CONTRARY to the market growth of PC and console games last year with its battalion of new titles, players are spending more time playing old games like Fortnite and League of Legends, according to a newly released game industry report by market researcher Newzoo.

Although these two markets grew by 2.6% in 2023 and reached US$93.5 billion (RM443 billion) in revenue, Newzoo’s research indicates that the data points towards only a small number of publishers and developers benefitting from the uptick of what games people were playing and spending money on.

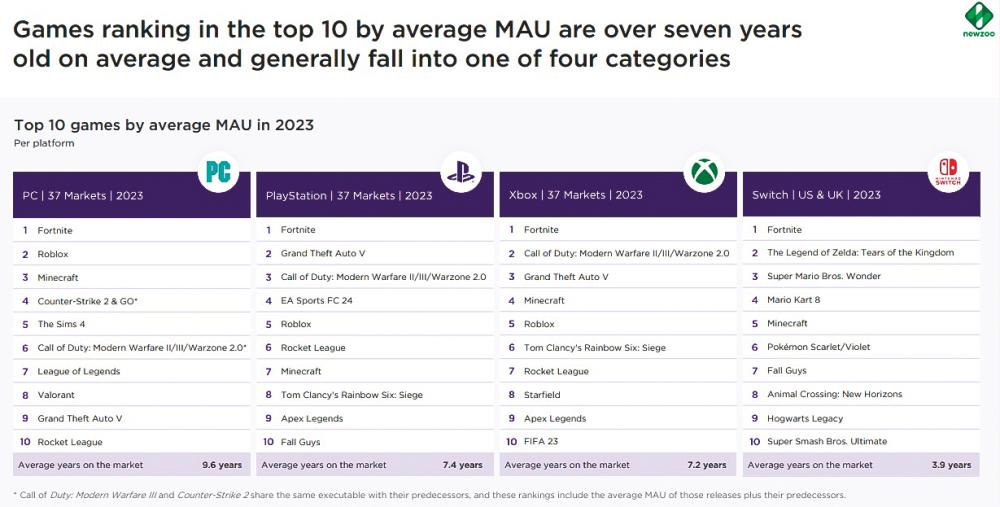

The top 10 games on each platform ranked by the average number of monthly active users is almost entirely filled by old games. On PC, PlayStation, Xbox and the Switch, Fortnite took the top spot.

The other titles on the lists are not surprising: Apex Legends, Call of Duty, Counter-Strike 2, Fall Guys, Grand Theft Auto V, Minecraft, Roblox, Rocket League and Valorant. For the Xbox and PlayStation consoles, last year’s Starfield is the only single-player game that made the top 10 cut.

Based on the data, the average range of years these games have been on the market range from as old as 3.9 years to almost 9.6 years old.

As an indicator to players investing more time in old titles, 66 games account for 80% of all playtime in 2023, and 60% of that was spent in games older than 2017. Five of these old games, including Fortnite and Minecraft, accounted for 27% of all playtime in 2023.

The remainder, roughly 23% of the time spent in 2023 was spent on new games that were two years or younger. From that figure, 15% went to annual releases or franchises that released a new game every year such as Call of Duty and NBA 2K games.

Non-annual, new games like Diablo IV, Baldur’s Gate III and Hogwarts Legacy were forced to compete for remaining 8% of total playtime.

Newzoo’s data paints a depressing picture that while publishers and developers can be successful in the modern gaming climate, their offerings will continue to saturate the market, leading to players spending less time in new games and more in older, established titles.

This means new titles will find it increasingly hard to grow a player base when competing against highly popular “evergreen titles and robust content”.

Now, it is clear that the free market war between gaming companies is less about selling their game, but more on, in Newzoo’s words, “competing with these platform behemoths for a share of limited player hours”.