PETALING JAYA: Millennials and Gen Zs are found to favour online sources (69%) and family & friends as their preferred sources of information for their investment decision, according to the Institute for Capital Market Research (ICMR) Malaysia’s research report “The Rise of Millennial and Gen Z Investors: Trends, Opportunities, and Challenges for Malaysia”.

This showed how trust and relatability are key in how investors make financial decisions among the largest generational cohorts with the power to influence consumer and market trends over the next decade.

The research attempts to understand financial attitudes and behaviours of millennials and Gen Z investors, the largest generational cohorts with the power to influence consumer and market trends over the next decade. The Securities Commission (SC) Malaysia-linked think tank’s report is based on a nationwide quantitative survey of 1,500 respondents and supplementary qualitative interviews.

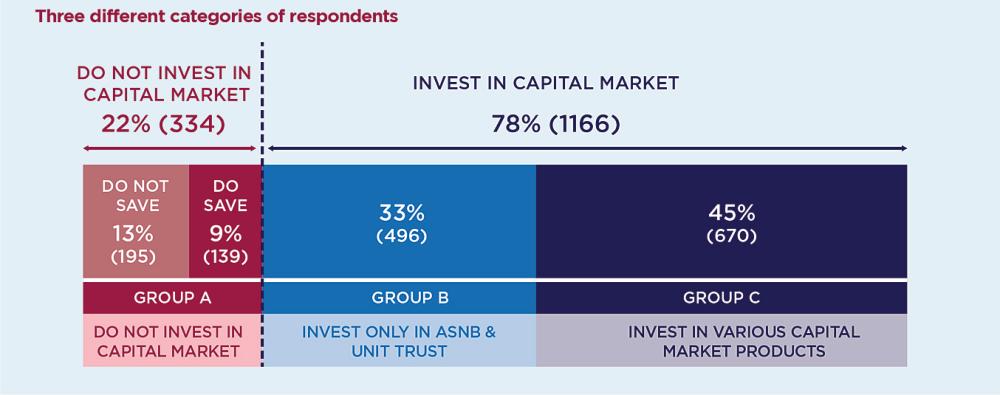

Subsequently, the survey found the respondents aged 21-40 years old could be divided into three mutually exclusive groups:

Group A – those who do not invest in any capital market products (22%)

Group B – those who invests only in Amanah Saham Nasional Bhd (ASNB) funds and/or unit trusts (33%)

Group C – those who invests in capital market products not limited to ASNB and unit trusts (45%)

Between the three, ICMR found distinct demographic and behavioural differences. Geographically, there’s a high proportion of respondents from the East Coast in group A, while group C has more respondents from the central region.

It also observed a gradual shift in the bell curve of household income whereby 69% of Group A earn less than RM5,000 in monthly household income, while there is a skew in Group C towards higher incomes, with 31% having household incomes above RM10,000.

On the subject of self-assessed financial literacy knowledge, only 9% of Group A felt that they are quite knowledgeable about investing, compared to 23% in Group B and 48% in Group C.

The think-tank noted self-assessed financial literacy knowledge is an indicator of one’s self-confidence when it comes to financial matters.

In addition, it found behavioural difference in the self-assessed risk tolerance between the three groups, as only 26% of respondents in Group A identified themselves as risk takers, compared to 39% in Group B and 57% in Group C.

The report suggests that there is a link between the likelihood of one investing, the kind of product one invests in, and ones’ demographics and behaviour.

Moreover the findings on the three groups highlight there is a plethora of factors linked to investment behaviour including income level, actual and perceived financial literacy, financial confidence, and risk tolerance. This indicates that a one-size-fits-all policy may be ineffective, as it does not address the nuanced behaviour and attitudes seen across the three groups.

Given the intersectionality between the various factors that influence an individual’s behaviour, ICMR called for a nuanced and tiered approach in policy for investors in different life stages, a renewed mandate for financial literacy that incorporates the right tools, self-awareness and techniques, behavioural approaches and design for policy and products, and acknowledging the underlying structural challenges that cannot be solved by market-based solutions.

Its chairman Tan Sri Munir Majid remarked that achieving the delicate balance between investor protection and investor empowerment requires a tiered approach to policy and products.

“Policy and products need to cater for individuals at different stages of readiness, and this is defined by individual life stages as opposed to the broad categorisations of age and income,” he said in a statement today.