KUALA LUMPUR: Funding Societies, the largest unified SME digital finance platform in Southeast Asia, has achieved US$3 billion (RM13.4 billion) over more than 5 million transactions of business financing to small and medium-sized enterprises across the region.

As the company expands across five countries in Southeast Asia, almost 100,000 SMEs have benefited from access to financing. It continues to support underserved SMEs via its extensive range of short-term financing solutions while achieving an overall platform cohort default rate under 2%.

In Malaysia, Funding Societies has disbursed RM2 billion in SME financing since its inception in 2017.

In its move to empower SMEs, the company began offering solutions beyond lending, such as payments and collections. Since establishing its payments business, Funding Societies has tripled its gross transaction value (GTV) year-on-year through its proprietary solution Elevate, and its integration of CardUp’s payments solutions for FY 2022.

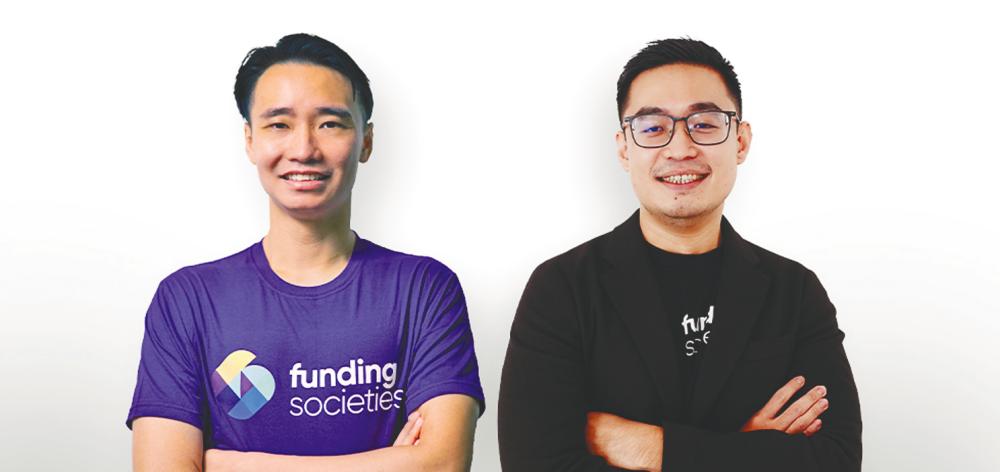

Funding Societies/Modalku co-founder & group CEO Kelvin Teo said, “2022 was a big year for Funding Societies despite the uncertain macro environment. Committed to empowering SMEs in Southeast Asia, we’ve raised our Series C+; scaled up in Thailand and Vietnam; deepened localised financing propositions; secured our first credit line from a global commercial bank HSBC with US$50 million (RM224 million), entered into payments with CardUp and investment into Bank Index, because SMEs’ needs extend beyond financing.

“While there are macro headwinds this year, we are optimistic to continue growing sustainably, as we did during Covid-19. We will continue to stay nimble, innovate, and scale up in financing, payments and other financial services – catering to various pain points of SMEs,” he added.

Chai Kien Poon, Funding Societies’ country head for Malaysia, remarked: “We are proud of how the team in Malaysia carried us across another milestone: touching the RM2 billion disbursement mark within six years. SMEs will continue needing additional financial support as they contribute towards the projected 4.5% GDP growth in 2023.

“We look forward – while working with stakeholders – to continue growing and positively impacting the Malaysian economy, and our society, by enabling MSMEs as well as creating and supporting jobs.”

In line with their commitment towards uplifting local SMEs, he said, they are looking to introduce new products this year, including extending their Islamic financing offerings.

“We look towards forging new industry partnerships to enable us to deepen our reach to the underserved, creditworthy SMEs,” he added.

In May 2022, Funding Societies introduced its first syariah-compliant trade financing solution based on Commodity Murabahah via Tawarruq, allowing SMEs to access a credit line of up to RM1 million – at zero collateral.

It is working to launch its syariah-compliant micro & term financing this month, expanding their syariah financing propositions across their product offerings, in line with their focus to grow their leadership in Islamic finance.

On the investor side, the fintech platform introduced its guaranteed investment notes which provide investors with a return of up to 8% per annum.