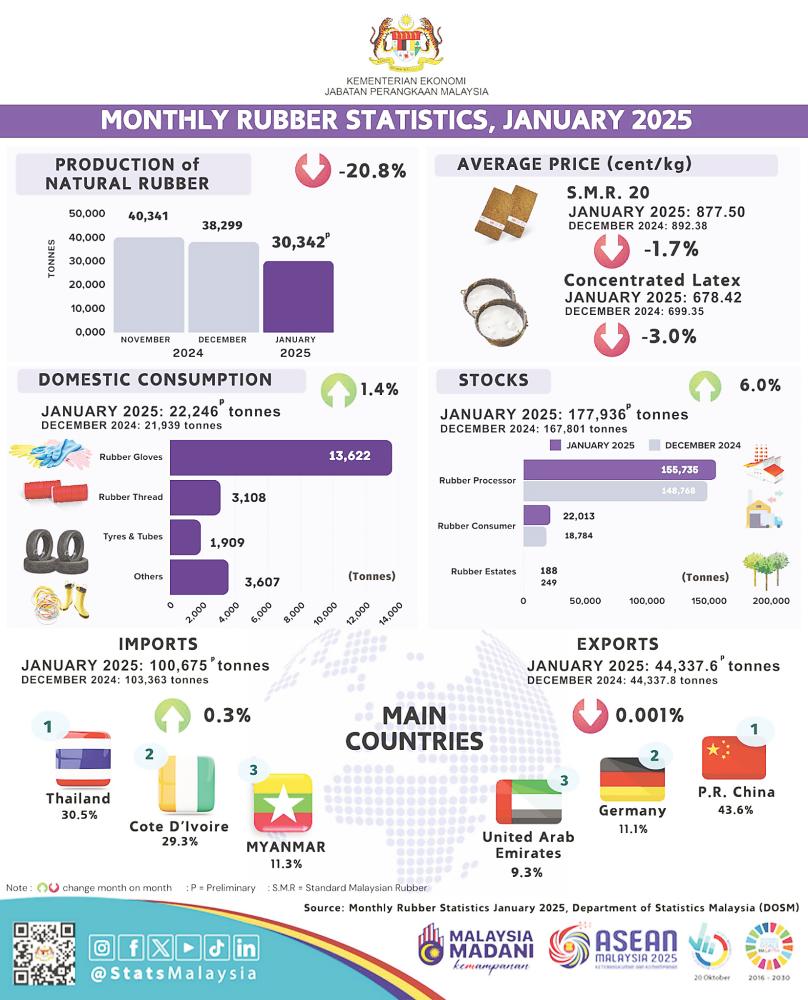

PUTRAJAYA: Natural Rubber (NR) production decreased by 20.8% in January 2025 (30,342 tonnes) as compared to December 2024 (38,299 tonnes) said Chief Statistician Malaysia, Datuk Sri Dr. Mohd Uzir Mahidin.

Year-on-year comparison showed that the production of NR increased by 0.2% (January 2024: 30,287 tonnes). Production of NR in January 2025 for Malaysia was mainly contributed by smallholders sector (87.0%) as compared to estates sector (13.0%).

Total stocks of NR in January 2025 increased by 6.0% to 177,936 tonnes as compared to 167,801 tonnes in December 2024. Rubber processors factory contributed 87.5% of the stocks followed by rubber consumers factory (12.4%) and rubber estates (0.1%).

Exports of Malaysia’s NR amounted to 44,337.6 tonnes in January 2025, decreased 0.001% as against December 2024 (44,337.8 tonnes).

China remained as the main destination for NR exports which accounted 43.6% of total exports in January 2025 followed by Germany (11.1%), the United Arab Emirates (9.3%), the United States (7.6%) and Portugal (3.0%).

The exports performance was contributed by NR-based product such as gloves, tyre, tube and rubber thread. Gloves were the main exports of rubber-based products with a value of RM1.4 billion in January 2025, a decrease of 8.1% as compared to December 2024 (RM1.5 billion).

Analysis of the average monthly price showed that Concentrated Latex recorded a decrease of 3.0% (January 2025: 678.42 sen per kg;December 2024: 699.35 sen per kg) while Scrap decreased by 1.9% (January 2025: 743.27 sen per kg; December 2024: 757.28 sen per kg). Trend of prices for all Standard Malaysian Rubber (S.M.R) decreased between 1.6% and 3.0%.

The World Bank Commodity Price Data reported the prices for TSR 20 (Technically Specified Rubber) has decreased 3.1 per cent (from US$1.99/kg to US$1.93/kg) and SGP/MYS (Singapore/Malaysia) decreased 0.6 % (from US$2.38/kg to US$2.37/kg).

According to the Malaysia Rubber Board Digest published in January 2025, the Kuala Lumpur Rubber Market displayed a mixed trend in tandem with the regional rubber futures markets owing to uneven economic performance of the US and China.

The market faced downward pressure from the strengthening of ringgit against the US dollar and declining crude oil prices.