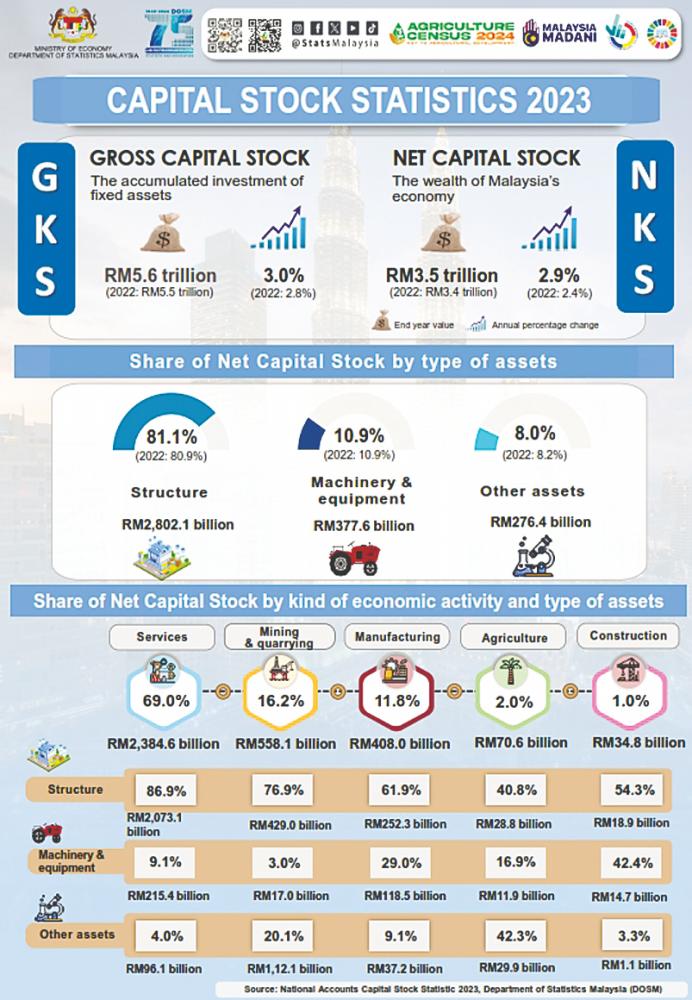

PETALING JAYA: Malaysia’s gross capital stock (GKS), which is accumulated fixed asset investments, reached RM5.6 trillion in 2023, an increase of 3%.

Concurrently, net capital stock (NKS), which refers to Malaysia’s capital assets, registered RM3.5 trillion.

Chief Statistician Malaysia Datuk Seri Dr Mohd Uzir Mahidin said, “NKS continued to grow at 2.9% in 2023 as against 2.4% in the previous year in line with the growth of gross of fixed capital formation which recorded 5.5% this year. This NKS expansion was supported by better growth across all sectors except for agriculture which grew at a slower pace of 0.4% from 0.6% in 2022.”

NKS by kind of economic activity was largely from the services sector grew at 3.5% and remained the largest contributor (69%) compared to other economic activities, reaching RM2.4 trillion in 2023.

Financial, insurance, real estate, and business activities are the largest contributors at 33.1%, followed by transportation & storage and information & communication and utilities activities, which recorded at 19.3% and 10.5%, respectively.

The manufacturing sector increased 3.2% and contributed 11.8% to total NKS with a value of RM408 billion. This contribution was dominated by the petroleum, chemicals, rubber & plastic products at 36.3% which rose at 3.4% compared to 2.9% in the previous year. Electrical, electronic and optical products contributed 32.9% with a growth of 2.8% (2022: 2.2%). This was followed by food, beverages & tobacco that contributed 11.2%, with growth of 7% (2022:6.1%).

NKS for mining & quarrying increased marginally by 0.3% from a negative 0.01% the previous year. Construction sector grew at the same rate of 3.4% for both years, while the agriculture sector grew slower due to the decreasing investment in capitalised planting since 2015.

Mohd Uzir said, “All types of assets for NKS increased compared to 2022. Structure continued to dominate NKS with a contribution of 81.1%, grew by 3.1% in 2023 (2022: 2.7%). Machinery & equipment assets contributed 10.9%, increased 2.8% as against 1.6% in the previous year. Meanwhile, other assets accounted for 8.0% with a growth of 1.0% in 2023 (2022: 0.8%). Malaysia’s asset composition is similar to those of other countries namely Australia, South Korea and Singapore”.

In terms of capital intensity, mining & quarrying sector was the most capital intensive compared to other sectors while the agriculture sector remained lower than national capital intensity. The capital intensity ratio measures the amount of capital required relative to the number of employed workers. Generally, high capital intensity indicates that an industry requires a larger amount of assets for each worker.