PETALING JAYA: Malaysia’s gross fixed capital formation (GFCF) recorded a value of RM314.5 billion at constant prices in 2023 compared to RM298.2 billion in 2022, according to the Department of Statistics, Malaysia today.

The combination of global economic pressures, domestic policy adjustments, sector-specific challenges, and financial conditions significantly contributed to the moderate in GFCF growth in Malaysia in 2023.

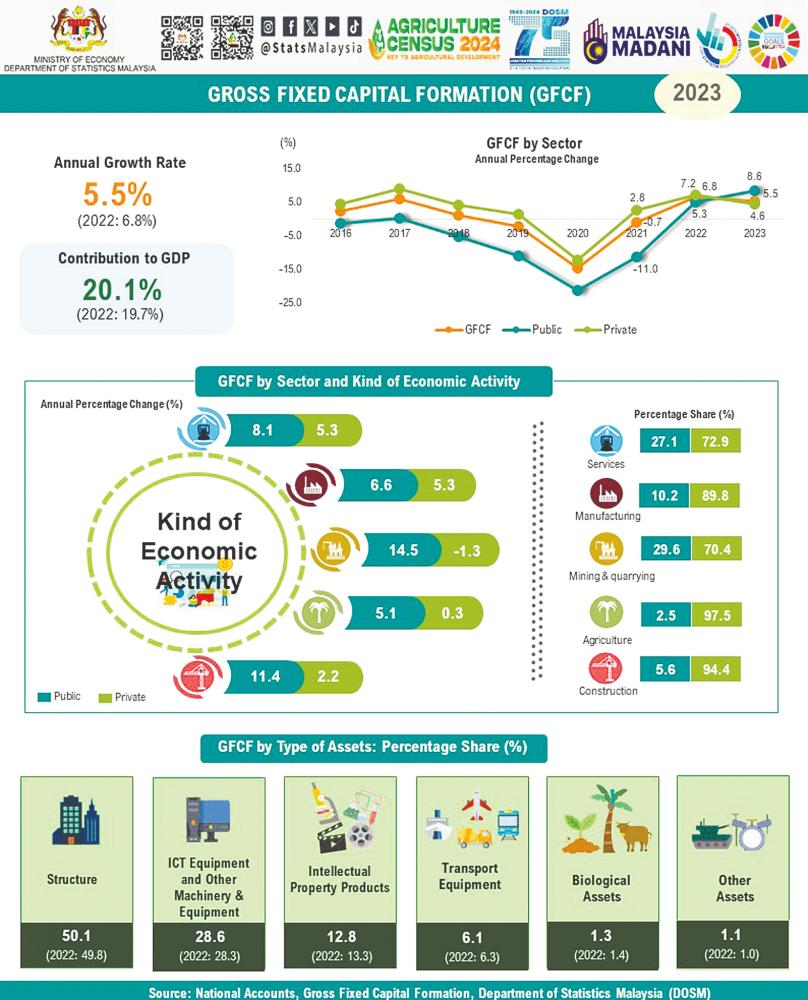

Chief Statistician Malaysia, Datuk Seri Dr Mohd Uzir Mahidin said, “GFCF remained the second largest component of GDP with a share of 20.1% of the total economy. GFCF grew 5.5% in 2023 compared to 6.8% in the previous year.”

He added that all major activities showed an improvement in 2023, especially investment in fixed assets in services and manufacturing activities.

“The strong performance of services activity was driven by transport & storage and information & communications and wholesale and retail trade sub-activities, which increased by 9.9% and 8.9%, respectively in 2023,” he said.

Meanwhile, manufacturing activity grew at 5.5% (2022: 10%) in 2023. The moderate growth was influenced by food, beverages and tobacco at 8.9% (2022: 14.7%), electrical, electronic & optical products and transport equipment at 6.8% (2022: 9.3%) and petroleum, chemical, rubber and plastic products at 4.5% (2022: 8.7%).

The GFCF for mining & quarrying activity grew at 2.9% in 2023 compared to 1.8% in 2022. Agriculture activity grew at a slower pace of 0.4% (2022: 1.1%) in 2023. The marginal growth was influenced by the decrease of rubber and oil palm sub-activity at 5.4% (2022: -4.3%).

Additionally, construction activity moderated to 2.7% compared to 3.4% in the previous year.

Structure was the largest contributor to GFCF by type of assets, accounting for 50.1% (2022: 49.8%), followed by ICT equipment and other machinery & equipment, with a contribution of 28.6% (2022: 28.3%), while intellectual property products contributed 12.8% (2022: 13.3%).

GFCF by sector was dominated by the private sector (77.2%), which grew modestly by 4.6% (2022: 7.2%), while public sector (share: 22.8%) expanded to 8.6% compared to 5.3% in the preceding year.

Mohd Uzir said services activity was the major contributor to the GFCF of the private sector with 63.9% compared to 63.6% in 2022. This was followed by manufacturing activity which contributed 23%. Meanwhile, other activities accounted for 13.1% of the total GFCF of the private sector.

GFCF of the public sector was led by services activity, with a contribution of 80.5% followed by mining & quarrying 9.9% and manufacturing 8.8%).

Among other Asean member countries, Indonesia and Singapore recorded GFCF growthh of 7.6% and 4.9% in 2023 respectively. In addition, fixed asset investment in Thailand experienced slower growth of 1.4% compared to 6.7% in 2022.