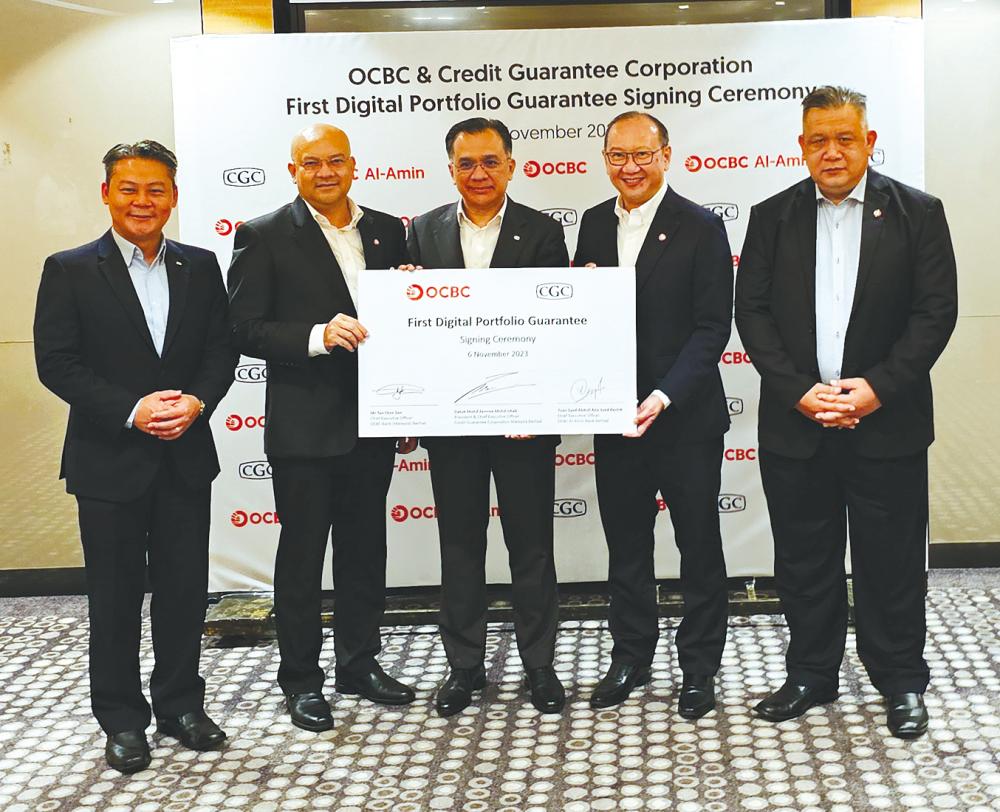

PETALING JAYA: In a concerted effort to boost financing to micro, small and medium enterprises, OCBC Bank (Malaysia) Bhd and its Islamic banking subsidiary OCBC Al-Amin Bank Bhd are collaborating with Credit Guarantee Corporation Malaysia Bhd (CGC) to provide up to RM100 million this year in portfolio guarantee (PG), available in both conventional and Islamic banking tranches.

With this, OCBC Malaysia has surpassed the RM1 billion mark in PG schemes with CGC.

The current PG tranches involve RM50 million in conventional and a further RM50 million in Islamic banking facilities. The latter will be made available through OCBC Al-Amin.

And, for the first time, the tranches will be made available to SMEs digitally via OCBC Bank’s and OCBC Al-Amin’s digital platforms, BizFinancing and BizFinancing-i.

The PG schemes are partially secured by CGC at 70% of the facility amount, with a tenure of up to five years. The financing amount made available to MSMEs is up to RM600,000 with no collateral required.

CGC president and CEO Datuk Mohd Zamree Mohd Ishak said, “With this groundbreaking accomplishment, the timing cannot be more perfect than now as MSMEs continue to recover from the aftermath of the pandemic. This PG tranche involving RM50 million in conventional and the other RM50 million in Islamic facilities will certainly benefit OCBC Bank and OCBC Al-Amin MSME customers.”

OCBC Al-Amin initially, became a prime mover of the initiative, to make unsecured financing available when it introduced OCBC Al-Amin Business Cash-i (BC-i) in 2014 and became the country’s first SME wholesale guarantee in response to the alarming results of a Department of Statistics study during the time that found 55% of respondent MSMEs citing lack of collateral as the biggest constraint to obtaining financing.

According to OCBC Bank CEO Tan Chor Sen, the bank is constantly on the lookout for ways to provide greater convenience to MSMEs for meeting their working capital needs.

“As a bank that thrives on digital offerings, we are pleased to have launched this pioneer digital PG to MSMEs. They can now look forward to conveniently securing financing options to fulfil their short to medium term business financing needs without the hassle of walking into a branch. We are confident of good take up and will consider more such digital offerings in the future. We remain committed to playing an active part in the nation’s plan for MSMEs as a significant contributor to the country’s economic growth,” he said.