KUALA LUMPUR: The Royal Malaysia Police (PDRM) has dismantled a cryptocurrency investment fraud call centre, believed to be targeting Japanese citizens, following separate raids on two luxury residential properties in the capital on Aug 19.

A total of 21 individuals, aged between 22 and 37, were arrested. This group includes one local man, 16 Chinese men and one woman, a Lao woman, and one man each from Hong Kong and Myanmar.

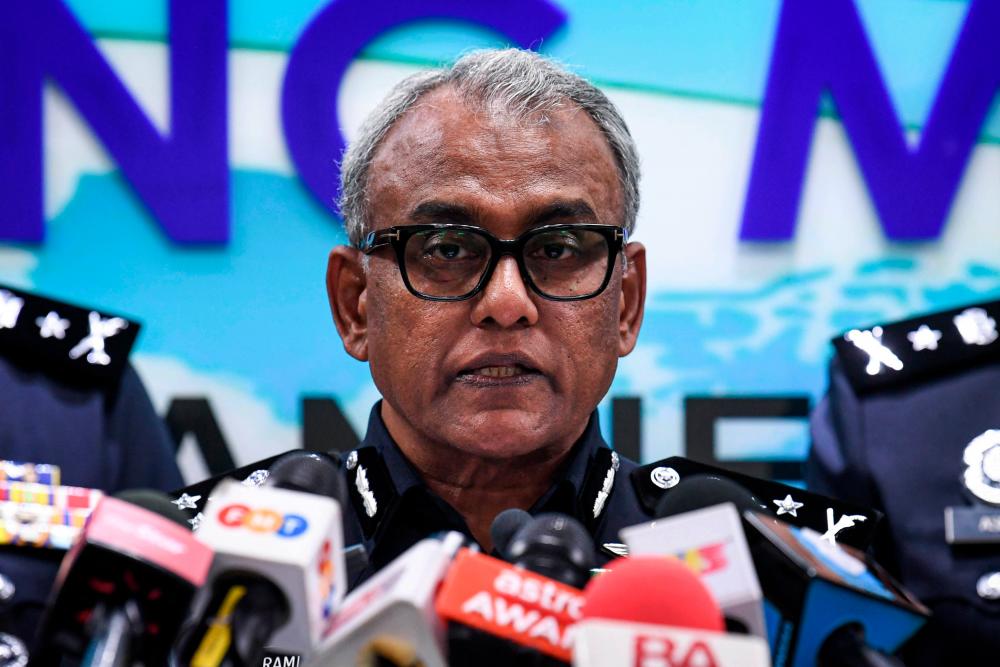

Bukit Aman Commercial Crime Investigation Department (CCID) director Datuk Seri Ramli Mohamed Yoosuf said that the foreign suspects were believed to be working as customer service representatives at the call centre, while the local suspect was the centre’s caretaker.

“According to our investigation, the call centre had been operating for only a month. The syndicate used luxury bungalows, surrounded by two layers of high fences and situated far from the main road, to conceal their activities from authorities,” he explained at a press conference at Menara KPJ, today.

“The arrested individuals were involved in seeking victims through social media platforms, such as Tinder and Monsters. Victims were then lured into investing, via the Bitbank and CoinCheck applications,” he added.

According to Ramli, the investigation also revealed that members of the syndicate entered Malaysia on Social Visit Passes, and received salaries in the form of commissions - 20 per cent of the money successfully defrauded.

Following the arrests, police seized 17 computer sets, 55 mobile phones of various brands, a router, a set of keys, and two alarm units.

“The detained local man was released on police bail on Aug 25, after his remand period ended. Meanwhile, the other 20 individuals are in remand detention, under the Immigration Act 1959/63,” he said, adding that the case is being investigated under Section 420 of the Penal Code.

Ramli also emphasised that any investment opportunities offered through social media platforms should be treated as fraudulent.

“There is no need for uncertainty regarding this matter. The public is advised to be cautious and clear about such investments,” he said.

“For those looking to invest, it is crucial to use schemes recognised by official investment bodies in Malaysia, such as the Securities Commission Malaysia and Bank Negara Malaysia,” he added.