

During the Period under Review, the Group adhered to its global procurement policy by sourcing a broad spectrum of products worldwide to provide a diversified range of choices for customers. For the six months ended 30 June 2024, the Group has sold more than 1,150 brands and over 3,237 stock keeping units (”SKUs”) of products in total, offering customers a diversified range of choices. The Group continues to optimise its product portfolio, phasing out older items to make room for the latest products and flavours, to stay abreast of changes in customer demands.

In order to enrich our product mix, enhance the effectiveness of control over product qualities and supplies and increase profitability, the Group continued to actively develop its private label products during the period. For the six months ended 30 June 2024, sales derived from private label products amounted to approximately HK$234,630,000 (for the six months ended 30 September 2023: approximately HK$192,986,000), accounted for approximately 16.8% of the Group’s overall revenue for the Period under Review.

The Group had a total of 11 private labels and 228 SKUs of products during the Period under Review, including masks, canned Chinese delicacies, cereals, milk, honey, nuts and dried fruits as well as a wide range of leisure food products.

MEMBERSHIP SCHEME AND MARKETING & PROMOTIONAL ACTIVITIES

As at 30 June 2024, the number of the Group’s registered fans and members was approximately 2,214,680 (30 September 2023: approximately 2,087,700). The number of mobile app members has reached approximately 1,112,031 (30 September 2023: approximately 980,000) as of 30 June 2024.

The Group conducted various marketing and promotional activities during the period which provided customers with a series of special offers for selected quality products from time to time to express our gratitude for our customers’ support and to enhance customer loyalty. Meanwhile, the Group continued to advertise in an all-round manner through television, newspapers, social media platforms and other media, which successfully obtained repeat customers, attracted new customers and greatly promoted the discussions about the Group in the market.

EMPLOYEES

As at 30 June 2024, the number of full-time and part-time employees of the Group was 1,313 (30 September 2023: 1,226). In order to retain staff and to suitably incentivise employees of the Group so as to increase staff cohesion and loyalty, the Group regularly reviews and updates its employee benefit plans and remuneration packages with reference to labour market supply and labour cost trend, as well as individual performance. Staff costs (excluding Directors’ emoluments) of the Group for the six months ended 30 June 2024 accounted for approximately 10.0% of revenue (for the six months ended 30 September 2023: approximately 9.1%).

OUTLOOK

Since last year, to boost the economy, the Hong Kong Government has been promoting the mega-event economy with a view to attracting tourists to Hong Kong by organizing a number of mega-events. However, the Group expects that the retail market will remain sluggish in the short term, and that the market environment will continue to be challenging due to factors such as the high interest rate environment and geopolitical tensions, the local and global economies being in a counter-cyclical state, coupled with the continuous increase in the number of outbound travel of Hong Kong people and the rise of the northbound consumption trend. The Group will closely monitor market changes and make prompt adjustments to its business strategies. We will strictly control costs and expenses, enhance operational efficiency and explore different development opportunities, so as to maximise returns for shareholders and investors.

With the further opening up of cities under the Individual Visit Scheme by the Mainland China from May 2024, visitor arrivals to Hong Kong is expected to increase, hopefully driving a gradual improvement in the local economy. The Group will continue to look for suitable opportunities to expand the shop network of its major retail brand “Best Mart 360˚ (優品360˚ )” and its global wine and food shop “FoodVille” to cater the diversifies demands of different customer segments for quality food products under our “dual-brand” model , while stay on monitoring the operation of the existing stores and make timely adjustments to its operation strategies when necessary.

The Group remains committed to uphold its business mission in offering products with the “Best Quality” and “Best Price” to its customers. We will continue to broaden our supply channels, optimise our sales categories and strive for price competitiveness to attract repeat customers. We will deepen the extension of our business-to-business (B2B) food wholesale business, further enriching the Group’s revenue streams. Furthermore, the Group will endeavor to develop its private label products, aiming not only to satisfy market demand for daily necessities but also to provide customers with a broader range of choices.

Looking ahead, the Group will adhere to a prudent approach to steadily expand our business footprint, maintaining our leading position in the Hong Kong leisure food retail market. Meanwhile, we will proactively explore opportunities for business expansion both in the Mainland China and overseas, thereby delivering stable and sustainable returns for our shareholders.

The issuer is solely responsible for the content of this announcement.