TOKYO: Japan's government bonds held steady in early trading on Tuesday, as investors looked ahead to a key central bank decision on debt purchase plans for the next fiscal year.

The 10-year JGB yield was at 1.45%, unchanged from the previous session, after falling 1 basis point (bp) to 1.44% earlier in the session.

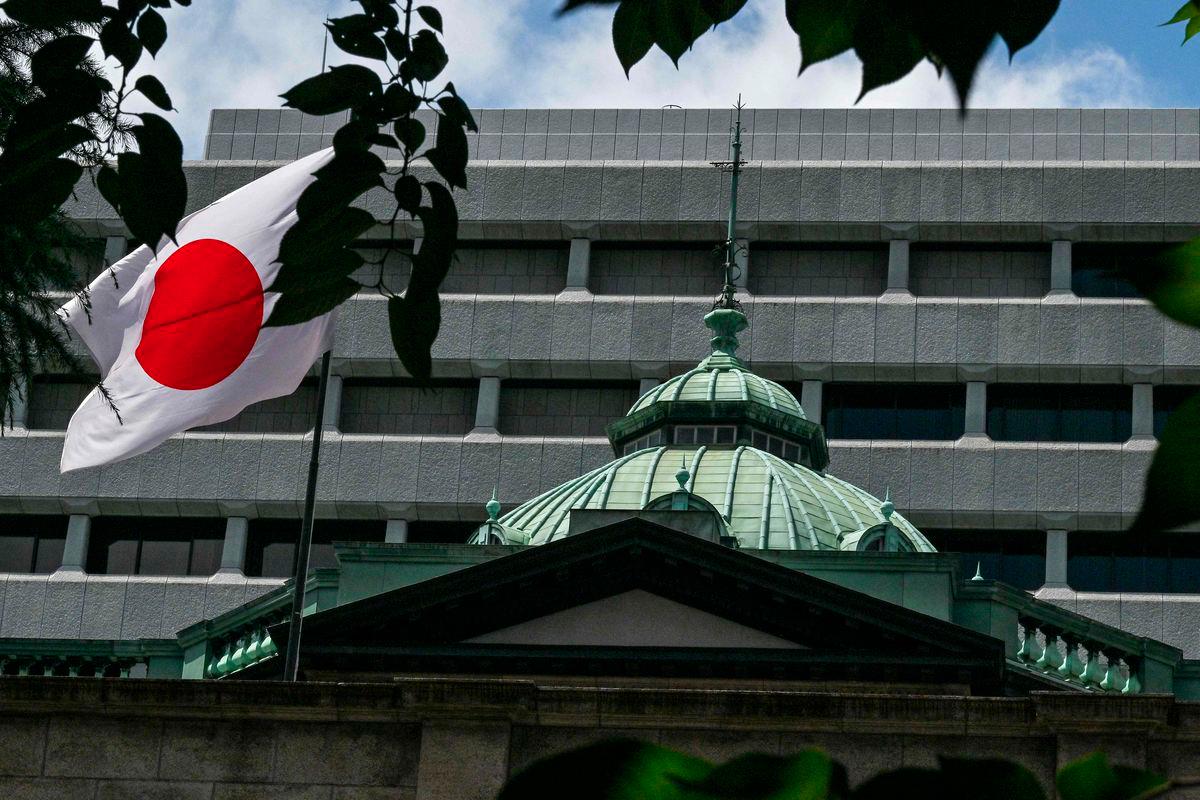

The Bank of Japan is expected to keep interest rates steady at the end of its two-day meeting and to announce a slower pace of reductions in its bond purchases from the next fiscal year.

A slowdown in tapering would effectively signal a dovish shift and offer support to the JGB market, which has been shaken by weak demand at recent auctions and a surge in super-long yields to record levels last month.

“Investors cautiously await the exact amounts of the cuts in the bond buying, but they also want to see any signs of the final goal of the reduction,“ said Yoshiro Sato, economist at Resona Holdings.

The BOJ began tapering its massive bond buying last year in a bid to wean the economy off decades of heavy stimulus and revive a market that had been left dormant by its dominant presence.

The central bank's tapering has coincided with weakening demand for long-dated debt among life insurers and other traditional buyers. At the same time, investors have grown wary of Japan's fiscal outlook, as some lawmakers advocate for increased stimulus spending to attract voters ahead of the upper house election in July.

Meanwhile, the Ministry of Finance is also expected to reduce the sale of longer-dated bonds to improve demand for such bonds.

The five-year yield was flat at 1.010% and the 20-year JGB yield slid 0.5 bp to 2.375%.