Financial literacy teaches you how to create a budget, stick to a budget, and save money.

That is why it is important for everyone to learn it; whether you are earning a four-figure salary or an impressive five-figure salary.

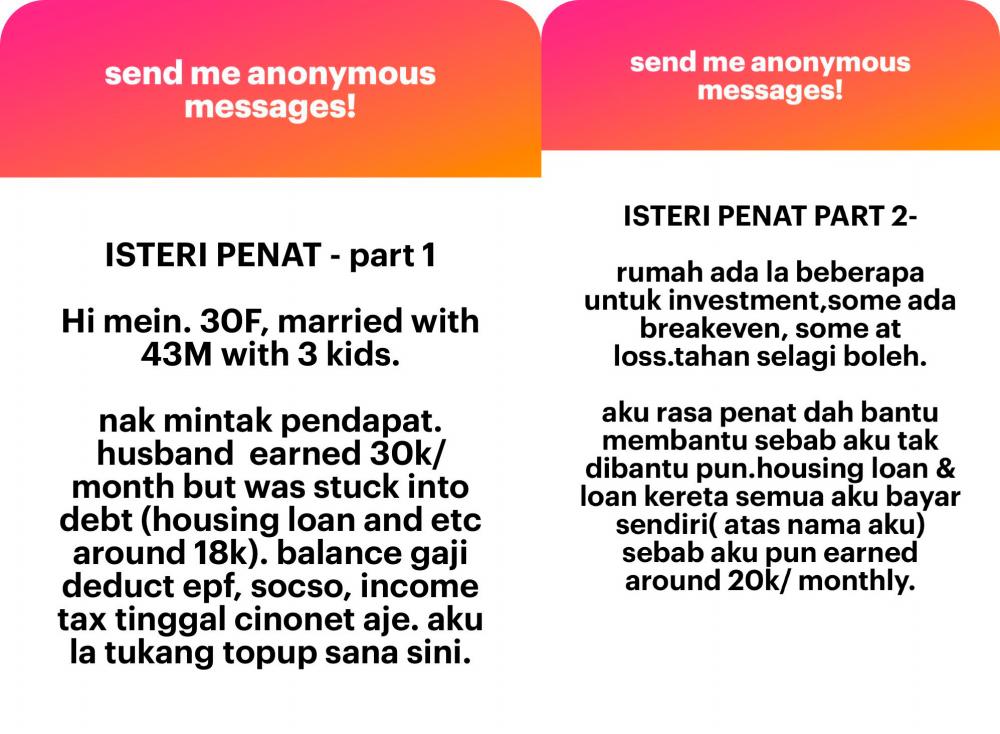

An anonymous woman recently took to @meinmokhtar to lament about her husband’s excessive spending despite earning a high salary.

In the post, the woman, 30, shared that she’s married to a 43-year-old man who earns a hefty RM30,000 a month.

Despite his high income, the husband has a pretty high debt of about RM18,000 a month, which according to the woman, includes multiple housing loans.

And once EPF, SOCSO, and income tax has been tallied in, there’s just a small amount of money left.

“There are a few houses for investment purposes, some are at breakeven, some running at a loss.”

Despite earning a lot, she explained that her husband has a habit of borrowing money from her at the end of the month.

“I would give because I feel sympathetic seeing his bank account has no money.”

The woman, who earned RM20,000 continues to lament that she feels exhausted constantly being the person to top up money for the bills, adding that she herself pays for the car loan and housing loan.

ALSO READ: 27-year-old saddled with nearly RM100k debt

She added that she wishes to be pampered like other wives whose husband would bring them travelling and would purchase luxury handbags.

“I do not know what to do now,” said the woman, saying that she even has to fork out money for the domestic worker’s salary and all the “advances” she gave him have not been returned.

She does credit her husband for ensuring the family has a place to live, he pays for all the bills, and provides her with ‘nafkah’.

“All I do is cook for him and the kids because I do not allow our maid to cook for our family.”

She shared that she hopes her husband would soon open his eyes to the sacrifices that she makes.

The post has quickly amassed 282,500 views and more than 160 comments from Malaysian netizens who were in disbelief that a couple who earned a combined salary of RM50,000 would have such financial difficulties.

“I think you guys have a money management problem. Each of you has a big salary. I don’t know what else to say because my salary isn’t even close to that much,” said @supirlor in disbelief.

A few netizens shared that they felt frustrated reading such a post as the couple were earning a lot but complaining about their financial situation.

READ MORE: M’sian with RM3k income struggles with RM500k debt.

“As someone with no income, one child, and a husband earning RM5,000 living in Klang Valley, I feel angry reading this. A high salary but still complaining. Check your expenses again. Cut where necessary. Why should netizens with smaller salaries have to teach you? By the way, how do you want your husband to appreciate you?” said @heatedperry.

“People say, “The bigger the pot, the bigger the crust,“ sis. With a big salary, use your brain to be smart, not just clever. There’s no other way to settle your debt unless you have to let go of some of your assets. You could also just find a financial advisor or go to AKPK,” commented @ZaraWanee.