Highlights:

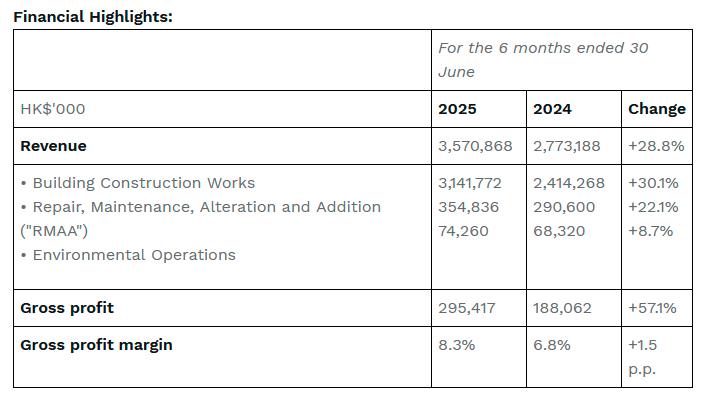

· Revenue increased by 28.8% to approximately HK$3,570.9 million.

· Gross profit increased by 57.1% to approximately HK$295.4 million.

· Gross profit margin increased by 1.5 p.p. to approximately 8.3%.

HONG KONG SAR - Media OutReach Newswire - 27 August 2025 - CR Construction Group Holdings Limited (”CR Construction“ or the “Company”, together with its subsidiaries, the “Group”; stock code: 1582.HK), a building contractor in Hong Kong, announced its interim results for the six months ended 30 June 2025 (the “Reporting Period”). During the Reporting Period, the revenue recorded by the Group amounted to approximately HK$3,570.9 million representing an increase of approximately 28.8% as compared to approximately HK$2,773.2 million for the six months ended 30 June 2024 (the “Corresponding Period Last Year”). Net profit of the Group during the Reporting Period was approximately HK$25.9 million.

During the Reporting Period, gross profit of the Group was approximately HK$295.4 million, representing an increase of approximately 57.1% as compared to approximately HK$188.1 million for the Corresponding Period Last Year. The Group's gross profit margin was approximately 8.3% and 6.8% for the six months ended 30 June 2025 and 2024, respectively. The gross profit margin of the Group increased slightly by approximately 1.5 percentage points by comparing the six months ended 30 June 2025 against the six months ended 30 June 2024.

During the Reporting Period, earnings per share of the Group was approximately HK4.86 cents.

BUSINESS REVIEW

Construction Operations

Building Construction Works

For the six months ended 30 June 2025, the revenue generated from the building construction works was HK$3,141.8 million, representing an increase of approximately 30.1% as compared to approximately HK$2,414.3 million for the six months ended 30 June 2024.

During the Reporting Period, the gross profit of building construction works was approximately HK$165.3 million, representing an increase of approximately HK$38.6 million as compared to approximately HK$126.7 million for the Corresponding Period Last Year. The gross profit margin increased to approximately 5.3% for the six months ended 2025.

Repair, Maintenance, Alteration and Addition (”RMAA”)

The revenue generated from the RMAA works increased by approximately 22.1% from approximately HK$290.6 million for the six months ended 30 June 2024 to approximately HK$354.8 million for the six months ended 30 June 2025.

During the Reporting Period, the gross profit of RMAA works was approximately HK$103.2 million, representing an increase of approximately HK$60.0 million from the gross profit of approximately HK$43.2 million for the six months ended 30 June 2025. The gross profit margin increased to approximately 29.1% for the six months ended 30 June 2025.

Environmental Operations

For the six months ended 30 June 2025, the revenue generated from the environmental operations was approximately HK$74.3 million, representing an increase of approximately 8.7% as compared to approximately HK$68.3 million for the six months ended 30 June 2024.

During the Reporting Period, the gross profit was approximately HK$26.9 million, representing an increase of approximately HK$8.7 million as compared to approximately HK$18.2 million for the six months ended 30 June 2024. The gross profit margin increased to approximately 36.2% for the six months ended 30 June 2025.

CONTRACT COSTS

The Group's contract costs primarily consisted of subcontracting costs, material costs, direct staff costs and site overheads. For the six months ended 30 June 2025, the contract costs recorded by the Group were approximately HK$3,275.5 million, representing an increase of 26.7% compared to approximately HK$2,585.1 million for the six months ended 30 June 2024.

PROSPECTS

Subsequent to 30 June 2025, the Group has been further awarded 1 new project relating to building construction works with original contract sum of approximately HK$206.2 million.

The Group has also attached great emphasis to technological innovation, enhancing its core competitiveness in the construction industry, and actively utilises digital technology to improve work efficiency and site safety. The total expenditure for the research and development is approximately HK$10.0 million during the Reporting Period.

During the Reporting Period, we successfully achieved the latest versions of the ISO 27001 Certification for Information Security Management System and the ISO20000 Certification for IT Service Management System, which serve as an important cornerstone for the Company's digital development. Several systems and projects developed by our technology team cover a wide range of functions, including SmarTrack, operational process digitalisation project, Robotic Process Automation, MaiaAI system, Site Worker Safety Tracking Watch, Intelligent Tower Crane Cockpit. These technological innovations enhance the Group's core competitiveness in the construction industry, and actively utilise digital technology to improve work efficiency and site safety.

In the second half of 2025, Hong Kong's economic activities are expected to continue steady development, while cost pressure is expected to rise with increasing construction volume. The government has introduced two strategic initiatives in the 2025-2026 Budget Proposal, which are anticipated to have positive impacts on the Group's operations. The increase of capital works expenditure creates new project opportunities for the construction sector, thereby expanding the market for the Group's core businesses. The Skills Enhancement Allowance Scheme for the construction sector is projected to reduce the Group's workforce development expenditures and enhance the skillsets of its human capital.

Our Group will continue to work hard to find new potential construction business opportunities to achieve Group's profit growth. At the same time, leveraging our experience in the industry, our Group is keen to explore suitable business opportunities in construction and environmental industries and other areas both domestic and overseas.

Hashtag: #ÈA I½¨ºB #CRConstruction

The issuer is solely responsible for the content of this announcement.