KUALA LUMPUR: The Telegram app is one of the 16 primary communication mediums commonly exploited in investment scams, said Bukit Aman Commercial Crime Investigation Department director Datuk Seri Ramli Mohamed Yoosuf.

He said that in the first eight months of this year, 1,346 investment scam cases, resulting in losses amounting to RM29.96 million, were linked to the use of Telegram.

Other mediums frequently used for these scams include Facebook and WhatsApp, each recording 948 and 873 cases, respectively, followed by Instagram (146 cases), face-to-face interactions (96 cases), social dating app (61 cases) and 393 cases involving other platforms such as WeChat and websites.

“Women constitute the majority of victims, with 2,124 people reporting losses totalling RM315.3 million, while 1,740 male victims recorded losses of RM170 million,” he told a press conference here today.

Ramli said the overall losses recorded from online investment scams were alarming, with RM483.95 million reported from January to August.

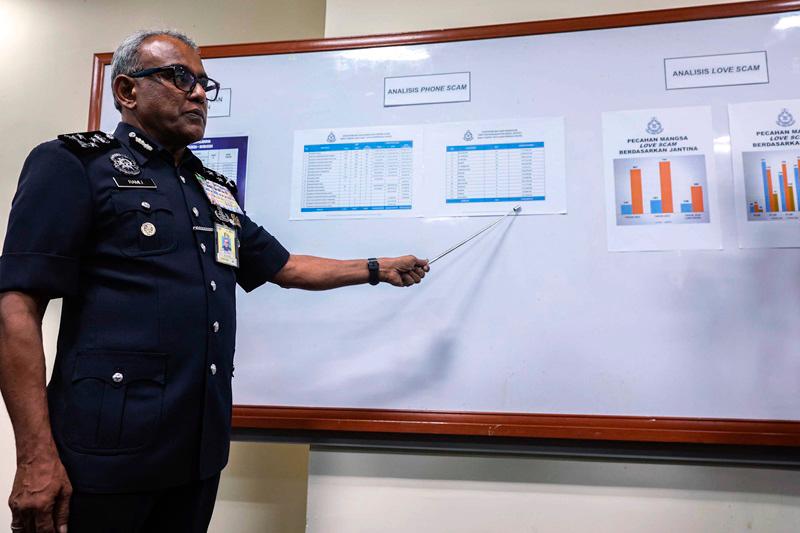

Regarding love scams, Ramli said women represented 79.3 per cent of the total 2,223 cases recorded from 2022 until August of this year, making them the most frequent targets.

He attributed this to emotional vulnerability and openness in personal relationships, which made women more susceptible to exploitation by syndicates.

“The syndicates don’t target specific age groups, as anyone can fall victim to a love scam. For instance, in 2022, the highest number of victims were in the 21 to 30 age group, with 211 individuals.

“In 2023, most victims were aged between 41 and 50 years, involving 215 individuals. As of August this year, the 21 to 30 age group once again recorded the most victims, with 178 individuals,” he said.

Ramli further said that the number of love scam cases this year is expected to match or exceed previous years, with 496 cases and RM23.3 million in losses recorded in the first eight months alone.

In 2023, police recorded 935 love scam cases involving RM43.9 million in losses, a rise from 792 cases and RM56.2 million in losses in 2022.

Meanwhile, Ramli said police also recorded 8,082 phone scam cases with a loss of RM434.2 million between 2022 and August this year, with impersonation as police officers having the highest number at 2,411 cases, followed by impersonation as Inland Revenue Board (IRB) officers (1,419 cases), lucky draw organisers (1,038 cases), delivery company staff (540 cases) and bank officers (539 cases).

“These syndicates constantly change their tactics according to the current situation and developments,” he said.

Over the first eight months this year alone, he said 125 phone scam cases involving suspects posing as e-commerce staff with losses amounting to RM3.92 million were recorded.

Ramli said the act of transferring calls from one agency to another, as often occurred in cases of phone scam, was not the way government agencies work.

Hence, he said the public needs to be aware that law enforcers such as the police, or even the IRB and Bank Negara Malaysia will not call to tell someone that they were involved in a crime.

“If you receive a dubious call and are transferred from one agency to another, that is a scam. End the call immediately to avoid becoming a victim,” he said.