DONALD Trump’s victory in the 2024 US presidential election has raised global concerns about how his economic policies may impact countries like Malaysia.

With an “America First” approach focused on protecting domestic interests, the Trump administration is expected to reshape international trade, shift investment flows and influence geopolitical relationships.

For Malaysia, this outcome presents not only challenges but also opportunities in key economic sectors, including trade, foreign investment and commodities.

Trump is anticipated to continue protectionist policies that prioritise US jobs and domestic production. His proposal to impose a 10% import tariff on all goods entering the US aims to reduce reliance on foreign products and bolster domestic manufacturing.

Additionally, Trump’s plan to impose tariffs as high as 60% on Chinese products could have significant implications for Malaysia, one of the major exporters of electronic products and components to the US. If high tariffs are applied to Chinese goods, Malaysian products incorporating Chinese components could also be impacted, potentially diminishing US demand for Malaysian exports.

While this situation presents risks, it also provides opportunities as companies diversify supply chains away from China. Malaysia benefitted from the “China+1” strategy during Trump’s first term, as exports to the US increased amid US-China trade tensions.

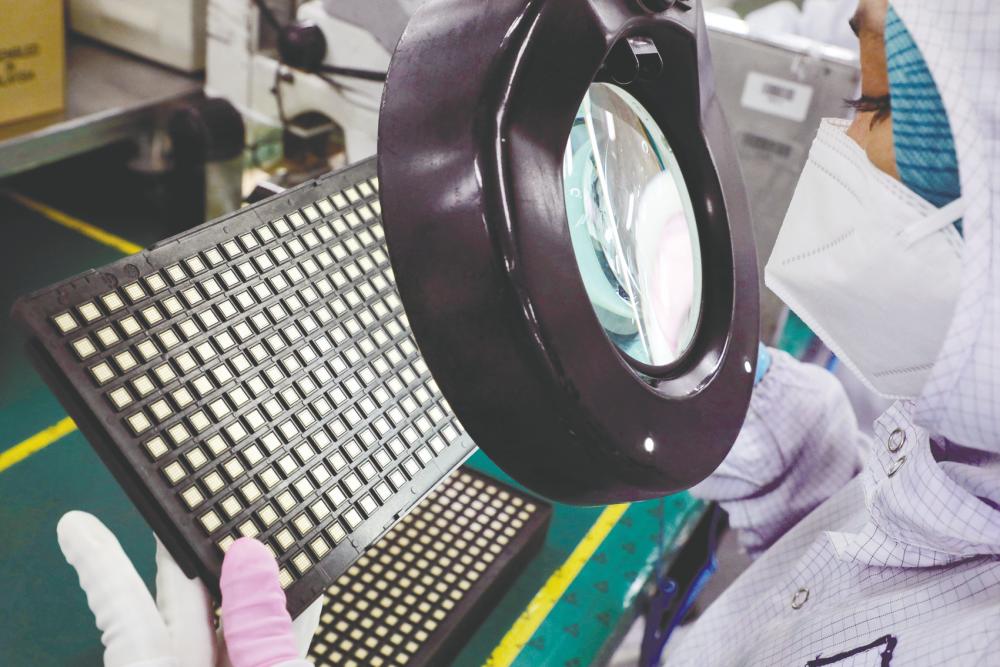

Malaysia’s semiconductor industry, a focus of large investments from multinational companies such as Intel and Infineon, may continue to attract interest as a stable manufacturing base.

Currently, Malaysia holds around 13% of the global market in chip packaging and testing, making it a favourable location for companies seeking to expand operations outside of China. These conditions indicate Malaysia’s potential to further establish itself as a manufacturing hub if it can maintain political stability and investor-friendly economic policies.

The energy sector is also likely to be affected. Trump’s pro-oil stance could lead to increased US production and exports of fossil fuels. Should global oil prices rise, Malaysia, as an oil exporter, stands to benefit from higher national revenue.

However, rising oil prices also carry inflationary risks, as increased energy costs could drive up production costs and consumer prices domestically. While the energy sector may gain, higher energy costs could pressure consumer purchasing power and escalate operational costs for local industries.

To maximise these potential gains, Malaysia will need to balance these impacts on the consumer sector and ensure monetary policies support price stability.

The Malaysian commodity sector, particularly palm oil, faces potential challenges as well. During Trump’s first term, the US imposed import restrictions on Malaysian palm oil companies such as FGV Holdings and Sime Darby Plantation over allegations of forced labour. These restrictions affected Malaysian palm oil exports to the US, reducing revenue and harming the country’s image as a responsible producer.

Should similar policies persist, Malaysia will need to strengthen sustainable labour practices and meet international standards to retain access to global markets and protect its reputation as an ethical producer.

Trump’s policies could bring added uncertainty to Malaysia’s capital markets and the ringgit’s value. With US interest rates currently at 4.75%-5.00%, any influence Trump may exert on the Federal Reserve to raise rates could lead global investors to favour US assets, potentially causing capital outflows from Malaysia.

In 2023, Malaysia saw a 6.8% decline in foreign equity inflows, and the ringgit depreciated by around 8% against the US dollar. This shift reduces liquidity in local capital markets, and foreign investors may approach Malaysian equities with greater caution, especially if Trump’s policies introduce additional tariffs or trade restrictions.

As demand for the US dollar rises, the ringgit may face continued downward pressure. A weaker ringgit could increase import costs, particularly in vital sectors like food and technology, compounding domestic inflationary pressures, which currently stand at 2.8%.

To address these challenges, Malaysia needs a strong risk management strategy to maintain market stability and support the ringgit amid growing uncertainties.

In addition, Trump’s protectionist stance may directly impact Foreign Direct Investment (FDI) into Malaysia. As a manufacturing hub in Southeast Asia, Malaysia could see reduced FDI if the US pursues an aggressive stance on countries with significant trade surpluses.

Trump’s emphasis on protecting US jobs and domestic economic interests may lead to decreased investment from US companies in Malaysia.

Concurrently, prolonged US-China trade tensions could make investors more cautious about Malaysia, which may be perceived as politically and economically vulnerable. Any decline in FDI could affect job creation, technology growth and Malaysia’s long-term economic stability.

Furthermore, Trump’s victory raises concerns about the future of the US-led Indo-Pacific Economic Framework (Ipef). Trump has previously expressed a desire to withdraw from trade agreements like Ipef, which he sees as “another TPP”. If this happens, Malaysia may face challenges in maintaining market access and regional economic integration.

To prepare, Malaysia must diversify its trade partnerships, strengthen local industries and foster growth in resilient sectors. Malaysia’s involvement in Ipef reflects its commitment to regional economic integration, which could help mitigate the negative effects of US protectionist policies.

In summary, Trump’s victory could have significant implications for Malaysia’s economy. Protectionist policies and prolonged trade tensions could disrupt global supply chains, increase market uncertainty and challenge Malaysia’s economic growth.

Malaysia must be prepared with sustainable and adaptable strategies to tackle these challenges while capitalising on emerging opportunities to maintain economic resilience amid an increasingly complex global landscape.

The writer is a researcher and Islamic Finance consultant.

Comments: letters@thesundaily.com