THE Malaysian housing market has been languishing after experiencing the boom in 2010-2015. Though house prices continued to rise since 2015, a gradual slowdown of the pace was prevalent throughout 2015-2020. This was partly attributed to the implementation of various cooling measures to curb speculation since 2014, as well as the global economic downturn that began in early 2018 due to the US-China trade tensions, followed by the pandemic-induced recession in early 2020.

Moreover, the country housing market has been marred by lingering issues such as ongoing inventory overhang, rising cost of doing business, decreasing household affordability, higher household debts, tighter credit standards which have badly affected the buying sentiment; and hence, contributing towards a market downturn.

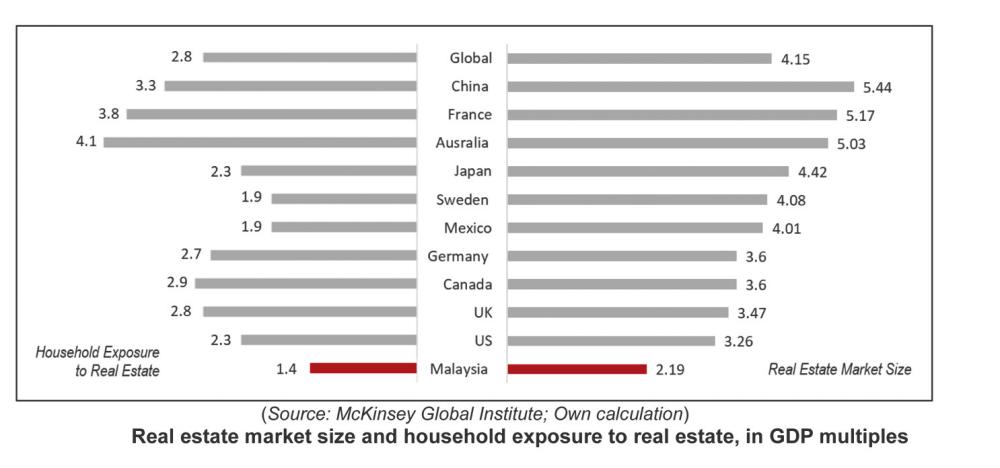

Having said that, the country’s housing market is not yet at the high-risk low-return proposition; not even at the risk of bubble when compared to the global top-10 most valuable real estate markets. This is because with a real estate ratio in GDP multiple of 2.19 – an indicator that is similar to the price-to-earnings (P/E) ratio of a particular stock, which gives investors a sense of potential future yield over the long-run – the country’s housing market size is considered moderate and rather manageable. Also, despite of having a high household debt to GDP (73.4% as of Jun 2021), Malaysian households are generally having relatively lower exposure to real estate sector; as the country’s household real estate stock in GDP multiples sits at the lower end (1.4) as compared to other countries (see chart).

While this should signify a positive housing market growth condition, property developers may find it difficult to sustain a consistent expansion due to current challenges in both the local and global economies. Most importantly, the country’s prime property markets like Penang, Kuala Lumpur, Johor, and Selangor have started to show an inflection point in growth, where high-growth stage featured with speculation herd instinct and rapid expansion in investment volume is becoming less and less prevalent in these markets. Rather, these markets are led by those rational demands emphasising on own-stay and self-occupied, lifestyle living and upgrading, as well as higher quality consumption.

As for the rest of the markets where supply is still underneath the demand, market expansion in volume is expected to continue due to the intensifying urban agglomeration process, increase in household income, and the decrease in household size. In this sense, investors who are interested with the Malaysian housing market should be sensitive to such a domain differentiation in each individual local market, so as to establish a productive long-term real estate investment strategy and management mechanism.

Rationally, the downsides are limited and the current valuation of the Malaysian real estate market is favourable for long-term investment, given that the fundamentals of the housing market still remain intact, owning to the continual economic growth, rising population, increasing demand for better quality of living and improvements in infrastructure.

This article was contributed by MKH Bhd manager of product research & development Dr Foo Chee Hung and Leverage Value Sdn Bhd real estate analyst Wong Gee Way.