PETALING JAYA: Despite concerns over rising inflation, the local industrial real estate sector continues to flourish while the retail sector is slowly recovering, according to property consultancy Knight Frank Malaysia.

According to its latest report Real Estate Highlights for H1’22, the local industrial sector has seen steady growth in recent years, largely due to a higher e-commerce penetration rate, which is one of the direct results in addition to higher warehousing space requirements to meet the surge in last-mile delivery as well as the structural shift towards omnichannel retailing.

As for the retail sector, the resumption of all economic activities signifies a better outlook in terms of better employment opportunities and improvement in consumers’ disposable income. Moreover, following the unpredictable and unprecedented periods of lockdown, pent-up demand is anticipated to drive consumer spending. The local sector is in for a better year ahead following reopening of the economy and international borders supported by the country’s high vaccination rate.

The report features the findings of property market performance across Klang Valley, Penang, Johor Baru and Kota Kinabalu.

On the industrial sector, Knight Frank said the logistics sector continues to grow, with third-party logistics (3PL) and e-commerce key players expanding their operations, leading to higher demand for logistics and warehousing space.

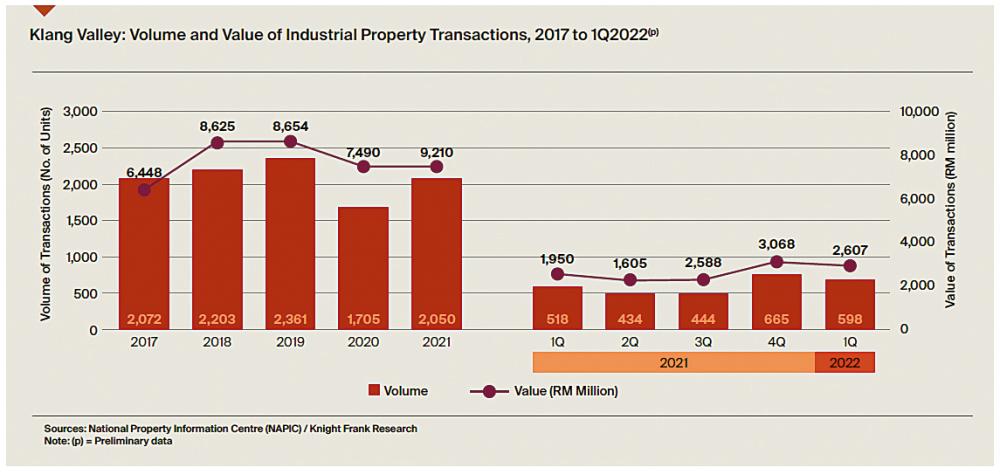

Knight Frank Malaysia research and consultancy senior executive director Judy Ong said the industrial property sector in Klang Valley saw a rebound in market activity with 2,050 industrial properties worth RM9.21 billion changing hands in 2021, which reflected annual increments of 20.2% and 23.0% in transacted volume and value respectively.

Separately, its land and industrial solutions executive director Allan Sim pointed out that manufacturers and logistics players are concerned about rising transport costs, shortage of labour and disruption in supply chain.

“The main concerns among manufacturers and logistics players are rising transportation costs, shortage of labour and disruption in supply chain. With more multinational companies setting up new businesses and facilities within the Asean region, Malaysia is expected to benefit from this diversification and reshaping of global supply chain strategies,” he said in a statement yesterday.

He added that, unsurprisingly, the number of institutional investors and real estate investment trusts chasing after industrial and logistics real estate in Malaysia continues to increase, evidenced by entry of new investors – the first industrial-related acquisition by KIP REIT consisting of a mixture of industrial facilities and industrial land in Pulau Indah amounting RM78 million and Capitaland Malaysia Trust’s first industrial purchase of a 5.11ha freehold industrial warehouse for RM80 million in Batu Kawan, Penang.

Additionally, developers are observed to be venturing into large industrial and warehousing developments, such as Titijaya Land Bhd with its recent RM200 million build-to-suit arrangement of a logistic commercial complex for DHL Properties in Penang, and IJM Corp partnering China Harbour Engineering Company Ltd for their first industrial and logistics development in Kuantan.

On the retail sector, Knight Frank Malaysia group deputy managing director Keith Ooi said the MIER Consumer Sentiments Index improved to record at 108.9 points in Q1’22, surpassing the 100-point optimism threshold. The positive index in the review quarter was driven by consumers’ optimism for better income and employment opportunities.

“The cumulative supply of retail space in Klang Valley stands at circa 66.09 million square feet as of H1’22, following completion of Mitsui Shopping Park Lalaport and Malaysia Grand Bazaar,” he added.

While Lalaport BBCC brings with it an authentic Japanese shopping experience by introducing a throng of first-to-market brands, including Nitori, Nojima, Coo&Riku, Shin’Labo, Matcha Eight and Tamaruya, Malaysia Grand Bazaar is the city’s first artisanal mall and seeks to become an incubator of local entrepreneurs catering to a wider customer base.

“Incoming retail supply includes the KSL Esplanade Mall in Klang, IOI City Mall Phase 2 in Putrajaya, Retail Component of Datum Jelatek in Taman Keramat as well as EcoHill Walk in Semenyih,” he remarked.

Alongside refurbishments, the obvious shift in consumer behaviour due to the pandemic, coupled with the acceleration in digital transformation, has encouraged retailers and mall operators to increasingly adopt omnichannel strategies to increase sales and improve engagement.

Meanwhile, Knight Frank Property Management mall management director Yuen May Chee explained that mall operators have been persistently continuing to personalise retail experiences to cater to consumers’ preferences as well as to address the health and concerns of shoppers through asset enhancement initiatives.

While some have turned to installing air-purifying systems in all of their retail premises, others have delved into social commerce, offering shoppable live streams and collaborations to introduce personal shopping services, as well as creating online platforms to provide affordable retail spaces for small businesses. There is also a rise in green initiatives as shown by hypermarket chain Lotus’s Malaysia’s rooftop solar photovoltaic project at 12 stores and one distribution centre; offsetting over 6,600 tonnes of carbon emissions annually.

Occupancy rates of shopping centres were stable during the review period, with improvement of revenue for mall operators. Major malls such as Suria KLCC, Pavilion Kuala Lumpur, Mid Valley Megamall and Sunway Pyramid continue to retain solid crowd pulls and have stable occupancy rates.