AS Malaysia’s digital economy flourishes, a new financial trend is transforming the way consumers shop: Buy Now, Pay Later (BNPL).

Once seen as a niche payment option, BNPL has rapidly gained traction, especially among young Malaysians, thanks to its

integration with major e-commerce platforms and mobile apps.

However, as usage surges, so do concerns over its long-term consequences, especially with the extent of its proliferation into businesses that reasonably should not offer it, such as a recent BNPL advertisement by a fried chicken fast food chain in Malaysia.

Big BNPL bang

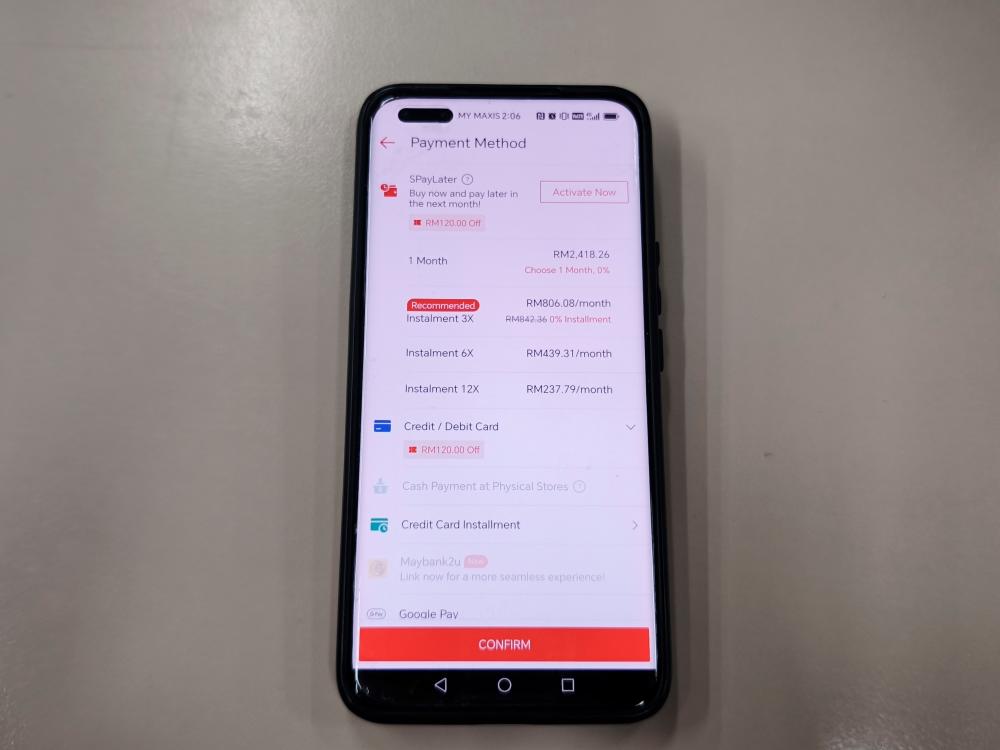

In recent years, BNPL services such as Atome, Shopee PayLater, Grab PayLater and Pace have embedded themselves into Malaysia’s retail and digital ecosystem.

These services allow consumers to split payments into interest-free instalments, often without the need for traditional credit checks.

This model has proven immensely popular among the country’s youth. According to a 2023 report by Bank Negara Malaysia, the adoption of BNPL services is highest among those aged 18 to 30. The appeal lies in its simplicity and accessibility, especially for individuals who do not own credit cards or lack a formal credit history, but do own smartphones and internet access.

A key driver of BNPL’s growth in Malaysia is its seamless integration into e-commerce apps. Platforms such as Shopee and Lazada offer PayLater options directly at checkout, creating a frictionless experience that encourages impulse purchases.

Meanwhile, Grab PayLater extends BNPL services beyond retail, letting users defer payments on ride-hailing, food delivery and in-store QR code purchases.

This level of integration has been shown to boost conversion rates and increase average basket sizes for merchants, according to industry insights from BNPL providers.

For brands, offering BNPL has become a competitive necessity, particularly in sectors such as fashion, electronics and beauty.

This is a financial model that thrives on technology. Algorithms assess eligibility in seconds using alternative credit scoring methods, while mobile apps make instalment management intuitive and accessible. With push notifications, gamified reward systems and personalised offers, many platforms nudge users towards frequent use without fully highlighting the financial risks.

Despite its perks, BNPL is increasingly being scrutinised for fostering unsustainable financial habits. As many BNPL providers do not report to central credit agencies, debts can accumulate unchecked, until missed payments trigger late fees or third-party collections.

Predatory for vulnerable demographics

The Federation of Malaysian Consumers Associations has also voiced concerns, with CEO Saravanan Thambirajah highlighting that the younger generation are particularly prone to impulse spending via BNPL due to its “illusion of affordability”.

The ease and accessibility of BNPL services disproportionately impact younger and lower-income Malaysians, who are often the least financially prepared to manage multiple instalment payments.

Often at the lower end of the economic spectrum and lacking financial literacy, these consumers are frequently targeted through social media advertising and in-app promotions, framing BNPL as a lifestyle upgrade rather than a loan.

According to data from Fintech News Malaysia, the majority of BNPL users report using the service for non-essential purchases, such as fashion items, gadgets and entertainment.

While some platforms have introduced spending caps or payment reminders, consumer education remains limited. However, as more Malaysians embrace these services, the risks of debt accumulation, along with financial, technology and social media illiteracy must not be ignored.

In a world of instant gratification with just a few swipes on our phones, the question remains: Are we buying convenience now and paying the price later?

To quote Jay-Z: “If you can not buy it twice, you can not afford it”.

After all, just because you can buy now and pay later, does not mean you should.