PETALING JAYA: A five-sen billing discrepancy flagged on Reddit has exposed wider concerns over improper rounding practices, with users cautioning that what appears insignificant at the checkout can translate into substantial consumer losses when applied repeatedly across large volumes of transactions.

The original post described a diner who noticed his restaurant bill, totalling RM154.55 had been rounded up to RM154.60, despite Bank Negara Malaysia (BNM) guidelines stating that amounts must be rounded to the nearest five sen following the withdrawal of the one sen coin.

After checking BNM’s website and confronting restaurant staff, the diner was told the discrepancy was caused by a system issue and he was refunded the five sen.

“I know many people think, ‘Oh, it’s only five sen, why argue?’” the Reddit user wrote.

“But imagine if it was 1,000 people they did this to – that’s almost RM50 extra profit without customers knowing.”

The user added that the restaurant was frequently crowded and alerted others to “beware”.

The post quickly gained traction, prompting dozens of responses from Malaysians who shared similar experiences across restaurants, telecommunications providers, banks and utility companies.

Reddit user sshen urged consumers to broaden their vigilance beyond food outlets.

“While you’re at it, check your telco and utility bills. This rounding mechanism should only be used for over-the-counter payments but our sneaky providers always round up our bills,” the user wrote.

“Imagine one cent times millions of customers.”

Another user, Mozart8110 said he checked his mobile phone bills and found it was being done to him as well.

He expressed frustration over service quality and questioned what action could be taken against such practices.

Others questioned the logic of rounding in an increasingly cashless economy.

User LatterDimension877 said there was “no reason” for rounding when payments are made digitally.

“You paid with Touch ’n Go, not cash. Why round up?” the user wrote.

User GeologistPrimary2637 pointed out that even for cash transactions, rounding from five sen to 10 sen is incorrect.

“Always round to the nearest five. We have five sen coins and always have,” the user wrote, suggesting that some systems may be deliberately programmed to profit from the additional amount.

Frustration was also directed at businesses that attribute discrepancies to technology.

OriMoriNotSori described “blaming the system” as a lazy but commonly accepted excuse, likening it to retailers citing system outages to avoid providing services.

The discussion later expanded to bank charges.

User apitzhnu claimed some banks impose annual fees for unlimited ATM withdrawals, despite cash withdrawals becoming increasingly uncommon.

“This charge was not informed and they keep charging every year without you knowing,” the user wrote.

“Imagine one million customers are charged – they earn millions.”

The user urged others to check their statements, noting such charges often appear under descriptions such as “Debit Advice”.

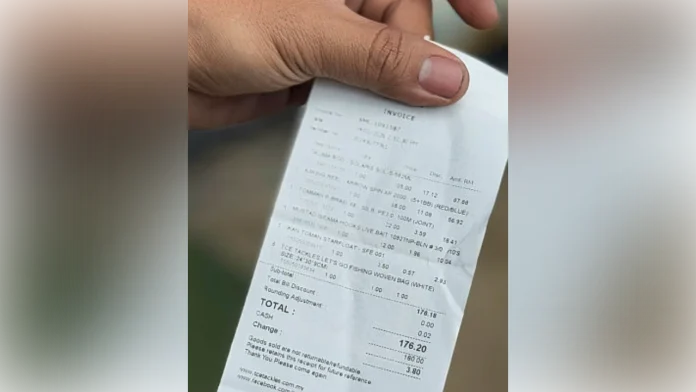

Several users shared personal encounters involving restaurants.

User sipekjoosiao recounted being short-changed five sen at a pizza chain outlet, despite the receipt clearly stating the correct amount.

After confronting the cashier, the user eventually received the change and later filed a complaint that resulted in an apology and staff retraining.

“This is not about the money,” the user wrote. “You never assume and makan duit customer like this.”

Others raised compliance concerns beyond rounding.

User chekuhakim questioned whether invoices issued solely in Chinese met Malaysian requirements, noting that tax invoices should include Bahasa Malaysia or English.

Meanwhile, user MiniMeowl said they stopped patronising a restaurant altogether after it repeatedly rounded bills to the nearest 10 sen, even for cashless payments.

“Every day they are taking five sen extra from customers,” the user wrote.

Collectively, the responses reflect growing public frustration and a sentiment that minor discrepancies should not be dismissed lightly, particularly when repeated across large numbers of transactions.