THE US markets ended last week on a positive note despite being feeble throughout due to Middle East tensions and economic data uncertainties. Most of the recovery of the indices came late Friday after US jobs market data showed that the US may go into a “soft landing” versus a deep recession.

The Dow Jones Industrial Average ended at a record peak of 42,352.75 as investors saw the strong labour market as a sign that the Federal Reserve’s 50bps interest rate cut recently will unlikely push the economy into negative growth.

Treasury rates in the bond market jumped last Friday after the Bureau of Labour Statistics released a report showing the US economy added 254,000 jobs in September while the unemployment rate dipped to 4.1%.

Overall for the week, the US jobs report was incredibly strong on every front possible – job creation, unemployment, wages and hours worked. The rise in job openings – up by 329,000 to 8.04 million in August 2024 – indicates continued labour demand, but the decrease in job quits suggests growing caution among workers.

This labour market uncertainty aligns with the US central bank’s focus on addressing economic weakness, particularly as inflation cools. The recent rate cuts, including the expectation of further reductions, are likely aimed at supporting labour market resilience and stimulating growth in sectors showing demand, such as construction. While the inflation backdrop is allowing the Fed to start moving monetary policy back to neutral, we think it will be in 25bp increments at the end of the year not the 50bps we saw in September.

Historical Data Showing Positive Trend May Continue

Our take for now on the US markets remains positive in the mid-term as we foresee the US economy heading towards the right direction.

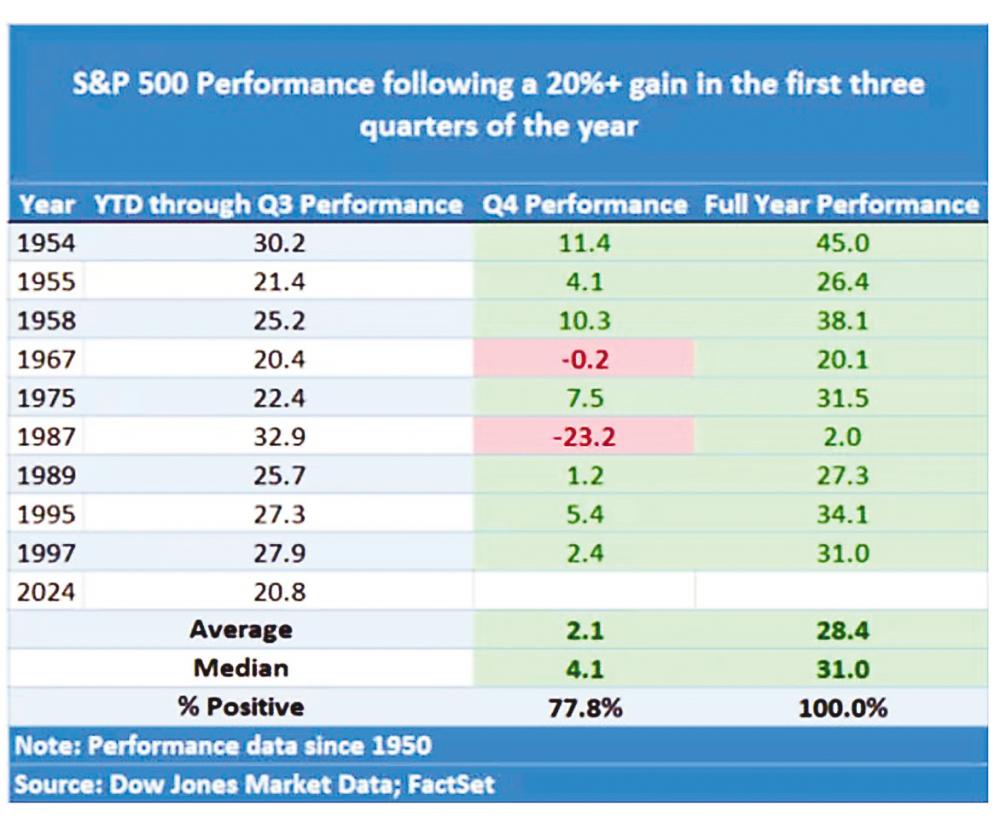

● Based on the data that was collected by FactSet on the right, the S&P500 continued to register strong positive performance after a 20% or more return in the first three quarters of the year.

● One of the two years when the index struggled in the fourth quarter was 1987, when the “Black Monday” selloff hit in October. The index still managed to eke out a gain that year, rising 2%.

● Since 1950, the S&P 500 has achieved a 20% increase during the first nine months of a year 10 times, including in 2024.

● In the nine previous instances, the index rose, on average, 2.1% in the fourth quarter. Its median return was even higher, at 4.1%. It continued to climb during the fourth quarter more than 77% of the time.

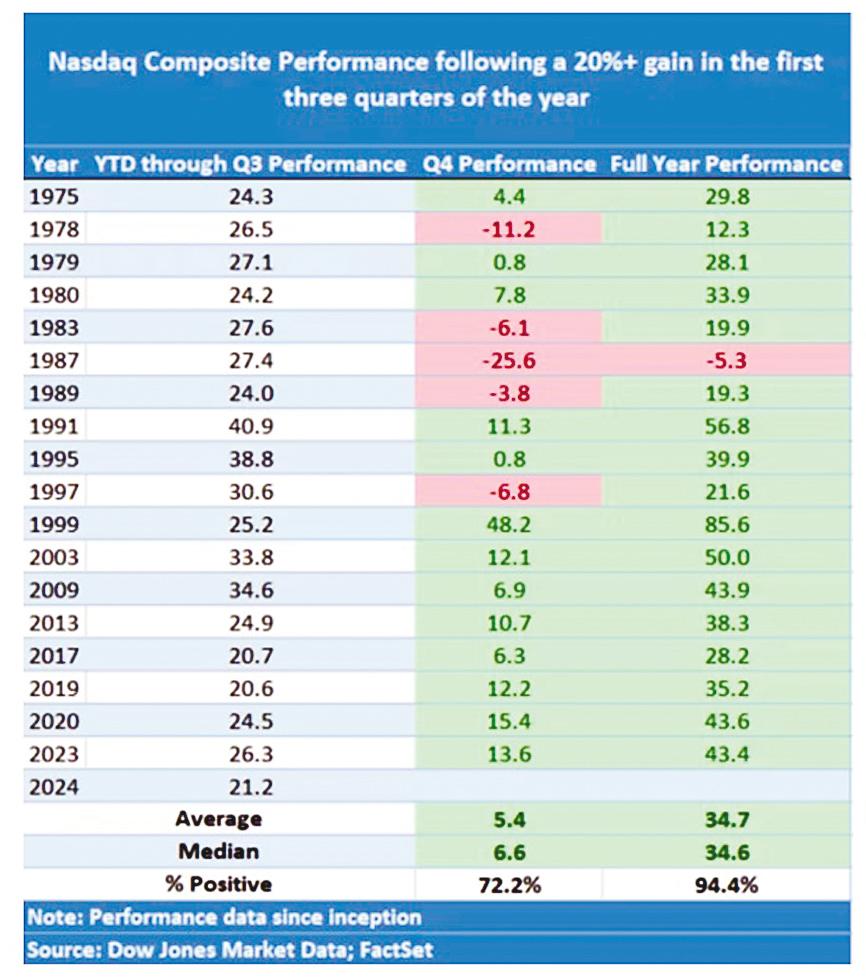

● The Nasdaq Composite has risen more than 20% during the first nine months of the year on 19 occasions, including 2024. In all but five instances it continued to climb, with a median gain of 6.6%, during the fourth quarter.

At this juncture, we remain optimistic on the historical trend, but we are also reminding investors that there is no guarantee that the data will repeat itself. We will continue to manage our portfolio tactically and will continue to monitor the Middle East conflict that could dampen the uptrend in the fourth quarter. Any easing of the current predicament faced by the Middle East countries could possibly push the major indices back into a rally mode.

This article is contributed by Berjaya Mutual Bhd chief investment officer Datuk Dr Nazri Khan.