KUALA LUMPUR: On a month-on-month (m-o-m) basis, Malaysia’s trade in October 2023 expanded by 6.8% to RM239.52 billion. Exports increased by 1.5% to RM126.19 billion and imports registered a double-digit growth of 13.4% to RM113.33 billion.

Trade surplus reached RM12.87 billion, marking the 42nd consecutive month of trade surplus since May 2020.

Malaysia’s trade declined at a softer pace of 2.4% year-on-year (y-o-y), compared with the double-digit decrease reported in the previous month. Exports eased by 4.4% and imports reduced marginally by 0.2%. Malaysia’s performance was similar with its key trading partners notably China, Taiwan RoC and Indonesia which experienced negative trade growth in October 2023 and a reduction in global imports.

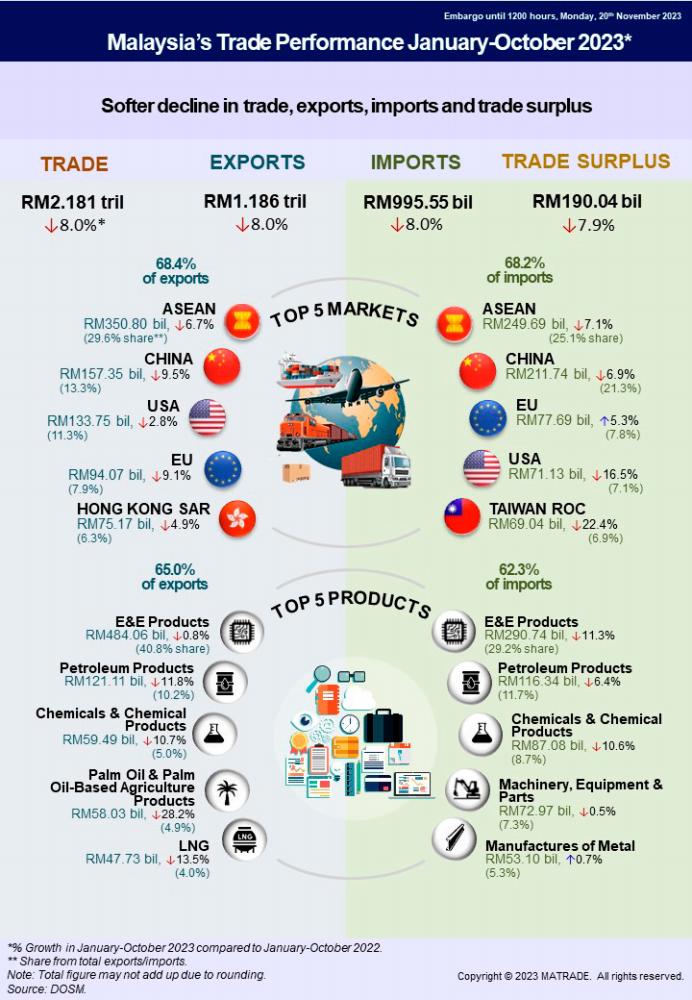

For the period of January to October 2023, trade surpassed the RM2 trillion mark, reaching RM2.181 trillion. Exports amounted to RM1.186 trillion, while imports were valued at RM995.55 billion. Trade, exports and imports each posted an 8% decrease compared to the corresponding period last year. Trade surplus was lower by 7.9%, amounting to RM190.04 billion.

In October 2023, exports of manufactured goods, constituting 85.3% or RM107.59 billion of total exports slipped by 3.5% y-o-y as a result of lower demand for petroleum products as well as electrical and electronic (E&E) products. However, exports of transport equipment, processed food, machinery, equipment and parts, manufactures of metal, paper and pulp products as well as wood products registered expansion.

Exports of agriculture goods (7.1% share) improved by 3.3% to RM8.90 billion compared to October 2022, marking its first positive growth after twelve consecutive months of decline.

Exports of mining goods (6.9% share) dipped by 21.9% y-o-y to RM8.75 billion attributed to lesser exports of liquefied natural gas (LNG) and crude petroleum.

Major exports in October 2023:

• E&E products, valued at RM49.23 billion and accounted for 39% of total exports, decreased by 2.3% compared to October 2022;

• Petroleum products, RM13.85 billion, 11% of total exports, ↓23.7%;

• Palm oil and palm oil-based agriculture products, RM6.56 billion, 5.2% of total exports, ↓0.8%;

• Chemicals and chemical products, RM6.47 billion, 5.1% of total exports, ↓2.5%; and

• Machinery, equipment and parts, RM5.16 billion, 4.1% of total exports, ↑6.6%.

On a m-o-m basis, exports of agriculture and mining goods rose by 10.7% and 10.4%, respectively while exports of manufactured goods declined marginally.

For the period of January to October 2023, exports of manufactured goods weakened by 6.3% to RM1.016 trillion compared to the same period of 2022 attributed to lower exports of petroleum products, palm oil-based manufactured products and rubber products. However, exports of processed food, paper and pulp products as well as transport equipment recorded strong growth.

Exports of mining goods declined by 12.8% to RM84.92 billion owing to lower shipments of LNG and crude petroleum due to lower commodity prices.

Exports of agriculture goods dropped by 23.0% to RM77.74 billion, underpinned by lesser exports of palm oil and palm oil-based agriculture products following the decrease in export prices of palm oil.

In October 2023, trade with Asean rebounded by 1.7% y-o-y, took up 26.9% or RM64.39 billion of Malaysia’s total trade. Exports edged down by 5.7% to RM36.57 billion due to lower exports of E&E products and petroleum products. However, the contraction was partially offset by increased exports of chemicals and chemical products, coupled with palm oil and palm oil-based agriculture products. Imports from Asean recorded double-digit growth of 13.4% to RM27.82 billion.

Among Malaysia’s major export markets in Asean that recorded double-digit growth were Vietnam which grew by RM585.2 million and the Philippines increased by RM441.5 million each buoyed by higher exports of petroleum products. Trade, exports and imports expanded by 5.7%, 2.7% and 10.0%, respectively compared to September 2023.

For the period of January to October 2023, trade with Asean dropped by 6.9% to RM600.49 billion compared to the corresponding period of 2022. Exports dipped by 6.7% to RM350.8 billion resulting from lower shipments of petroleum products, chemicals and chemical products as well as palm oil and palm oil-based agriculture products. Nevertheless, increased exports were registered for non-metallic mineral products, beverages and tobacco as well as processed food. Imports from Asean dropped by 7.1% to RM249.69 billion.

In October 2023, trade with China represented 17.7% or RM42.31 billion of Malaysia’s total trade, recording a 1.9% y-o-y increase after experiencing seven consecutive months of decline. However, exports to China eased by 7.0% to RM17.13 billion attributed to the decrease in exports of LNG, palm oil and palm oil-based agriculture products, E&E products as well as chemicals and chemical products. Despite the

contraction, positive growth was seen for exports of metalliferous ores and metal scrap, petroleum products as well as paper and pulp products. Imports from China rose by 8.9% to RM25.18 billion.

Compared to September 2023, trade, exports and imports were higher by 10.6%, 3.1% and 16.3%, respectively.

For the period of January to October 2023, trade with China contracted by 8.0% to RM369.09 billion compared to the same period of 2022. Exports fell by 9.5% to RM157.35 billion on the back of reduced shipments of E&E products, palm oil and palm oil-based agriculture products as well as iron and steel products.

In contrast, exports grew for paper and pulp products, metalliferous ores and metal scrap, transport equipment and processed food. Imports from China was lower by 6.9% to RM211.74 billion.

Trade with the United States (US) in October 2023 which accounted for 9.2% of Malaysia’s total trade declined by 7.7% y-o-y to RM22.14 billion. Exports picked up by 4.0% to RM14.3 billion, marking a turnaround after two successive months of decline.

The expansion was contributed by higher exports of transport equipment, manufactures of metal as well as machinery, equipment and parts. Imports from the US contracted by 23.5% to RM7.84 billion.

On a m-o-m basis, imports increased by 2.3% while trade and exports were lower by 1.4% and 3.2%, respectively.

During the first ten months of 2023, trade with the US edged down by 8.0% to RM204.87 billion compared to the same period of 2022. Exports eased by 2.8% to RM133.75 billion on account of lower exports of wood products, rubber products as well palm oil-based manufactured products. Conversely, positive growth was seen in exports of E&E products, transport equipment as well optical and scientific equipment.

Imports from the US fell by 16.5% to RM71.13 billion.

The EU – Positive Uptick in Trade Trade with the European Union (EU) which constituted 7.5% of Malaysia’s total trade in October 2023 recorded a 3.4% y-o-y increase to RM18.07 billion. Exports declined slightly by 0.1% to RM9.77 billion owing to lower shipments of iron and steel products as well as petroleum products. Nonetheless, the decrease in exports was mitigated by the double-digit expansion of E&E products and transport equipment. Imports from the EU expanded by 7.8% to RM8.3 billion.

Exports to the EU markets that recorded significant growth were Ireland which increased by RM251.4 million owing to strong exports of transport equipment, Italy (↑RM246.9 million, palm oil-based manufactured products) and Germany (↑RM190 million, E&E products). Compared to September 2023, trade, exports and imports climbed by 2.9%, 0.6% and 5.7%, respectively.

During the first ten months of 2023, trade with the EU contracted by 3.1% to RM171.77 billion compared to the same period of 2022. Exports edged down by 9.1% to RM94.07 billion underpinned by lower exports of palm oil and palm oil-based products as well as rubber products while higher demand was seen for E&E products, transport equipment as well as optical and scientific equipment.

In October 2023, trade with Japan which absorbed 5.4% or RM12.88 billion of Malaysia’s total trade, fell by 19.5% y-o-y. Exports decreased by 23.4% to RM6.63 billion on lower shipments of LNG, E&E products as well as crude petroleum. In contrast, double-digit export growth was recorded for optical and scientific equipment as well as processed food. Imports from Japan dipped by 14.9% to RM6.25 billion.

On a m-o-m basis, imports expanded by 11.7% while trade and exports eased by 0.4%

and 9.7%, respectively.

In January to October 2023, trade with Japan weakened by 14.1% to RM129.86 billion compared to the same period of 2022. Exports dropped by 13.3% to RM70.9 billion due to lower shipments of LNG, petroleum products as well as E&E products. However, higher exports was recorded for crude petroleum as well as optical and scientific equipment. Imports from Japan declined by 15.0% to RM58.96 billion.

In October 2023, trade with Free Trade Agreement (FTA) partners which contributed 66.2% or RM158.58 billion to Malaysia’s total trade declined slightly by 1.6% y-o-y.

Exports to FTA partners contracted by 5.6% to RM86.28 billion and imports grew by 3.6% to RM72.3 billion.

In term of markets, increases in exports were recorded to the Republic of Korea (ROK) which grew by 9.5% to RM5.28 billion and Mexico (↑10.9% to RM1.76 billion) driven by solid exports of petroleum products. Meanwhile, exports to Hong Kong SAR edged up by 5.9% to RM7.87 billion led by higher exports of E&E products and exports to India (↑4.6% to RM3.94 billion contributed by higher exports of palm oil and palm oil-based

agriculture products.

Expansion in exports were registered to Türkiye which expanded by 3.3% to RM1.15 billion boosted by solid exports of iron and steel products. Additionally, exports to Peru rose by 6.6% to RM57.5 million bolstered by higher exports of textiles, apparels and footwear while exports to Chile grew by 1.4% to RM48.3 million due to higher demand for processed food.

Compared to September 2023, trade, exports and imports expanded by 4.7%, 1.4% and 9.0%, respectively.

Trade with FTA partners during the first ten months of 2023 contracted by 7.6% to RM1.472 trillion compared to the same period of last year. Exports was lower by 6.8% to RM826.13 billion and imports decreased by 8.6% to RM645.94 billion.

Total imports in October 2023 contracted marginally by 0.2% y-o-y to RM113.33 billion.

During the period of January to October 2023, imports weakened by 8.0% to RM995.55 billion compared to the corresponding period of 2022. Imports of intermediate goods dropped by 14.8% to RM505.05 billion compared to the same period last year, capital goods (↑1.1% to RM101.7 billion) and consumption goods (↓0.1% to RM85.16 billion).