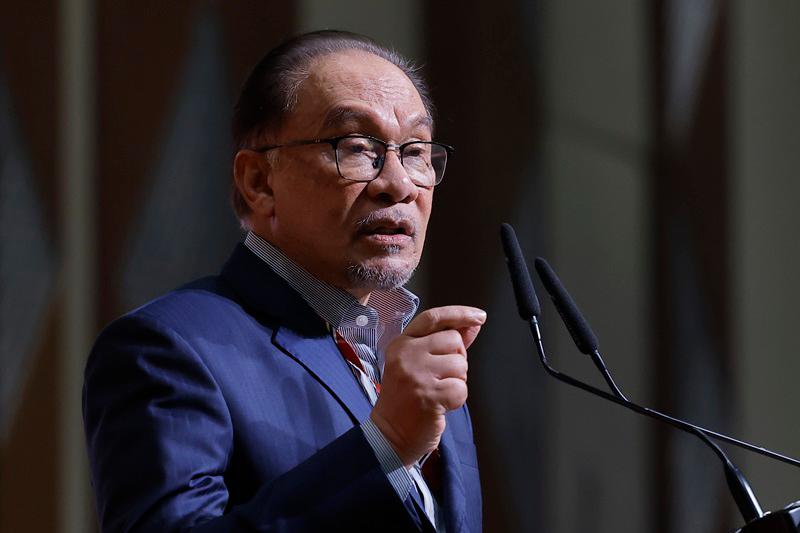

KUALA LUMPUR: The reaffirmation of Malaysia’s sovereign credit ratings and positive economic outlook by S&P Global Ratings (S&P) and Fitch Ratings (Fitch) is a “testament to the government’s responsible economic management and how the MADANI Economy reform agenda is delivering positive results,” said Prime Minister Datuk Seri Anwar Ibrahim.

Anwar, who is also the finance minister, said this includes the continuous reforms across institutions to enhance ease of doing business and competitiveness, as well as the continuing progress of projects and policy reforms under the New Industrial Master Plan 2030, the National Energy Transition Roadmap, and the Mid-Term Review of the 12th Malaysia Plan.

“With a buoyant labour market and stronger trade and investment performance already pushing the first quarter 2024’s gross domestic (GDP) growth beyond market expectations to 4.2 per cent, the government is confident that the full-year 2024 economic growth will be within its official growth target range of 4 to 5 per cent,” he said in a statement released by the Ministry of Finance (MOF) today.

Recently, Malaysia’s sovereign credit ratings were reaffirmed by S&P at A- and Fitch at BBB+, with both maintaining their “stable” outlook.

“The reaffirmation by both agencies indicates international stakeholders’ continued confidence in the country’s robust and resilient growth, (despite) a challenging external environment and the escalation of geopolitical conflicts,” the MOF said.

It noted that S&P’s ratings on Malaysia “are underpinned by the country’s strong external position and monetary policy flexibility. In addition, its economic growth rate trend is faster than sovereigns of similar income level.” S&P also highlighted that “Malaysia is going to be a key beneficiary in the global semiconductor industry boom period, which will be powered by AI (artificial intelligence) computing needs,” according to the statement.

The ministry noted that “Fitch expects Malaysia’s GDP growth to rebound to 4.4 per cent in 2024 and 4.5 per cent in 2025, up from 3.6 per cent in 2023, on resilient domestic demand and investments in the manufacturing sector.”

The MOF said the government is firmly committed to ensuring public finance sustainability by adhering to a consistent fiscal consolidation trajectory moving forward.

“The tapered fiscal deficit of 5.0 per cent in 2023 is expected to narrow further to 4.3 per cent in 2024.

“In the medium term, the government aims to achieve a budget deficit of three per cent or less, as outlined in the Public Finance and Fiscal Responsibility Act 2023 enforced on Jan 1, 2024.

“This aligns with the fiscal target under the MADANI Economy framework to achieve fiscal sustainability and enhance governance,” the MOF said.