HONG KONG SAR - Media OutReach Newswire - 5 July 2024 - Today, IX Asia Indexes announced the 1st Half 2024 Review of the IX Digital Asset Industry Classification System (”DAICS®”), aiming to provide the professionals worldwide with a transparent and standardized classification scheme to determine sector and exposure of particular digital assets. DAICS® classifies digital assets into 2 main categories: a) Cryptocurrencies and b) Asset Backed Tokens and a 3-tier system for each category. For Cryptocurrencies: 1-Industry/ 2-Sector/ 3-Sub-sector; for Asset Backed Tokens: 1-Asset Type/ 2-Branch/ 3-Sub-branch (Appendix 1). The results are as follows:

a) Cryptocurrencies

i) Structure and definitions

Tier 1: Industry Changes

The industry groups remain unchanged with 5 industries.

1) Payment (110),

2) Infrastructure (120),

3) Financial services (130),

4) Tech & Data (140) and

5) Media & Entertainment (150).

Tier 2: Sector Changes

The number of sectors remain unchanged with 16 sectors. There is modification in Sector name under Media & Entertainment (150)/ Social Media & Community Sector. The definition of Social Community sector remains unchanged.

Modification in sector name.

Before

Social Media (15010)

After

Social Media & Community (15010)

ii) Classification Changes

VeChain (VET)

Before

Industry: Tech & Data (140)

Sector: Storage & Sharing (14010)

After

Industry: Infrastructure (120)

Sector: Application Development Protocol & Smart Contract (12010)

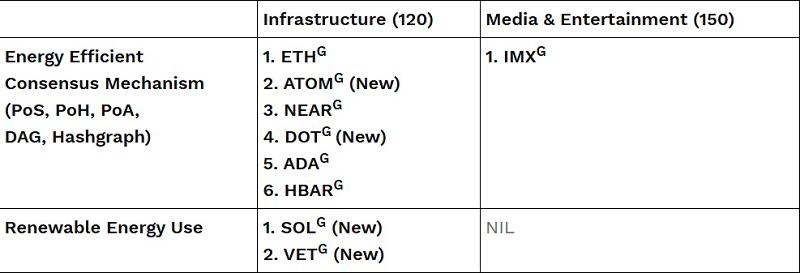

iii) Green coins label

There are 9 Greens coins in this review:

iv) Coverage of DAICS®

DAICS® coin coverage: top 50 coins by market capitalization

DAICS® market capitalization coverage: 87.493%*

The % coverage of market capitalization of the 50th ranked coin: 0.092%

Member changes within the TOP 50 coins in DAICS® : 6 coins in and 7 coins out

(For more details about the industry weighting and the 6 changes, please see Appendix 4).

*As of 22nd May 2024, based on past 90 days market capitalization ranking including all coins* (exclude stable coins and pure DAO governance tokens)

Note: G as ‘Green’ labelling for cryptocurrencies that adhere to the principles of sustainability

* * (For details on Industry & Sector definitions under DAICS®, please refer to Appendix 2 & 3)

b) Asset Backed Tokens (ABT)

i) Structure and definitions

Tier 1: Asset Types Changes

The asset types remain unchanged at 6

1) Culture (205),

2) Real Estate (215),

3) Financials (235),

4) Entertainment (255),

5) Natural Resources (265), and

6) Green Economy (275).

Tier 2: Branch Changes

The branches remain unchanged at 31.

(For details on Asset types and Branches, please refer to Appendix 3).

ii) Classification Changes

Nil

iii) Coverage of DAICS®

IX Asia Indexes has not started to classify any ABT. ABTs will be added to DAICS® in the next stage when a fair amount of popular asset-backed tokens are available in the market. A new ABT registry will be made available to the public. Although there has been an increase in the number of ABTs, ABTs only comprised 0.106% of the total market capitalization of digital assets. A classification summary and definition table are available at Appendix 5 & 6.

For further information regarding the methodology of the DAICS®, please refer to the “IX Digital Asset Industry Classification System”- principle and guiding methodology on the company website https://ix-index.com/daics.html.

All classification changes including the ixCrypto Infrastructure Index and ixCrypto Stablecoin index will take effect on 19th July, 2024.

For more details on our DAICS® qualification criteria, please email daics@ix-index.com.

For a full version of the appendixes 1-3, please refer to ix-index official website.