KUALA LUMPUR: Retirement Fund Inc (KWAP) is optimistic about domestic market growth this year and aims to increase investments in the public and private segments.

KWAP CEO Datuk Nik Amlizan Mohamed said the pension fund is seeing a strong growth trajectory in the domestic market, and various economic activities will spur the market to grow further.

“We are quite positive about the domestic market’s growth and are strategically planning to increase investments in the local market.

“We are also expecting the ringgit to strengthen this year, which will benefit our domestic investments,” Nik Amlizan told reporters at KWAP’s Financial Year 2023 (FY23) results briefing today.

KWAP’s fund size grew from RM158.1 billion in 2022 to RM169.8 billion in 2023, marking a 7.4% or RM11.7 billion increase.

Net income for the year rose to RM9.7 billion, a significant increase from RM263 million in 2022.

KWAP delivered a strong total fund investment return of 8.2% for the year.

Of the asset classes, public equity investments recorded a time-weighted rate

of return (TWRR) of 11%, while the private equity portfolio delivered a TWRR of 7.9%.

The fixed income portfolio achieved a TWRR of 6.2%, the infrastructure portfolio attained a TWRR of 5.2%, and the real estate obtained a TWRR of 3.5%.

The solid performance reflects KWAP’s effective investment strategies and asset allocation decisions.

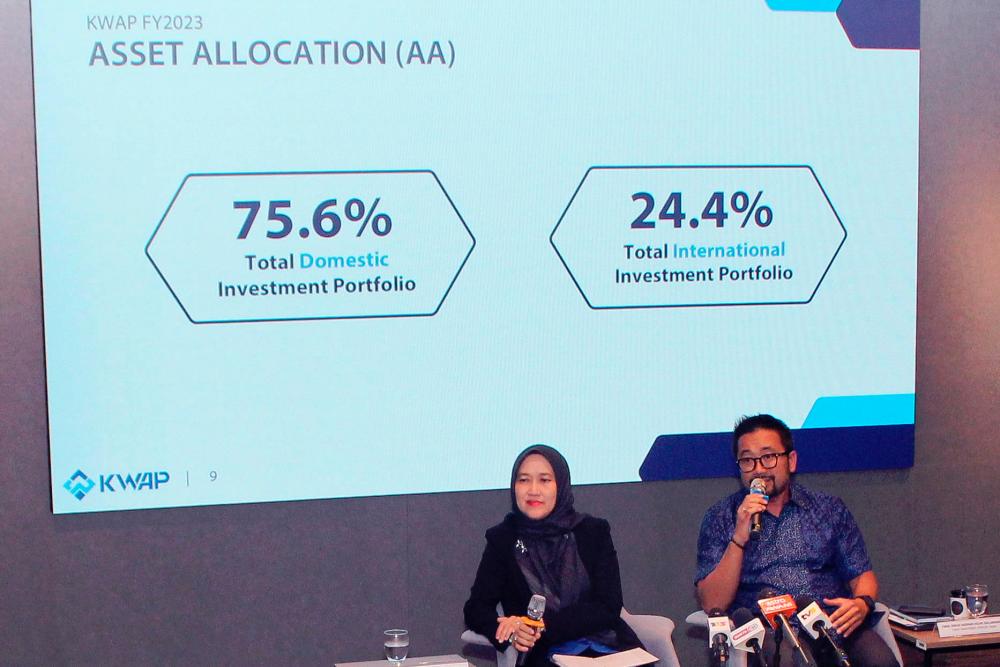

KWAP has remained a key investor in Malaysia, with 75.6% of its investment assets invested in Malaysia, while only 24.4% were divested in the international market.

Public investment made up 87.7%, or RM149 billion, of the total investment assets, and the remaining 12.3%, or RM20.8 billion, was in the private market.

In FY23, KWAP’s asset allocation (AA) outlined a distribution encompassing 47.9% in public equity, 35.5% in fixed income, 5.3% in real estate, 4.8% in private equity, 2.1% in infrastructure, and the remaining 4.4% in money market.

Further, the RM2.7 billion in contributions received in 2023 came from three main sources: federal government contributions, government shares, and employer contributions.

The latter included contributions from statutory bodies, local authorities, and secondment agencies.

Nik Amlizan said KWAP’s notable performance in 2023 builds on its strong track record in meeting its financial and social objectives.

“These results validate our investment model’s effectiveness in generating sustainable returns for our stakeholders.

“We are also structuring our investment effort and initiatives around the Madani framework, and this approach allows us to deliver positive returns for our beneficiaries while contributing to Malaysia’s sustainable development.

“Our continued success affirms KWAP’s financial strength and demonstrates our commitment to creating long-term value for our pensioners and the country as a whole,” she said.

In May this year, KWAP announced plans to invest up to RM3 billion in syariah-compliant investments through its Dana Pemacu vehicle. This investment is aimed at supporting high-growth domestic Malaysian companies and catalysing the venture investment ecosystem.

Chief investment officer Hazman Hilmi Sallahuddin said KWAP aims to increase its foreign investment to 30% and double its private market exposure to slightly above 20%.

He also expects net income to moderate to around RM5 billion to RM6 billion, as per its track record and targets a long-term sustainable investment return of 7.0% annually.

“Given the current sentiment improvement in the forex (foreign exchange) market, we can only achieve that in the next one or two years. We hope this year will be better than 2023, mainly driven by the domestic market.

“But having said that, in the long run, I think our strategy remains to have a balanced exposure,” he said.