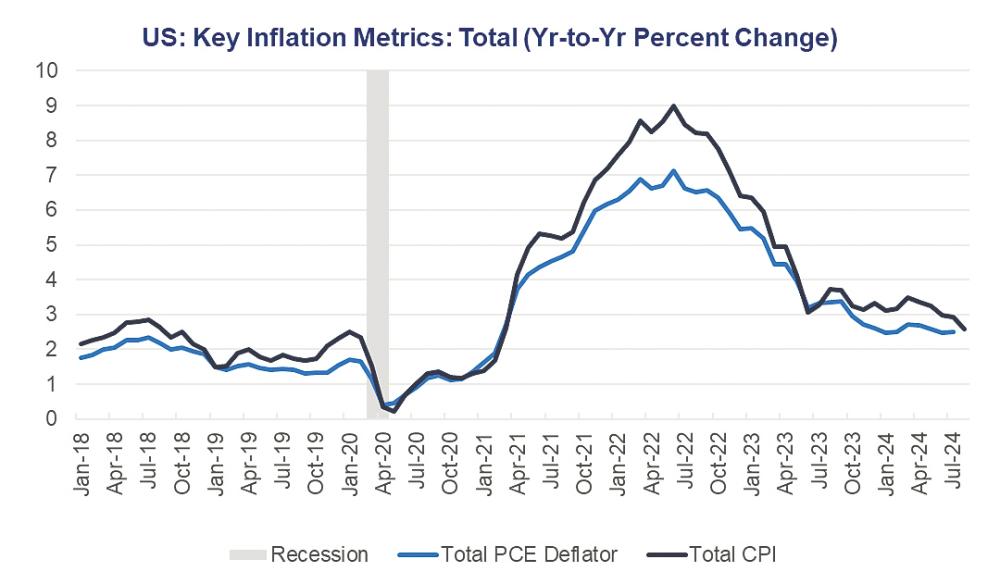

THE performance of the US markets ended in positive territory throughout last week. The Nasdaq-100 Composite Index added 0.69% week-on-week (w-o-w) to close at 18,119.6 while the S&P500 Index gained 0.46% to end at 5,738.2. Investors received encouraging inflation data that could give the US Federal Reserve (Fed) more reason to cut interest rates further. US August personal consumption expenditures (PCE) increased 0.1%, matching expectations from economists and analysts’ poll. PCE increased 2.2% at an annualised pace, below the 2.3% forecast.

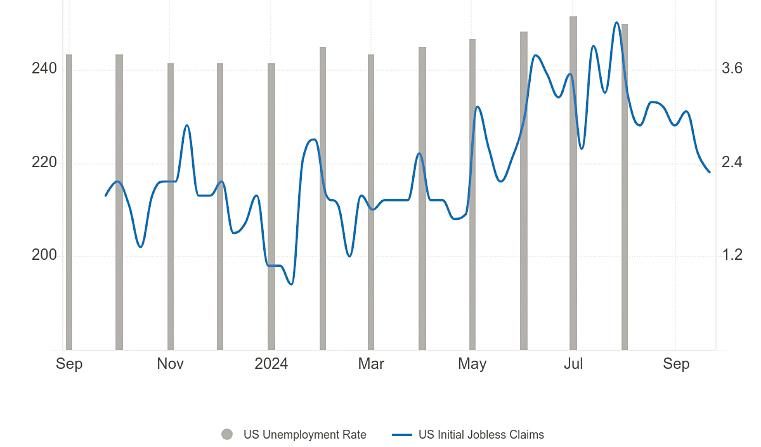

Throughout last week, a number of data that were released assured investors of the strength of the US economy – initial jobless claims fell more than expected in the latest week, indicating a strong labour market, while the final reading of second-quarter gross domestic product growth came in at a robust 3%.

The PCE data is on the correct glidepath to the 2% annual inflation target. This allows officials to focus more on the growth and jobs backdrop. With income growth looking tepid and households noticing a downshift in the job market, pricing for substantial Fed policy easing looks set to persist.

Given the recent trends in jobless claims, the US unemployment rate may remain relatively stable in the short term. The drop indicates a labour market that is softening but not collapsing. While more workers are staying on unemployment benefits, the decline in new claims points to fewer layoffs, indicating the labour market still retains some strength. Overall, the unemployment rate is likely to hover near its current level, with a potential for slight increases, but significant spikes are unlikely. This also suggests a modest US rate cut by the end of the year.

In an environment where inflation is looking much better behaved, the market pressure for ongoing substantial Fed interest rate cuts will persist. If we get the unemployment rate rising back to 4.3% this Friday – where consensus is expecting 4.2% – and a sub 75,000 payrolls print expect the calls for a second 50-basis point rate cut to grow markedly.

At this juncture we remain positive on the overall situation of the US economy while managing our private mandate and unit trust portfolios prudently. We believe that the setback in August and September performance will be temporary and the major holdings of our portfolio will continue to recover due to the positive outcome of the economic data.

Looking ahead, most major indices are in a good shape to register and test new highs and we firmly believe that the portfolio performance will also move in tandem with the positive outcome of the data released. We are currently almost at our maximum exposure in the portfolio and expecting for a positive turnaround October onwards.

This article is contributed by Berjaya Mutual Bhd chief investment officer Datuk Dr Nazri Khan.