WHEN we were in school, our teachers taught us everything we needed to prepare us for the world ahead. We learnt about language, gained some basic knowledge that included mathematics, geography, history, and even a few life skills. We were taught everything we needed to survive.

However, almost all of us had to learn one very important life skill on our own: financial planning.

Most young adults entered the workforce with little to no knowledge of what to do with their first salary. Very often, they find themselves so overwhelmed by their first taste of financial independence that they don’t think about their financial security in the future.

They relish being able to spend their money on wants like a new smartphone, new clothes, or other fun things in life. Sometimes, they do remember to “save” a portion of it, but very often it will just sit in a simple savings account in a bank, earning a few ringgit in interest/returns each year.

So many young people waste their first five to 10 years in the workforce living paycheque to paycheque, and only begin thinking seriously about saving for the future once they reach middle age, or once they encounter a life change, such as a marriage, or plan for a big purchase, like their first house.

Some people put aside funds to save for their children’s tertiary education, and some may want to put a substantial amount of savings for retirement.

These types of plans often involve huge sums of money, and for those trying to make up for lost time, the pressure is on to reach their financial goal as quickly as possible. At this point, they would need to shift their financial strategy from merely ‘saving’, to ‘investing’ in order to reap bigger returns.

Fortunately, there are many safe options for people looking to invest and to grow their wealth. One of the most widely suggested options is investing in Unit Trusts.

What are Unit Trusts?

A Unit Trust is a form of collective investment that allow investors with similar investment objectives to pool their savings which are then invested in a portfolio of shares or other assets. These different investments may include securities such as shares and bonds, as well as cash equivalents.

The key reasons for investing in Unit Trusts.

Unit Trusts are managed by professional fund managers, or companies licensed by the Securities Commission Malaysia referred to as Unit Trust Management Companies (UTMCs). UTMCs are authorised to issue or offer for the purchase of units of a unit trust scheme. These professionals will be investing your money on your behalf, using their expertise to help you achieve your financial goals, leaving you free from the burden of having to study the markets and making decisions on each individual investment.

Some of the benefits of investing in Unit Trusts.

Investing in a Unit Trust also offers you the advantage of being able to start out with only a small amount of capital, making it an affordable option for those who are just beginning their financial freedom journey.

Time is money

There are many reasons why investing in Unit Trusts makes good financial sense, particularly if you already have a goal in mind. You can choose to invest in a Unit Trust for varying lengths of time, anywhere from one to three years (which is defined as a short-term investment), three to five years (medium-term) to five years and longer (long-term).

Here are some examples of how these investment strategies would work with your particular goals:

Short-term: These are good for more immediate goals such as buying a car, looking to take a holiday, or wanting to start a family.

Medium-term: These are suitable if you are looking for slightly higher returns to be used towards the down payment for a house, or seeking capital to start a new business in the near future.

Long-term: These are more suitable for big financial goals that you have lined up for the future, such as paying for your young child’s tertiary education, or if you want a comfortable nest egg by the time you are ready to retire.

What are the risks involved?

As with most forms of investments, there are risks involved. But the beauty of investing in Unit Trusts is that you are able to choose an investment strategy that best fits your risk appetite.

In general, there are three types of investment strategies to take into consideration, based on your level of risk:

Conservative: This is often the best strategy for older investors who have a large amount of capital and prefer stability over quick gains. Investments in this risk category tend to be in safe assets that are not easily susceptible to market shocks or swings, and very often, help to preserve the principal amount you invest.

Moderate: For investors who are willing to take some risks, this strategy is the perfect balance between wanting to preserve your principal investment, while still taking advantage of some assets that can offer potential growth in the near future.

Aggressive: For younger investors, a small amount of capital can go a long way, especially if they are willing to invest for the long term. While there might be a chance that they may lose some of their initial capital, the fact that they have time on their side means that they can take higher risks in order to maximise growth.

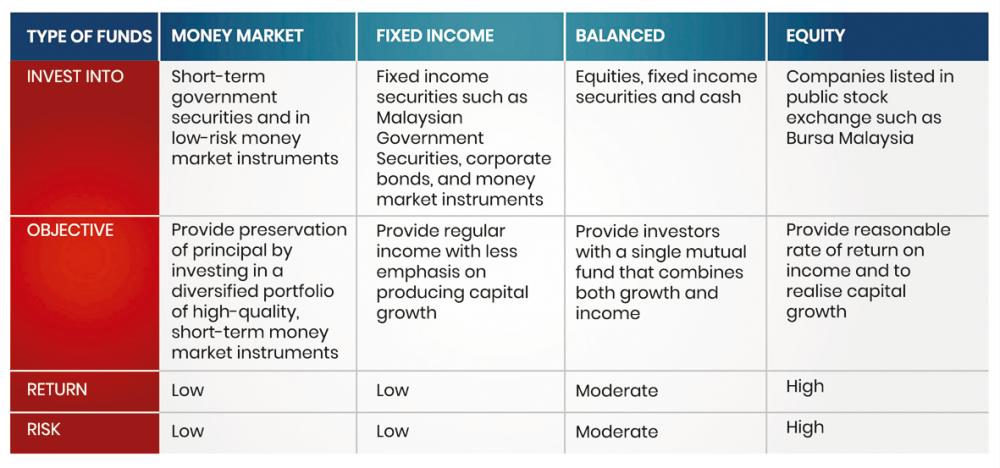

A quick look at the types of investments that offer returns based on risk appetites.

One way to gauge your risk appetite is by comparing your investment to one of the most secure forms of savings accounts available: a bank’s fixed deposit account.

Let’s say you are dealing with a 12-month fixed-deposit account (FDA) with an interest rate of 1.85% per annum. You have invested RM100,000, and are hoping to double your principle. Under those investment terms, it will take just under 40 years for your principal sum to turn into RM200,000.

However, by placing some of your money in Unit Trust funds, you may be able to achieve a moderately higher return, which commensurate with the slightly higher risks (depending on the type of fund you invest in) – and reach your goal faster.

If you invested in a Unit Trust with potential returns of 5% per annum, you are looking at achieving your goal in about 15 years instead. This is the power of compounding – any additional returns above your average FDA returns could potentially save you the time needed to reach your financial goal.

Thus, Unit Trust funds may be suitable for investors looking to earn potentially above-average returns within a shorter time.

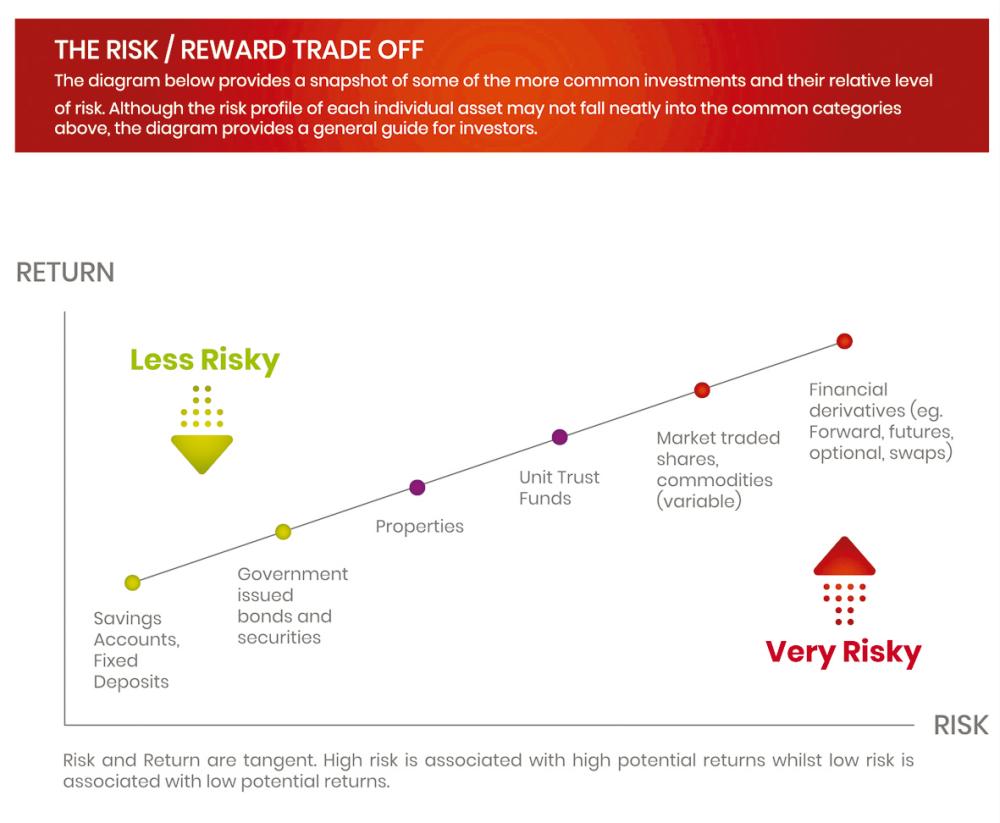

Take a look at how Unit Trust funds measure up to other forms of investments and savings:

For those looking to start their financial journey, Unit Trusts are both safe and potentially profitable.

Unit Trusts offer a middle ground when it comes to investment options, safer than direct investments in the market, and yet has the potential to offer better returns than standard savings accounts. For those looking to safeguard their financial future or grow their wealth, it is well worth considering investing your money into Unit Trusts.

To find out what other steps you can take to reach financial freedom, look out for the next article in our series on Your Personal Journey to Financial Security, only in theSun, brought to you by Federation of Investment Managers Malaysia (FIMM).

Visit FIMM’s website for more details on Unit Trust Management Companies (UTMC), information on Unit Trust Schemes and Private Retirement Scheme, as well as the lists of approved funds.