THE Covid-19 pandemic not only provokes challenges along with the economic downturn, but also brings opportunities and changes to the country’s housing market. A “reset” is significantly observed in both the supply and demand sides of the market after the disruptive impact of the pandemic, and is likely to bring changes to structural issues – oversupply, overhang, overprice – that facing the industry.

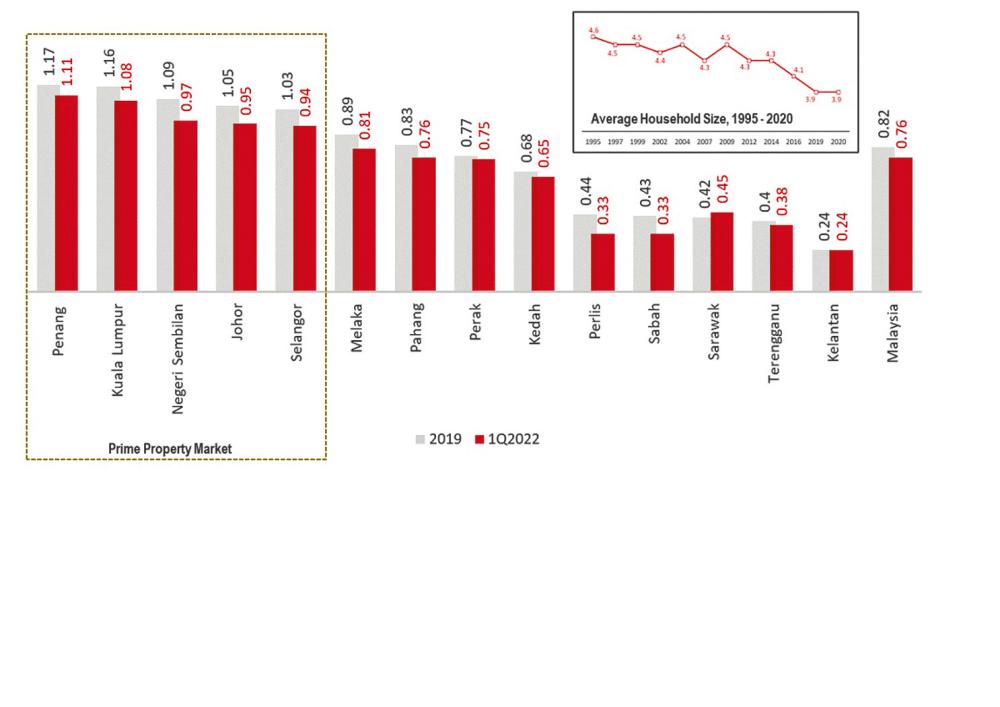

As indicated by the lower housing supply-demand ratio – a ratio of existing housing stocks to the number of households that is used to examine if there is an imbalance between the supply and demand of housing in a country or state – the current housing market is becoming more stabilised. Prime property markets that once considered as “oversupply” (with a ratio of more than 1.1) and “near-to-saturation” (approaching a ratio of 1.1) in 2019 are experiencing a drop in 2022 (see chart). This is mainly due to the slowdown in supply and the increase of size-shrinking households, which have reduced the supply-demand ratio. This should signify a more balanced supply and demand with healthier growth condition moving forward.

While overhangs are found decreasing from 35,592 units in Q1’22 to 34,092 units in Q2’22, it is undeniable that the figure is still trending high compared to the one in the pre-pandemic era. Having said that, overhangs in the residential housing segment are not as severe as we thought, as it happens across the board of all pricing category of products, with a majority of them contributed by products priced RM500,000 and below. The high number of residential housing overhangs is more of a result of reduced housing affordability and lower sentiment due to depriving household income, rather than the mismatch in pricing. In contrary, overpricing is still the dominant factor of service apartment overhangs, as a majority of them are products priced RM500,000 and above, which are mainly contributed by the Johor market. In general, overpricing has become less prevalent in the current housing market as there is limited room – due to the declined housing affordability and – to support house price rises. In this sense, the market is expected to be free from any impeding bubble in the immediate future.

In terms of the demand side, a high number of residential housing transactions – with an increase of 26.3% in volume and 32.2% in value year-on-year – indicates that homeownership aspiration in a developing country like Malaysia still remains high. It is just that potential buyers are more realistic and cautious when it comes to buying properties amid the high-cost environment. Most of them, especially the first home buyers, are adopting a wait-and-see approach in anticipation for economic and political uncertainties. In this sense, property developers should go back to the fundamental principles of property development when determining what types of products to be released and which group of buyers they are targeting on.

Instead of lowering the price points on products as an attempt to enhance competitive advantage, or relying heavily on market-spurring initiatives, property developers should strike for “value creation” when positioning their products in the market. It is because only products that can deliver a sense of “practical”, “humanised”, and “value-added” living environment are more likely to resonate with today’s home buyers. As long as the supply side of the market is becoming more responsive and sensitive to the demand, the overall downsides should be limited, and the current property market is still favourable for long-term investment.

This article is contributed by MKH Bhd manager of product research and development Dr Foo Chee Hung.